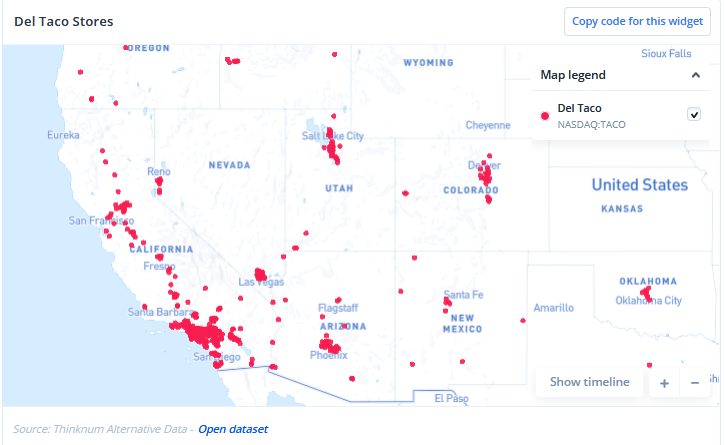

Del Taco Restaurants (NASDAQ:TACO) is the second-largest Mexican-American fast-food restaurant chain in America. No matter what the earning's report this week said, or the estimates, or the revenue, this is still a profound and incredible fact to put into writing because there are no Del Taco locations in the northeast. The west coast, the south, and parts of the Midwest have all apparently been hiding a pretty good secret from us New Yorkers, and we just wanted to highlight that. We're not jealous or anything.

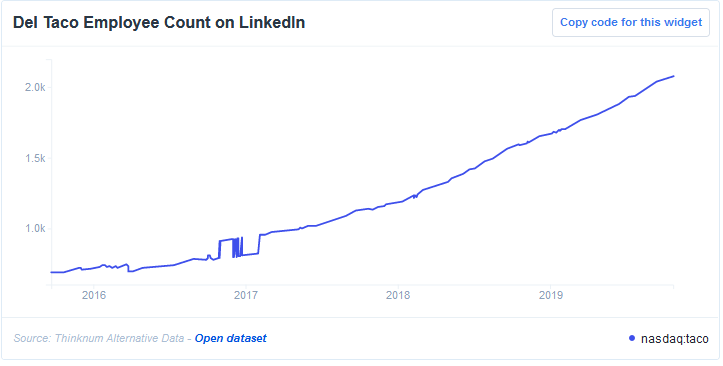

Okay, now onto the important stuff, the alternative data. In the past two years, the total staff count doubled, and it's still climbing into the stratosphere.

This makes sense, given Del Taco added close to 40 new stores over the last year and a half.

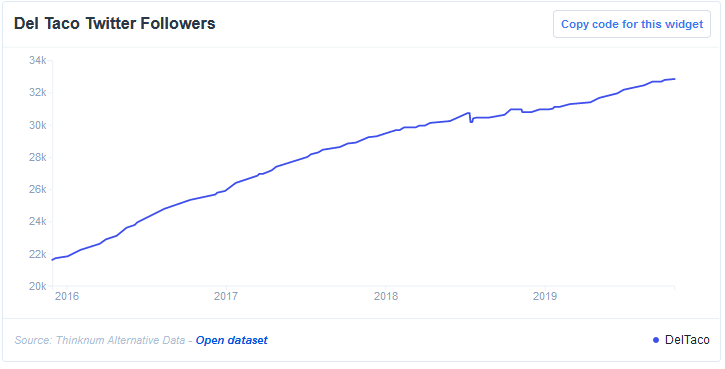

Twitter followers are up over 51% over the last four years, and it seems like people are content with Del Taco's taco focused social media advertising.

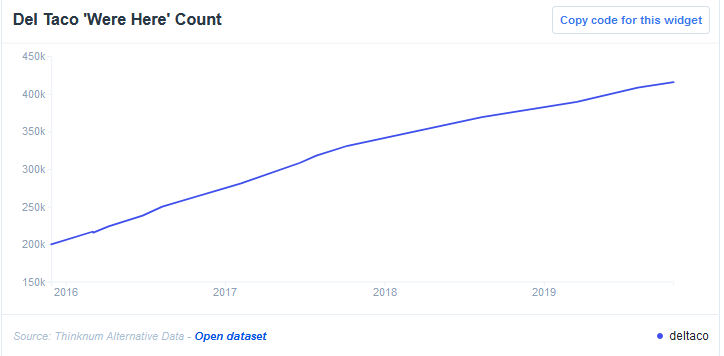

And people continue to check in on Facebook (NASDAQ:FB), telling the website they are in fact "here" at a Del Taco.

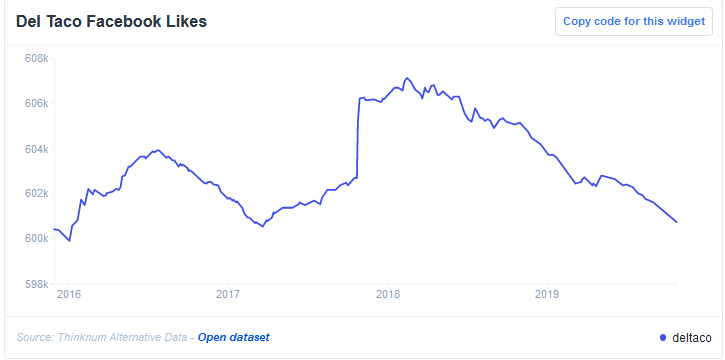

The only bad thing we found in our alternative data was Facebook (NASDAQ:FB) likes are down roughly 5,000 since February 2018. But the Y-axis on the next chart is within a few thousand, so it could be a lot worse.

About the Data:

Thinknum tracks companies using the information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.