It's easy to forget that even those assets labeled as "defensive" or "low volatility" have their risks. Consumer staples and utility stocks, while often seen as steady performers, are at their core still equities.

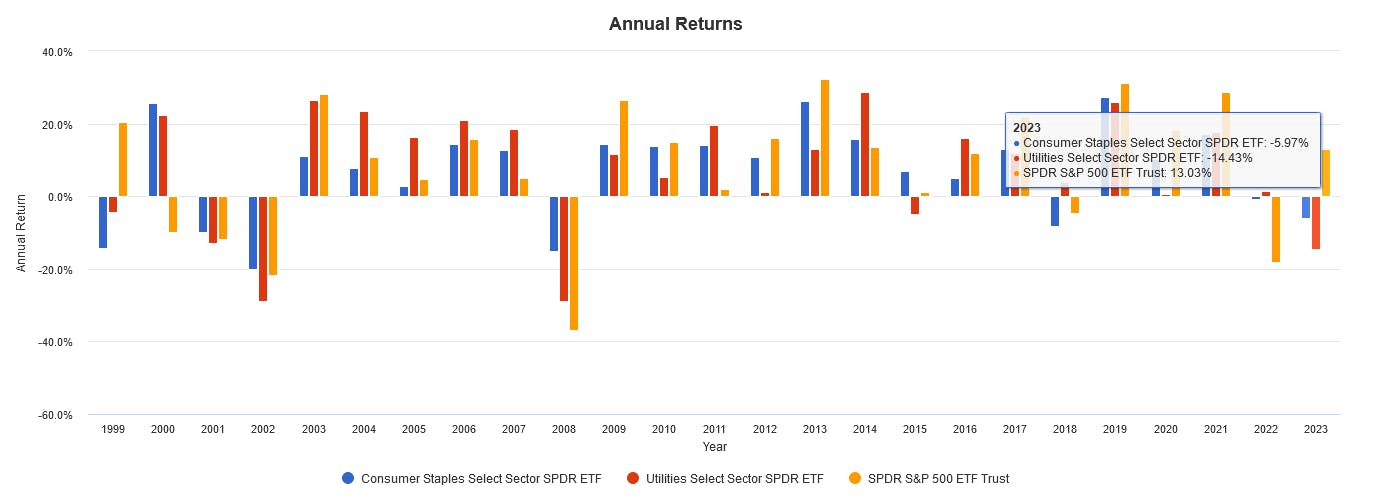

This has been evident in 2023, as two of the most prominent NYSE listed defensive sector ETFs, the Utilities Select Sector SPDR ETF (NYSE:XLU) and the Consumer Staples Select Sector SPDR ETF (NYSE:XLP), reported year-to-date total returns of -14.34% and -5.97% respectively as of September 30.

Here's a look at some of the key factors that contributed to the underperformance of these defensive sector ETFs so far in 2023.

Why Consumer Staples Have Faltered

In 2022, consumer staples ETFs like XLP emerged as clear victors, particularly as inflation soared and traditionally riskier sectors, such as technology and consumer discretionary, took a hit.

The inherent qualities of the consumer staples sector, including their ability to adjust prices in response to rising commodity costs – think sugar, for instance – granted them an edge in maintaining margins.

"As input costs for food and beverage manufacturers and grocers increased dramatically due to inflation last year, the inelasticity of demand combined with pricing power helped this segment achieve strong revenue growth, gross margin growth, and relatively strong equity returns," says Rene Reyan, Head Thematic and Specialty ETF Strategist at Invesco.

However, it's crucial to understand that this capability isn't limitless. Prolonged price increases can challenge consumer loyalty and test the elasticity of demand for these goods, potentially leading to decreased sales volumes if consumers seek cheaper alternatives or reduce consumption.

"While the food and beverage industry priced its way out of inflationary pressure throughout most of 2022, the consumer's ability to absorb price increases is not limitless, and the peak profit margin era of the current cycle is wrapping up," Reyan says. "Food and beverage companies must now contend with weakening pricing power in a backdrop of low food inflation, growing labor costs, and consumer strain."

Furthermore, a significant portion of stocks in the consumer staples sector lean towards value rather than growth. In financial climates where growth stocks are the flavor of the day, it's only natural that these value-tilted staples would trail behind.

The shifting dynamics between value and growth orientations can significantly influence sector performance, and this year, consumer staples found themselves on the less favored side of that pendulum swing.

Why Utilities Have Faltered

Utilities, often celebrated for their resilience due to the evergreen demand for their services, have faced significant challenges this year.

Despite the constant need for utilities, there are limits to how much these companies can shield their fundamentals from intense macroeconomic headwinds, especially in an environment dominated by persistently high interest rates.

The backdrop of 2023's financial landscape is characterized by an unrelenting rate hike trajectory, with 11 consecutive interest rate increases. This "higher for longer" environment had severe implications for utility companies.

Utilities typically carry a considerable amount of debt on their balance sheets due to the capital-intensive nature of their operations. As interest rates rise, the cost of servicing this debt increases, squeezing profit margins and potentially affecting dividend payouts.

Higher rates also increase the cost of capital for utilities, making new infrastructure projects more expensive, which can stymie growth and investor expectations.

Additionally, the current financial environment has seen bond yields reach historic highs. With treasury bills now offering investors yields of over 5% that are virtually risk-free, the allure of utility stocks diminishes.

If investors can secure these attractive yields without taking on the equity risk associated with stocks, it's only logical they'd gravitate towards the safer option. This shift in investor preference has, in turn, likely contributed to a sell-off in utility stocks, further pressuring the sector.

This content was originally published by our partners at ETF Central.