Searching for battered and bruised assets through an ETF lens continues to highlight commodities. There are select cases of deep value represented by other asset classes, but at the extreme, this quest still favors funds that target raw materials – echoing the results from The Capital Spectator’s previous review of ETFs that have fallen out of favor.

The definition of deep value for this analysis – 5-year return — is based on a paper by AQR Capital Management’s Cliff Asness and two co-authors: “Value and Momentum Everywhere” via a 2013 issue of the Journal of Finance. Although there’s no shortage of alternative value metrics, the logic for using 5-year performance starts with the fact that it can be applied across a wide set of assets, thereby offering a level playing field for evaluating value. As such, 5-year results offer a useful tool as a first approximation for identifying funds that appear to be deeply discounted by Mr. Market, a state that implies that expected returns are relatively high a la the value proposition.

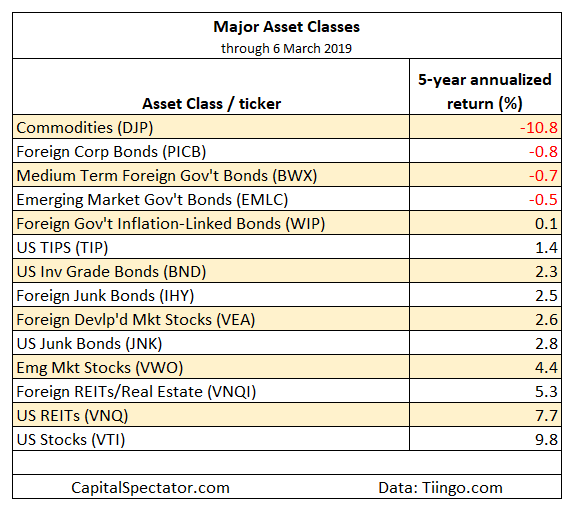

On that basis, let’s review value pricing across a broad range of markets. The ranking below covers 135 exchange-traded products that run the gamut: US and foreign stocks, bonds, real estate, commodities and currencies. (You can find the full list here, sorted in ascending order by annualized 5-year return — based on 1260 trading days — through yesterday, March 6).

Note that the list becomes quite granular in spots. In equities, for instance, the ETF list ranges from broad regional definitions (Asia, Latin America, etc,) to country funds, down to US sectors (energy, financials, for instance) and industries (e.g., oil & gas equipment & services). The only restriction is what’s available for US exchange-listed funds. Otherwise, the search is broad and deep, or at least as broad and deep as permitted given the current lineup of ETFs.

Let’s start with the major asset classes for a big-picture profile. Once again, a broad definition of commodities is the weakest performer by far. The iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP)– an exchange-traded note, by the way – is underwater by an annualized 10.8%. By comparison, the second-biggest five-year loss is a relatively mild 0.8% decline via foreign corporate bonds, as represented by Invesco International Corporate Bond (PICB).

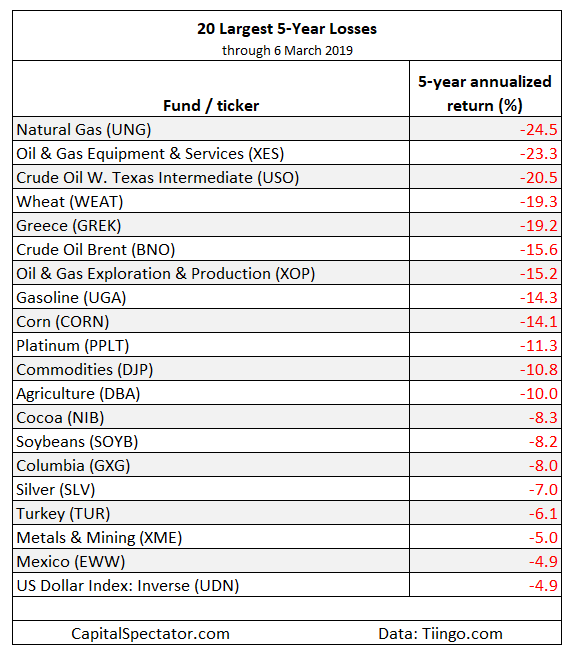

The next table shows the deepest 20 losses for the full list of 135 funds. The biggest setback is currently found in natural gas:United States Natural Gas (NYSE:UNG) has lost an annualized 24.5% over the past five years. Note that the deepest loss for equities in the table below is represented by SPDR S&P Oil & Gas Equipment & Services (NYSE:XES), which has shed 23.3% a year.

For perspective, results at the opposite end of the spectrum are dominated by tech stocks. Topping the list for 5-year annualized return for all 135 funds: SPDR S&P Semiconductor (NYSE:XSD), which currently enjoys an 18.7% annualized return over the past five years – a performance that can be thought of as the anti-value poster child.