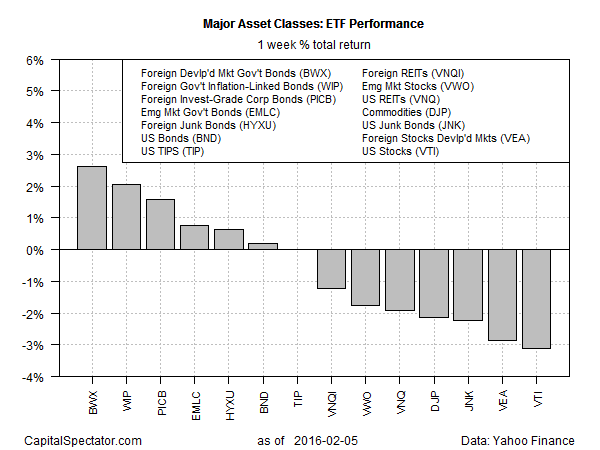

The crowd piled into investment-grade bonds last week as economic worries triggered an exodus out of risky assets. Reviewing the major asset classes for the week just passed through an ETF lens reveals sharply divided results. The safe-haven trade generated handsome gains for several ETFs representing broad measures of the global fixed-income realm for the five trading days through Feb. 5. Even the usually weak corner of emerging-market government bonds caught a break. Stocks, REITs, and commodities, by contrast, suffered hefty losses.

Last week’s big winner: SPDR Barclays (L:BARC) International Treasury Bond (N:BWX), which posted a strong 2.6% total return. At the opposite end of last week’s performance ledger: US equities, based on Vanguard Total Stock Market (N:VTI), which tumbled 3.1%.

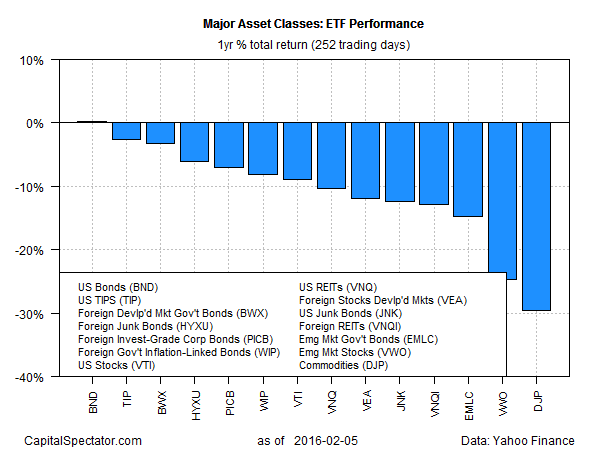

Meantime, the trailing 1-year profile continues to wallow in red ink. The lone exception for our ETF proxies tracking the major asset classes: US investment-grade bonds via Vanguard Total Bond Market (N:BND). But let’s not get too excited. This ETF’s gain over the trailing 252-trading-day period through Feb. 5 is a bit less than 20 basis points. But that’s a world above the broadly defined commodities bucket, which remains dead last for the trailing one-year period via the nearly 30% loss for iPath Bloomberg Commodity Total Return Exp 12 June 2036 (N:DJP) as of last Friday.

What’s driving the risk-off trade? Gavyn Davies at Fulcrum Asset Management summarizes the current state of affairs, explaining in the FT that global economic growth is “now fraying at the edges.”

The growth rate in global activity remains broadly unchanged at around 2.8%, little different from the rates recorded since mid 2015. However, there has been a further slowdown in economic activity in the advanced economies (AEs), which are growing at only 1.2%, down from 1.6% late last year.

Decelerating growth is old news, of course, but as Davies points out there’s a new joker in the deck.

For the first time since 2012, the growth rate in the AEs is clearly below trend (estimated at 1.7%). Furthermore, the US nowcast is now at its lowest since the recovery began in 2009.

The question is whether markets have gone off the deep end and are confusing slower growth with something darker? Perhaps, although for the moment the sentiment bias remains unmistakably bearish. Earlier today Reuters reported that European stocks fell to 16-month lows following news over the weekend that

“China’s foreign reserves fell for a third straight month in January, as dollars were dumped to defend the yuan and curb capital outflows….”

Rational or not, negative momentum in risky assets rolls on.

“Investors can’t make up their minds about the global economy, but the risk of recession and deflation is rising,”

notes Francois Savary, chief investment officer at the Geneva-based Prime Partners.

“It’s not enough that valuations have receded quite significantly and earnings haven’t been too bad — sentiment is very low and there isn’t much visibility right now. That’s frightening.”