One of the handful of airliners in focus this week is Delta Air Lines, Inc. (NYSE:DAL). Slated to reported first-quarter earnings before the market opens tomorrow, April 10, the airline giant is one of the many suffering on the back of Boeing's (NYSE:BA) production halt. Below we will dive into what the options market is pricing in for the shares' post-earnings moves, and see how DAL has performed on the charts of late.

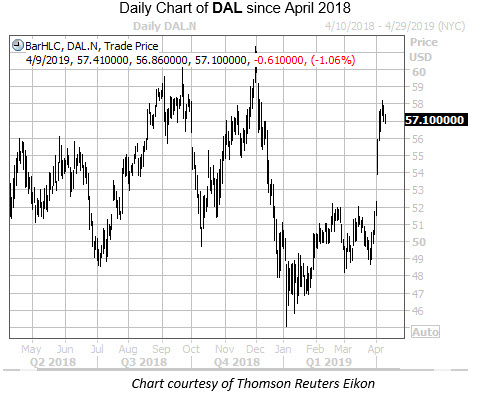

DAL has had a volatile run on the charts, just last week seeing an impressive bull gap which paved the way to a multi-month peak near $58. Since then, however, the shares have pulled back to the $57 mark, and were last seen trading down 1.1%, at $57.10. Year-to-date, Delta stock is clinging to a 14% gain.

Moving onto DAL's earnings history, the airliner has closed higher the day after reporting in its last six earnings. Over the past two years, the shares have swung an average of 2% the day after earnings, regardless of direction. This time around, the options market is pricing in a more than double 5.7% swing for Wednesday's trading.

Coming into today, analyst attention was leaning bullish on the airline giant, with 10 of 14 firms sporting "buy" or "strong buy" ratings. Plus, the stock's average 12-month price target of $64.26 comes in at a 12.5% premium to current levels.

Digging deeper, short interest fell 22.3% on DAL during the past two reporting periods, but now represents just 2.1% of the stock's total available float. At Delta stock's average pace of daily trading, it would take less than two day for shorts to buy back their bearish bets.