Denbury Resources Inc. (DNR) is an independent oil and natural gas company. As of December 31, 2011, the Company had 461.9 million barrel of oil equivalent of proved oil and natural gas reserves, of which 77% was oil.

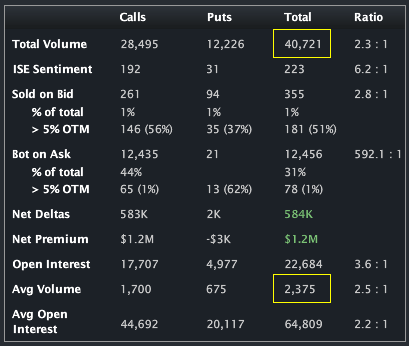

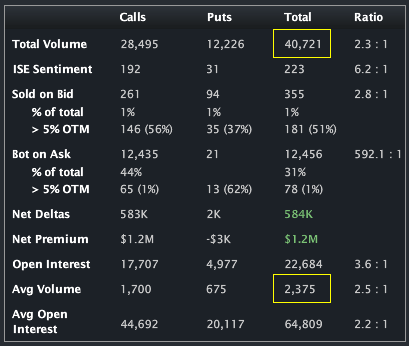

This is an order flow note -- order flow that has repeated. The company has traded over 40,000 contracts on total daily average option volume of just 2,375. The largest trade accounted for 36,000 contracts was a purchase of the May 20/22 call spread for $0.70, selling 12,000 of the May 18 puts @ $0.60 (net $0.10 debit) to fund it. I see 648,000 shares trading $19.58 -- likely the hedge. The Stats Tab and Day's biggest trades snapshots are included (below).

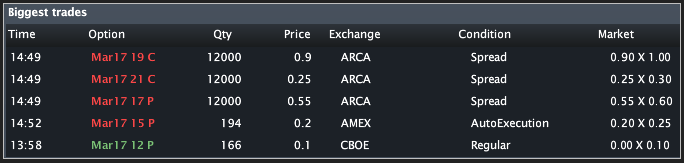

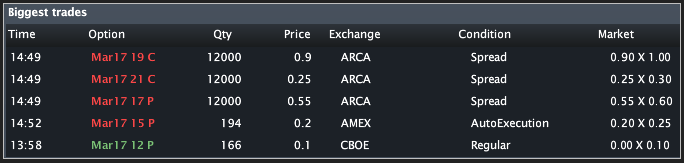

Interestingly, I see a similar trade going up on Jan 26th with the Mar 19/21 c/s and Mar 17 puts. I've included the biggest trades snapshot from that day, below:

That trade, if it was indeed a 19/21 c/s funded by a sale of puts, did quite well, as the stock closed at $19.61 on expo and paid $0.10. So, $0.61 in parity to $0.10 in cost.

The Options Tab (below) illustrates that both of the calls and the puts are mostly opening (compare OI to trade size).

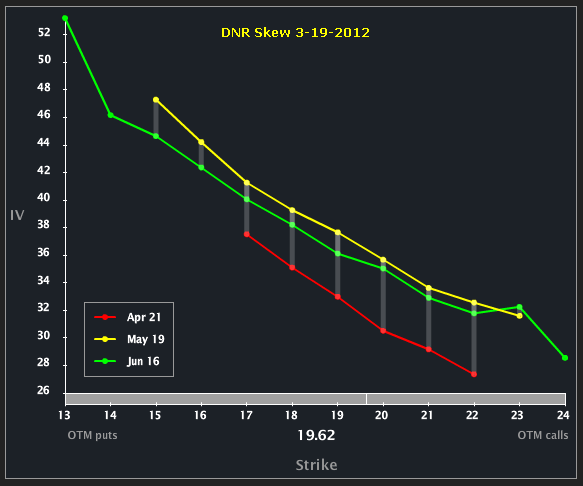

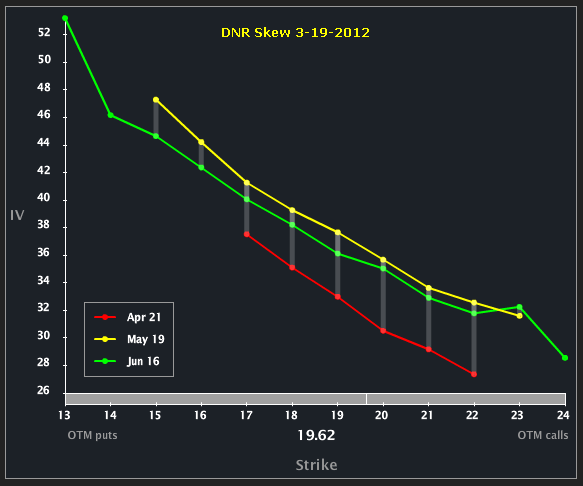

The Skew Tab snap (below) illustrates the vols by strike by month.

We can see how Apr vol is below the back two months -- with May the most elevated. The last two years earnings have been reported on 5-6-2010 and 5-5-2011, so it's a reasonable bet that the next earnings release will be in May of this year. In English, this is an earnings bet.

Finally, the Charts Tab (six months) is below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side, we can see that the underlying dipped to $11.37 in Oct and has now found its way to nearly $20. On the vol side, we can see how the implied has actually dipped of late -- now below both the short-term and long-term historical measures. The vol comps are:

IV30™: 31.75%

HV20™: 35.96%

HV180™: 56.39%

The 52 wk range in IV30™ is [32.12%, 79.11%]. In other words, the implied has breached a new annual low. I do note that the month of the trades (May) shows a 36.58% weighted average monthly vol. While that's not below the annual low, it's still well depressed to levels realized over the last year.

Disclosure: This is trade analysis, not a recommendation.

This is an order flow note -- order flow that has repeated. The company has traded over 40,000 contracts on total daily average option volume of just 2,375. The largest trade accounted for 36,000 contracts was a purchase of the May 20/22 call spread for $0.70, selling 12,000 of the May 18 puts @ $0.60 (net $0.10 debit) to fund it. I see 648,000 shares trading $19.58 -- likely the hedge. The Stats Tab and Day's biggest trades snapshots are included (below).

Interestingly, I see a similar trade going up on Jan 26th with the Mar 19/21 c/s and Mar 17 puts. I've included the biggest trades snapshot from that day, below:

That trade, if it was indeed a 19/21 c/s funded by a sale of puts, did quite well, as the stock closed at $19.61 on expo and paid $0.10. So, $0.61 in parity to $0.10 in cost.

The Options Tab (below) illustrates that both of the calls and the puts are mostly opening (compare OI to trade size).

The Skew Tab snap (below) illustrates the vols by strike by month.

We can see how Apr vol is below the back two months -- with May the most elevated. The last two years earnings have been reported on 5-6-2010 and 5-5-2011, so it's a reasonable bet that the next earnings release will be in May of this year. In English, this is an earnings bet.

Finally, the Charts Tab (six months) is below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side, we can see that the underlying dipped to $11.37 in Oct and has now found its way to nearly $20. On the vol side, we can see how the implied has actually dipped of late -- now below both the short-term and long-term historical measures. The vol comps are:

IV30™: 31.75%

HV20™: 35.96%

HV180™: 56.39%

The 52 wk range in IV30™ is [32.12%, 79.11%]. In other words, the implied has breached a new annual low. I do note that the month of the trades (May) shows a 36.58% weighted average monthly vol. While that's not below the annual low, it's still well depressed to levels realized over the last year.

Disclosure: This is trade analysis, not a recommendation.