More than a month has gone by since the last earnings report for Delphi Automotive PLC (NYSE:DLPH) . Shares have added about 5.7% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted as late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Delphi Automotive Q2 Earnings & Revenues Top Estimates

Delphi Automotive posted $1.71 per share of adjusted earnings in the second quarter of 2017, up from $1.59 earned in the prior-year quarter. Earnings per share surpassed the Zacks Consensus Estimate of $1.65.

Adjusted net income increased to $457 million from $435 million a year ago. This figure includes advantageous impact of reduced share count and lower tax rate.

Revenues were $4.32 billion and surpassed the Zacks Consensus Estimate of $4.2 billion.

Revenues increased 2.66% year over year, excluding the impact of currency exchange, commodity movements, acquisitions and divestitures. The upside was led by a performance improvement of 15% in South America, 3% in Europe, 15% in Asia and a stable performance in North America.

Adjusted operating income rose to $587 million from $580 million in the third quarter of 2016. Adjusted operating margin decreased to 13.6% from 13.8% in the year-ago quarter. This slight decline in margins can be attributed to the divestiture of Mechatronics and continued investments for growth. These were partly offset by sales growth and cost reduction initiatives.

Segment Details

In the Electrical/Electronic Architecture segment, revenues declined to $2.35 billion in the reported quarter. Also, adjusted operating income slid 3% to $333 million.

In the Powertrain Systems segment, revenues rose 4% to $1.2 billion. Adjusted operating income surged 21% to $162 million.

The Electronics and Safety segment’s revenues increased 10% to $821 million. However, adjusted operating income declined 9% to $92 million.

Share Repurchases

In second-quarter 2017, Delphi Automotive repurchased 1.09 million shares for approximately $95 million. Following this, the company had approximately $1.1 billion available for future repurchases under its current share buyback program.

Financial Position

Delphi Automotive had cash and cash equivalents of $792 million as of Jun 30, 2017 compared with $838 million as of Dec 31, 2016. Total debt increased to $4.1 billion as of Jun 30, 2017 compared with $3.96 billion as of Dec 31, 2016.

In second-quarter 2017, operating cash flow increased to $599 million from $575 million in 2016. Capital expenditure totaled $178 million compared with $172 million a year ago.

Outlook

For third-quarter 2017, Delphi Automotive decreased its revenue guidance to $4-$4.1 billion, compared with the previous expectation of $4.15–$4.25 billion. Adjusted earnings per share are expected to be in the $1.52-$1.58 range, comapred with the previous guidance of $1.62–$1.68.

Adjusted operating income is anticipated in the range of $520-$540 million (13.1% of sales) comapred with the previous guidance of $560–$580 million (13.5–13.7% of sales) in third-quarter 2017.

For 2017, Delphi Automotive increased its revenue expectation to $16.85-$17.05 billion, compared with the previous expectation of $16.5–$16.9 billion. Adjusted earnings per share are expected in the range of $6.55-$6.75 compared with the previous guidance of $6.40–$6.70.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter.

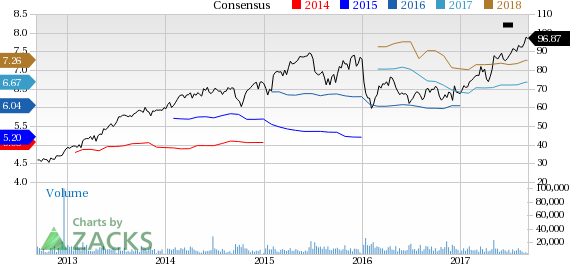

Delphi Automotive PLC Price and Consensus

VGM Scores

At this time, Delphi Automotive's stock has a strong Growth Score of A, though it is lagging a lot on the momentum front with a C. The stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is primarily suitable for growth investors while also being suitable for those looking for value and to a lesser degree momentum.

Outlook

While estimates have been moving downward, the magnitude of the revision is net zero. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Delphi Automotive PLC (DLPH): Free Stock Analysis Report

Original post

Zacks Investment Research