A summary of the weekly Commitment of Traders Report (COT) from CFTC to show market positioning among large speculators.

As of Tuesday 14th May:

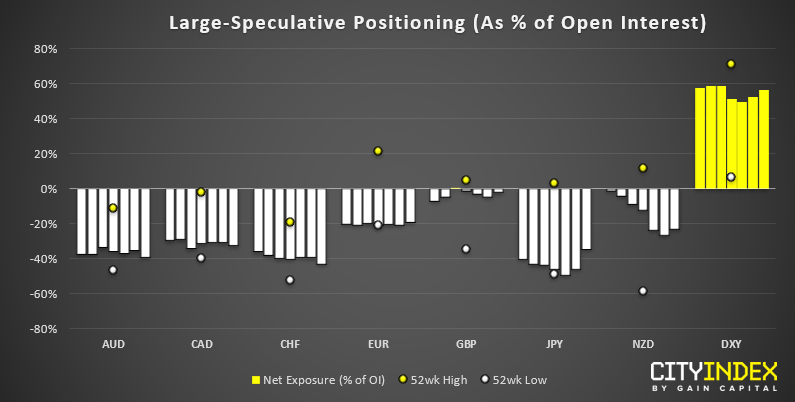

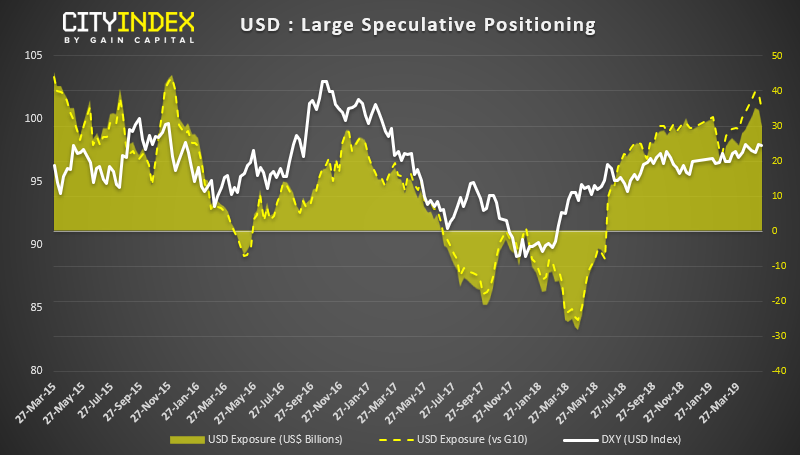

- Large speculators were net-long the US dollar by $29.7 billion ($34.3 against G10 currencies)

- Net long exposure to the USD fell by -$4.6 billion, the largest weekly decline in 3-month

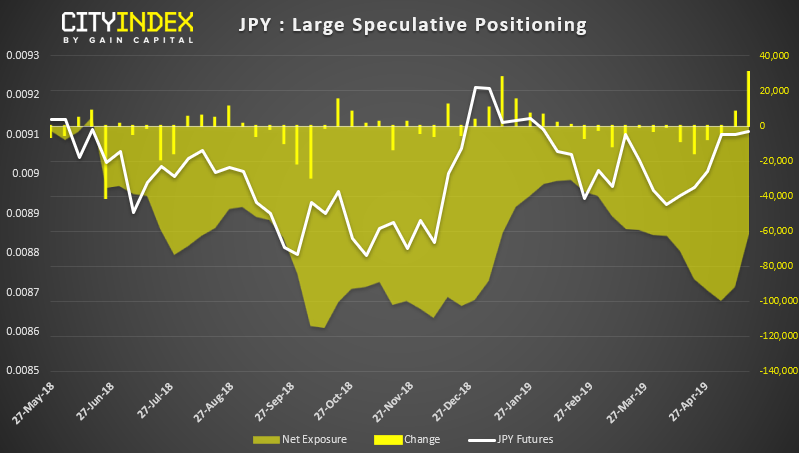

- Net short exposure on Japanese yen futures declined by 30.1k contracts, the largest weekly move among FX majors.

- Net short exposure for euro futures fell by 10.8k contracts

USD: Last week we noted that net-long positioning could be approaching a sentiment extreme. And now having seen two consecutive weeks of reduced long exposure, we’re closely watching to see if there is a follow-through.

JPY: Heightened trade tensions saw a further reduction of short exposure to the yen. 29.1k shorts were closed and 10k longs were added. With net-short exposure being reduced by 30.k contracts it was the largest weekly change since June 2018.

As of Tuesday 14th May:

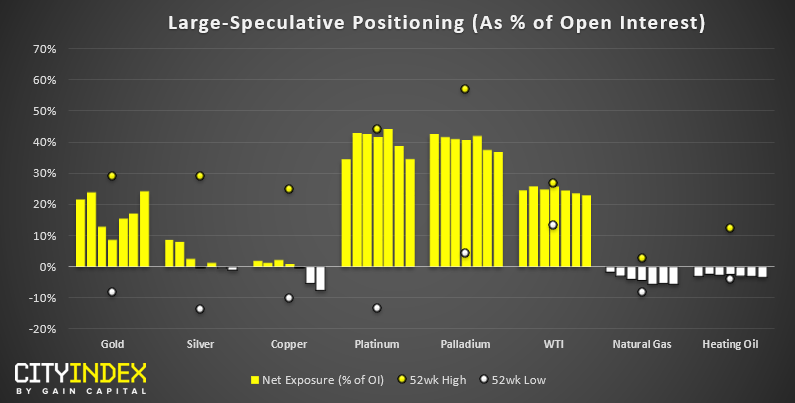

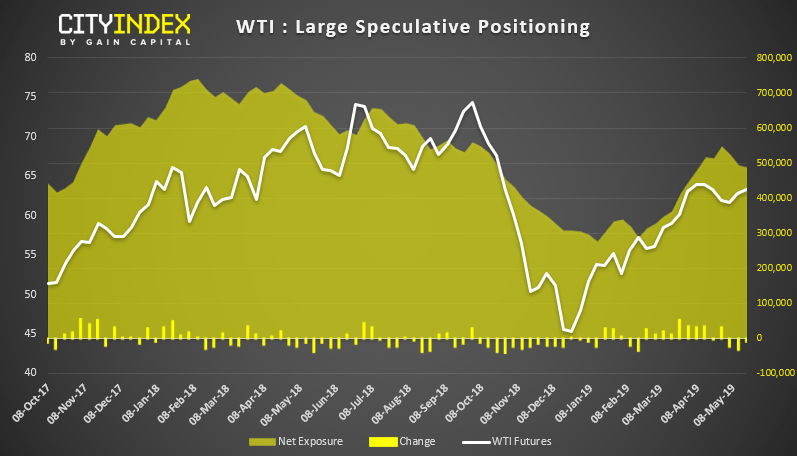

- Long exposure for WTI declined for a third consecutive week

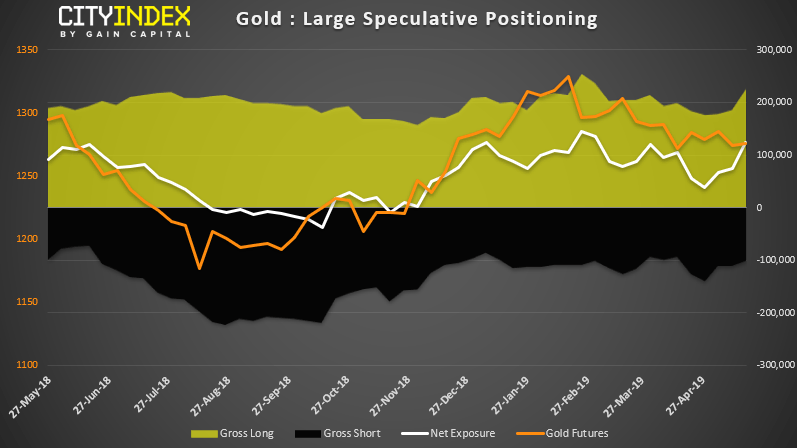

- Gold bugs were their most bullish since February

- Copper traders are their most bearish since early February

- VIX traders reduced short exposure by 60.6k contracts (totaling 90.6k fewer shorts over the past two weeks)

WTI: Crude oil traders reduced their bullish exposure for a third consecutive week, their longest streak since mid-January. Volumes were also lower, with -8.8k long contracts being closed along with -2.3k short contracts. We don’t see anything too alarming in these numbers, which appear to be part of a natural correction after such a bullish run. It’s also worth noting that prices have rebounded above $60.

Gold: Net-long exposure has increased over the past three weeks, totalling an increase of 87.1k contracts. Moreover, each week has seen new longs initiated and short bets closed. We remain bullish on gold although its retracement has already met the bullish trendline beneath the support zone. So bullish action needs to resurface soon or the validity of the original breakout (and pick-up of increased long exposure) comes into question.