The pace of loan growth has been declining recently. What does it mean for the gold market?

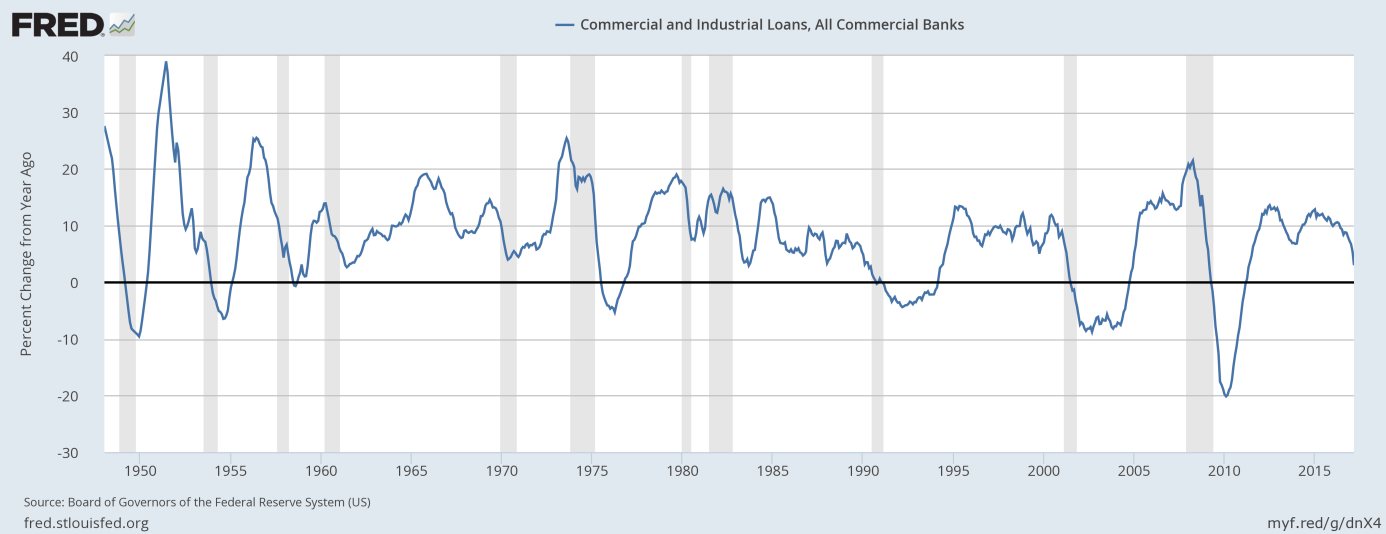

As the chart below shows, the annual rate of growth in commercial and industrial loans has been declining since 2015. In March, bank loans increased just 3 percent – a level not seen since the last recession.

Chart 1: The annual rate of growth in commercial and industrial loans from 1948 to March 2017.

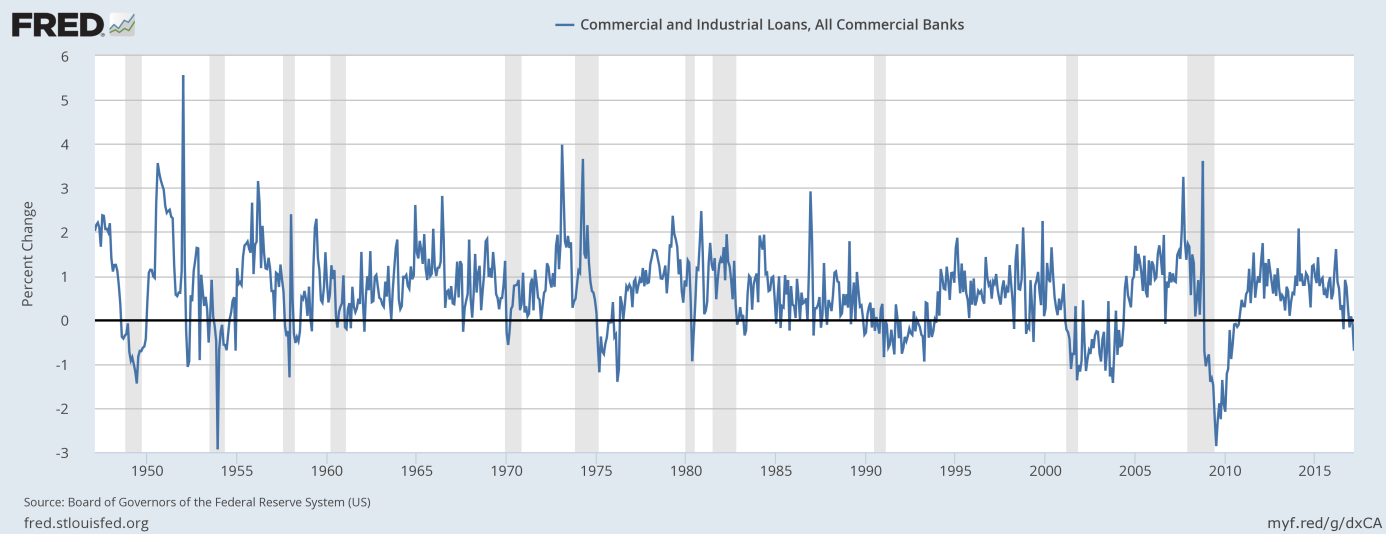

And it’s much worse on a monthly basis. As one can see in the chart below, in March, commercial and industrial loans granted by all U.S. commercial banks declined 0.7 percent, the second drop in a row.

Chart 2: The monthly rate of growth in commercial and industrial loans from February 1947 to March 2017.

The slowdown in loan growth may be a sign that something bad is happening in the economy. Historically speaking, such dynamics were associated with recessions. Surely, it may be the case that companies are incurring debt not in banks, but in the open market. Indeed, the first quarter was solid for bond issuance, suggesting that companies are relying less on bank credit.

However, the reasons to worry remain. Credit is the backbone of consumer spending and business investment. The slowdown may be caused by the weakness in auto sales.

What does it all mean for the gold market? Well, the slowdown in credit should hamper economic growth and it signals an increased risk of recession. Hence, the safe-haven demand for gold could increase in the near future, if the slowdown in bank loans continues and feeds into other data. On the other hand, investors should not focus on a single indicator, but always try to analyze several different indices. Other indicators do not paint a similarly gloomy picture, but it does not mean that the slowdown in credit may be neglected.

In any case, the price of gold should be affected in the coming days by yesterday’s FOMC statement and Friday’s employment report. The Fed did not change its policy and introduced only limited changes to the statement. Given the current comeback of risk appetites, and if the Fed's signals, it appears they remain on track to hike interest rates and we see strong job gains on Friday, gold prices should decline.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.