The search for deep-value plays in the ETF realm delivered a short list in August, when markets were humming far and wide. Let’s take a fresh review of the landscape in the wake of recent selling, which has pinched nearly every corner of global stocks, bonds, and real estate securities. Commodities have fared better in recent weeks, but this slice of the major asset classes was already suffering from a longer-run perspective and so there are still plenty of relative bargains on this front.

As before, the definition of value for this preliminary hunt for bargains is using five-year annualized return to rank funds, inspired by “Value and Momentum Everywhere,” a 2013 Journal of Finance paper by AQR Capital Management’s Cliff Asness and two co-authors. There are many ways to measure value, but as an initial screen across asset classes and its subsets there’s a case for starting the review with this metric. Why? It’s easy and facilitates the analysis across a broad range of assets on an apples-to-apples basis.

The pool of assets for this exercise: 135 exchange-traded products that run the gamut: US and foreign stocks, bonds and real estate, along with funds targeting commodities and currencies. (You can find the full list here, sorted in descending order by five-year return through yesterday, Oct. 8). Note that the full playing field becomes quite granular in spots. In equities, for instance, the ETF list ranges from broad regional definitions (Asia, Latin America, etc,) to country funds and down into US sectors (energy, financials, for instance) and industries (e.g., oil & gas equipment & services). The only limitation is what’s available for US exchange-listed funds. Otherwise, the search is broad as well as deep, or at least as deep as permitted given the current lineup of ETFs.

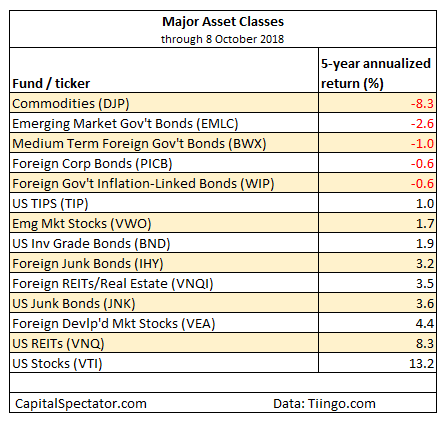

Let’s start by focusing on the major asset classes for a big-picture review. As in August, broadly defined commodities (iPath Bloomberg Commodity (DJP)) still rank at the top of the list for value. But this time there are a few more additions to the red-ink brigade, courtesy of modest losses in foreign bonds for the trailing five-year return.

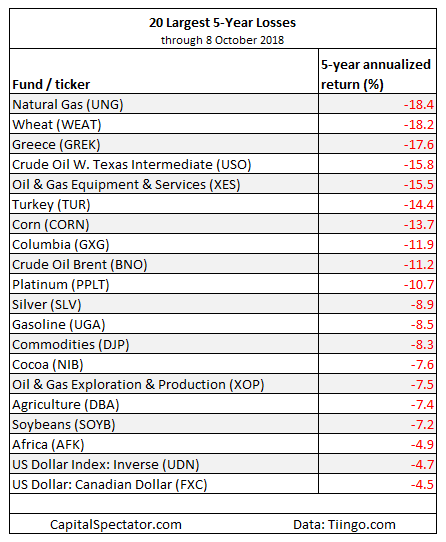

Turning to the 20-deepest losses for all the ETFs still turns up a commodities-heavy list. Note, however, that equity markets in Africa (VanEck Vectors Africa ETF (VanEck Vectors Africa (NYSE:AFK))) now make the cut, joining the only other equity funds on this short list — two holdovers from August: Turkey (iShares MSCI Turkey ETF (iShares MSCI Turkey (NASDAQ:TUR)) and Global X MSCI Greece (Global X FTSE Greece 20 (NYSE:GREK)) — and a new country fund entrant via Global X MSCI Columbia (Global X MSCI Colombia (NYSE:GXG)).

In the grand scheme of financial history, the current lineup of value plays remains modest in terms of the absolute depth of the five-year losses. But if recent trading activity is a guide, Mr. Market appears inclined to run a bigger sale on assets in the days ahead.