Delignit AG (DE:DLXG) continues to please with a 16% rise in FY18 EBITDA despite a demanding comparative and one-off contract as well as project start-up costs. Automotive, the major sector, stole the show with revenue up a quarter thanks to strong OEM activity and the maximisation of revenue per vehicle. This momentum, allied with an initial contribution from a potentially transformative OEM motor caravan order, underpins guidance of further double-digit growth in 2019 revenue at maintained EBITDA margin. Finances are healthy (year-end net debt was inflated by a temporary delay in customer receipts), allowing investment (up c 20% in FY18) and a progressive dividend policy.

Buoyant H218 curbed by one-off costs

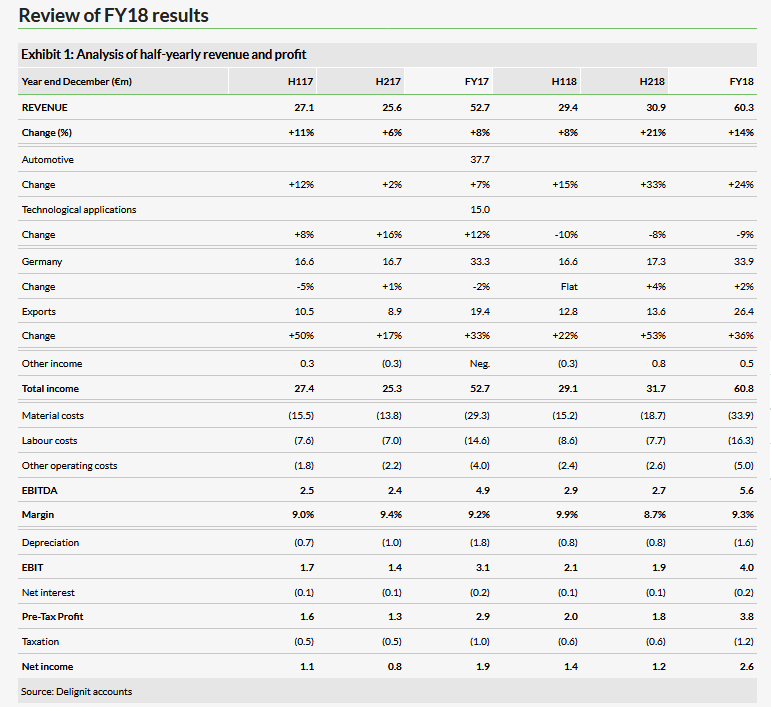

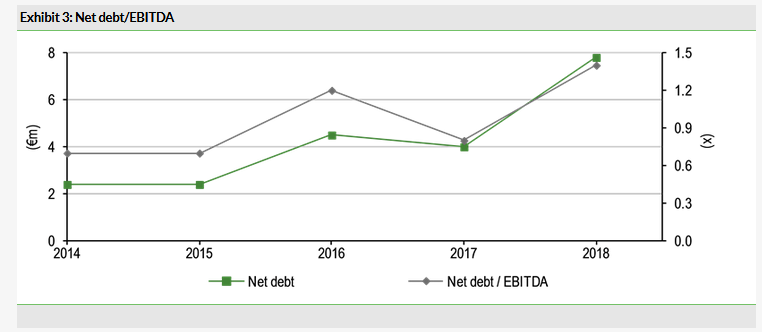

H218 saw a clear acceleration in revenue (up 21% y-o-y from 8% in H1) and FY18 revenue beat (up 14% against expected at least +8%). As in H1, Automotive was to the fore (revenue up by a third), reflecting high volumes from series supply contracts and demand for system solutions in cargo securing. Technological Applications remained subdued (revenue down 8% in H2) despite higher railway systems sales. Exports were again the driver (up by over a half) in line with strategic expansion. By contrast, there was a marked fall in the H2 EBITDA margin (8.7% vs 9.4% in H217) owing to one-off start-up costs, notably for the caravan model. However, the FY18 EBITDA margin of 9.3%, up marginally y-o-y, met guidance. A near doubling in net debt was largely due to the adverse timing of debtor payments.

Sustained growth expected

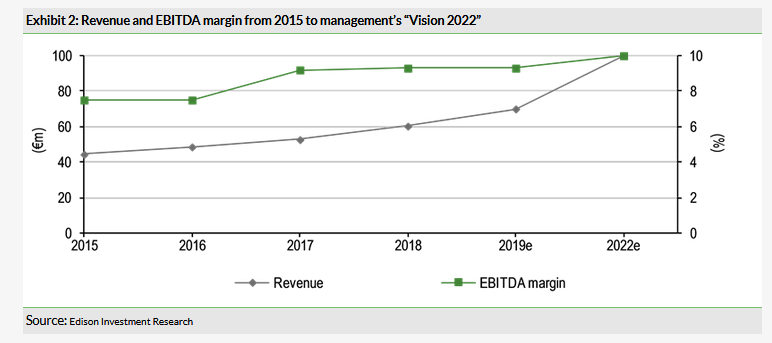

A confident statement reflects buoyant target markets, a good order book and increasing invitation to major tenders owing to Delignit’s reputation for development and technology. FY19 guidance is for top-line growth of c 14% and EBITDA margin similar to last year. Longer term, successful business model transition, as shown by the caravan order, supports management’s “vision” of revenue of over €100m at 10%+ EBITDA margin by 2022.

Valuation: Time to deliver

Key ratios appear to be at a significant premium to that of wood processing and automotive supplier peers. For example, management guidance for FY19 gives Delignit EV/EBITDA of c 11x (peer average c 7x). However, evident strong long-term growth prospects could lead to a visible reduction in valuation.

Business description

Delignit manufactures ecological products and system solutions based on sustainable raw materials for the automotive and railway industries. Exports account for over 40% of sales.

Bull

Solid order intake in the LCV and rail transport segments.

Increased and enhanced applications for existing products

Rapid take-up of the products in global markets.

Bear

High dependence on large OEM contracts.

An increase in oil prices could reduce the company’s profitability.

Valuations already factor in growth prospects, creating downside risk.

As shown in Exhibit 1, H218 saw contrasting fortunes as a surge in revenue (up 21%) was offset by a sharp dip in margin, notably at EBITDA level 8.7% vs 9.4% y-o-y and vs 9.9% in H118. As mentioned, this shortfall was attributable to one-off start-up costs and thus a function of investment, so should not reasonably concern. Indeed for the year as a whole EBITDA margin was slightly ahead of the previous year with principal costs, raw material and labour, both at a maintained ratio to revenue. With depreciation down and finance costs unchanged, the 2018 revenue boost of 14% was even more pronounced further down the line (pre-tax profit and net income up 31% and 33% respectively).

The revenue pattern was much as in the first half with Automotive and exports particularly buoyant thanks to continued OEM demand, additional orders from car makers and geographical expansion, notably in the US. Even allowing for positive macro conditions (eg in Germany light commercial vehicle registrations again up 5% in 2018), such progress is credited by management to its record investment (c €6m over the last two years) paying off in terms of both customised system solutions and expanded product applications. It was also more of the same for Technological Applications, with a further near double-digit percentage decline in revenue in H2 as headwinds in certain markets were not made up by higher railway systems sales.

Prospects looking good

Prospects, both macro and company-specific, appear set fair even if 2019 economic forecasts are for a slowdown in growth and attendant risks, eg trade policy tensions and Brexit. Its key market of light commercial vehicles is still expected to grow by 10% between 2017 and 2020. Management is mindful of disruption to registrations from the introduction of the new vehicle emissions test standard (WLTP) in Q318, but regards this as short-term and likely to be comfortably absorbed by the company thanks to high call-off OEM custom.

In “Vision 2022”, management has newly reiterated its forecast of revenue growing by two-thirds over the next four years, with expected clear economies of scale driving margin benefits (Exhibit 2 shows most cautious stated assumptions for 2022). This vibrancy is highlighted by the reference contract for interior systems for motor caravans. Not only is this award significant (revenue contribution of up to €10m pa after ramp-up with production due to run to 2027) but further evidence of expanded product applications.

Balance sheet and cash flow

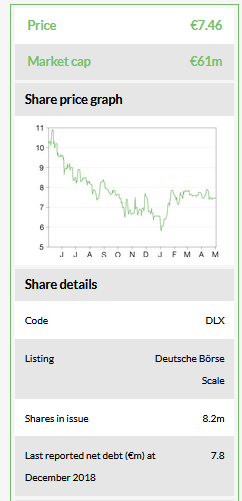

One-off factors, eg adverse timing of debtor payments, contributed to a near doubling of year-end net debt (€7.8m). Otherwise, Delignit remains lightly borrowed with ample room for investment and dividend growth. Even on stated net debt the equity ratio was only marginally down from 51% to 49%.

Valuation

Peer valuation

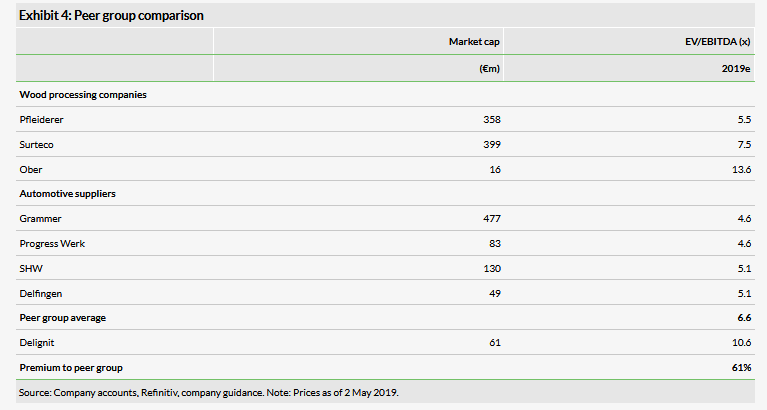

As there are no companies that match Delignit’s profile closely, for peer comparison we have identified four wood processing companies, even if with lower exposure to the automotive sector (Pfleiderer, Surteco and Ober), and four automotive suppliers (Grammer, Progress Werk, SHW and Delfingen), which offer products such as seat covers, insulation, components and systems for car interiors.

As consensus forecasts for Delignit are not available, we have conducted a comparative analysis based management’s revenue and EBITDA margin guidance for 2019. Despite recent prolonged consolidation, Delignit still trades at a considerable premium to the blended peer group on prospective EV/EBITDA (61%). Management’s guidance for FY19 implies an EV/EBITDA multiple of c 10.6x, admittedly on most cautious assumptions but well ahead of the 6.6x peer average. Although this suggests that the company’s apparently strong growth outlook is factored in, it also reflects confidence that investors should look at the long term ie management’s “vision” of more than €100m revenue in 2022 at a double-digit EBITDA margin owing to scale benefits. For indicative purposes, this may imply EBITDA of at least €10m ie 10% margin on €100m+ revenue, compared with formal guidance for the current year of c €6.5m. At the current market valuation, this would imply a multiple broadly in line with the peer group.