If you suffer from a fear of heights then careful when looking at the daily candle in USD/JPY. After holding the long USD/JPY Premium trade for over 2 months, we've finally taken profit at 105.45 from the 114.10 entry. The decision to close USD/JPY long and allow EUR/USD long to run (bought at 1.0540) was made 15 mins before today's NFP report. The decision to do so was about 90% technicals-related and less than 10% related to fundamentals as I had no idea the earnings figures would disappoint (0.2% m/m vs exp 0.3% m/m despite other positives such as falling Unemp rate to 4.8% from 4.7%, 235K NFP vs exp 200K consensus and NFP upward revision). But there's more to this.

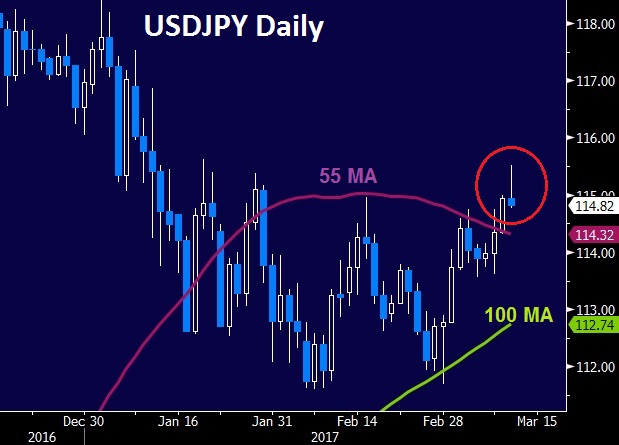

While holding the USD/JPY long (bought at 114.10) the position suffered extended unrealised losses (stop was 111), but as I made clear in the last 4-7 weekly Premium videos, the importance of the weekly candle to close at or above 112.40 support (50% fib of the Jun 2015-June 2016 move) that already worked as key support in Feb-Mar 2016) played a major role as it proved a solid foundation on the weekly candles from January to March 2017 (focus on weekly close not intraweek levels). After closing the USD/JPY long, today's candle failed at the 50% retracement of the smaller move (Dec to Feb move).

Why I Let EUR/USD Long Before NFP

A partial answer is my improved confidence with EUR/JPY after yesterday's break above its 55-DMA, which is the synthetic product of long EUR/USD and long USD/JPY. Another partial answer is related to the relationship between USDX and USD/JPY, which I will explain in next week's Premium video ahead of the Fed decision. Meanwhile, yesterday's EUR/AUD pre-ECB long is 150-pips in the green while both gold and silver longs are left to run at a loss.