Deere & Company’s (NYSE:DE) third-quarter fiscal 2017 (ended Jul 30, 2017) earnings surged around 27% year over year to $1.97 per share. Earnings also beat the Zacks Consensus Estimate of $1.93.

Net sales of equipment operations (which comprise Agriculture and Turf, Construction and Forestry) came in at $6.833 billion, jumping 17% year over year. Revenues, however, lagged the Zacks Consensus Estimate of $6.885 billion.

Price realization had an impact of 1% in the quarter. Foreign-currency rates did not have a material translation effect on net sale. Region wise, equipment net sales increased 11% in the United States and Canada, and 25% in the rest of the world. Total net sales (including financial services and others) were $7.808 billion, up 16% year over year.

Deere’s strong results were assisted by the contribution of improving farm- and construction-equipment markets. Performance benefits from advanced products and flexible cost structure also drove growth.

Operational Update

Cost of sales in the quarter increased 17% year over year to $5.265 billion. Gross profit in the quarter came in at $1.568 billion, advancing 14.7% year over year. Selling, administrative and general expenses flared up 11.6% to $791 million. Operating profit significantly improved 18% year over year to $776.8 million.

Operating income from equipment operations jumped 27.2% year over year to $795 million, stemmed by higher shipment volumes and price realization, partially offset by elevated production costs, higher selling, administrative and general expenses and warranty costs.

Segment Performance

Agriculture & Turf segment’s sales increased 13% year over year to $5.338 billion, primarily due to higher shipment volumes and price realization, partially offset by higher warranty costs. Operating profit at the segment climbed 20% year over year to $685 million, stemmed by higher shipment volumes and price realization, partially offset by escalated production costs, warranty expenses, and selling, administrative and general expenses.

Construction & Forestry sales increased 29% year over year to $1.495 billion, mainly as a result of higher shipment volumes, partially offset by higher sales-incentive expenses. The segment reported operating profit of $110 million compared with $54 million in the prior-year quarter. The upswing was driven by shipment volumes.

Net revenues at Deere’s Financial Services division totaled $741 million in the reported quarter, up 11% year over year. The segment’s operating profit came in at $200 million, up 5% year over year. Net income at the segment was $131.2 million, as against $125.9 million recorded in the year-earlier quarter.

Financial Update

Deere reported cash and cash equivalents of $6.537 billion at the end of the fiscal third quarter, as against $4.321 billion recorded at the end of third-quarter fiscal 2016. The company reported cash flow from operations of $729.3 million for the nine-month period ended Jul 30, 2017, compared with $1,324 million in the comparable period last year. At quarter end, long-term borrowing totaled $23.7 billion, down from $24.1 billion recorded at the end of third-quarter fiscal 2016.

Looking Ahead

Deere raised its total equipment sales growth outlook to about 10% year over year for fiscal 2017 from the prior guidance of 9% growth. It projects 24% growth for the fiscal fourth quarter, compared with year-ago period. The forecast included a positive foreign-currency translation effect of about 1% for fiscal 2017 and about 2% for the fiscal fourth quarter. For fiscal 2017, Deere expects net sales to increase about 11% year over year and projects net income to be roughly $2.075 billion.

Segment wise, Deere estimates Agriculture and Turf equipment sales to increase about 9% in fiscal 2017, including a positive currency-translation effect of about 1%. Industry sales for agricultural equipment in the United States and Canada are likely to be down about 5% in fiscal 2017 owing to weakness in the livestock sector and the lingering impact of low-crop prices. This is also expected to affect both large and small equipment.

In the EU28 region, sales will be flat to down 5% due to low commodity prices and farm income. In South America, industry sales of tractors and combines are likely to jump about 20%, on the back of improving economic and political conditions in Brazil and Argentina. Sales in Asia are projected to be flat to down slightly. Deere anticipates sales growth of turf and utility equipment in the United States and Canada to remain around flat for fiscal 2017.

The company foresees global sales for Construction & Forestry equipment to be up about 15%, with no material currency-translation impact. The forecast reflects moderate economic growth worldwide.

The outlook for net income from Financial Services has been set at $475 million for fiscal 2017. Lower losses on lease residual values will be partially offset by less-favorable financing spreads and an increased provision for credit losses.

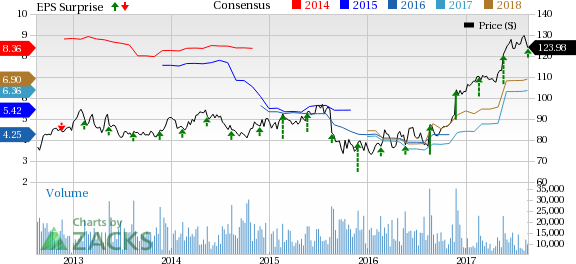

Share Price Performance

Deere has outperformed industry with respect to price performance in the past year. The stock gained 61.1%, while the industry recorded growth of 54.3% over the same time frame.

Zacks Rank and Other Key Picks

Currently, Deere carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the same space include AGCO Corp. (NYSE:AGCO) , Apogee Enterprises, Inc. (NASDAQ:APOG) and Caterpillar Inc. (NYSE:CAT) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has expected long-term growth rate of 13.51%.

Arista Networks has expected long-term growth rate of 12.50%.

Caterpillar has expected long-term growth rate of 9.50%.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without.

More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Apogee Enterprises, Inc. (APOG): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Original post

Zacks Investment Research