Delphi Automotive PLC (NYSE:DLPH) reported pricing of notes offering by its Powertrain Systems spin-off subsidiary, Delphi Jersey Holdings plc (DPS), which marks a significant development for the company’s planned spin-off of Powertrain Systems business.

Senior notes worth $800 million have been issued by DPS with an interest rate of 5% and the year-of-maturity as 2025. The offering has been upsized from the previously determined principal amount of $750 million, thanks to investors’ growing interest. This offering is expected to close on Sep 28, 2017, subject to normal closing conditions.

In addition, DPS and its wholly-owned U.S. subsidiary, Delphi Powertrain Corporation (Delphi Powertrain), have entered into a credit agreement on Sep 7, 2017. The credit agreement includes two five-year senior notes, of which, one is a $750 million term loan facility while the other, a $500 million revolving credit facility.

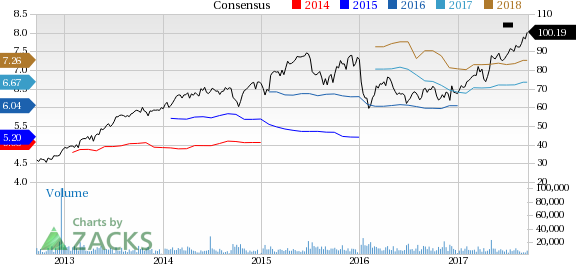

Delphi Automotive PLC Price and Consensus

The credit facilities will be available to DPS after satisfying certain customary conditions and conclusion of the separation of DPS from Delphi.

This eager participation in credit facilities and notes offering indicates robustness of the business and the company’s confidence to perform as a standalone entity.

DPS will use the generated proceeds from notes offering to fund the operating cash, pay taxes, fees and expenses related to the spin-off, besides distributing a dividend to Delphi.

Price Performance

Delphi’s shares have rallied 15.8% over the last three months, thus marginally outperforming the 14.5% increase of the industry it belongs to.

Zacks Rank & Key Picks

Delphi currently carries a Zacks Rank #3 (Hold).

A few better-ranked automobile stocks are Toyota Motor Corporation (NYSE:TM) , Ferrari N.V. (NYSE:RACE) and Allison Transmission Holdings, Inc. (NYSE:ALSN) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Toyota has a long-term growth rate of 7%.

Ferrari has a long-term growth rate of 14.1%.

Allison Transmission has a long-term growth rate of 10%.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Download the new report now>>

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Delphi Automotive PLC (DLPH): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Original post

Zacks Investment Research