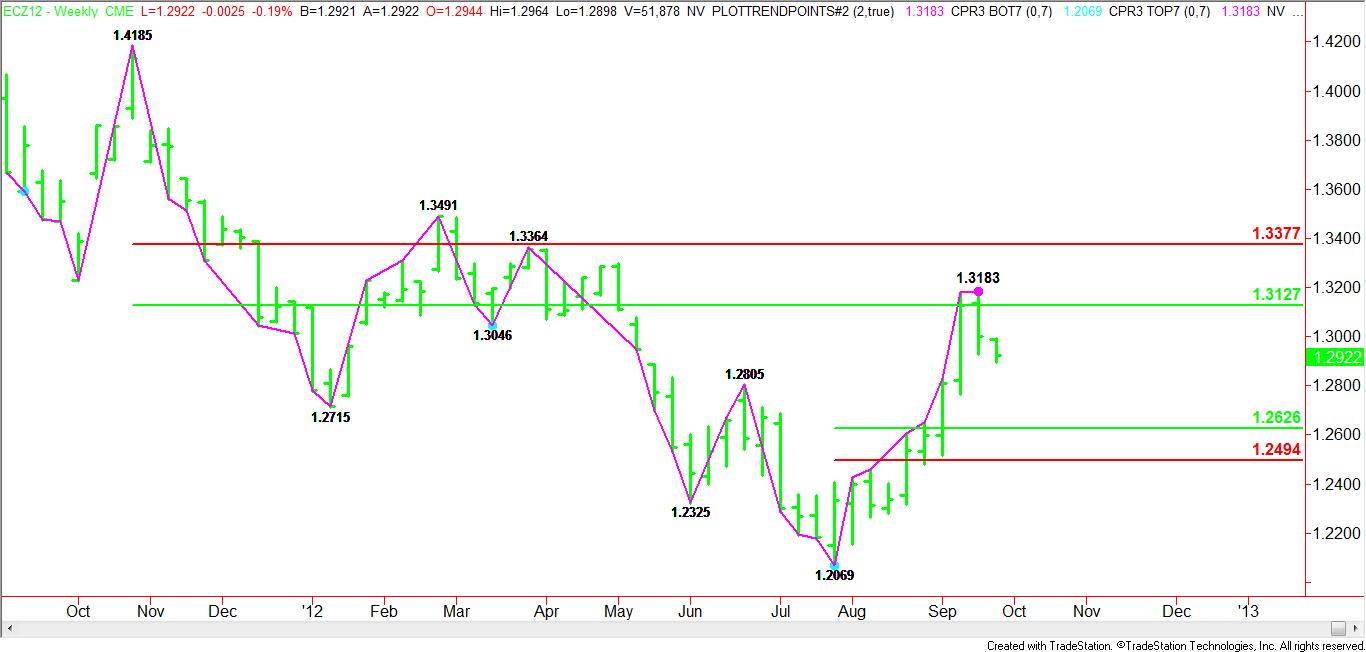

A simple technical analysis technique helped identify where the December Euro rally could stop and now the same technique has identified a potential downside target area.

Based on the 1.4185 to 1.2069 trading range, the 50 to 61.8 percent retracement zone was identified as a 1.3127 to 1.3377. The market stopped inside this zone last week at 1.3183 before forming a potentially bearish closing price reversal top on the daily and weekly charts.

On Monday the December Euro confirmed the weekly closing price reversal top with its follow-through to the downside. Because of this action, a new range has been created at 1.2069 to 1.3183. This range has created a new retracement zone and downside target at 1.2626 to 1.2494.

If downside momentum can continue this week then traders will begin to see clearly that the next downside target is 1.2626 to 1.2494. Typically after a closing price reversal top, this retracement is completed within 2 to 3 weeks.

With bearish news beginning to leak out of Europe regarding Spain and Greece, long traders may begin to pare positions, thereby pressuring the market. This is normal action following a strong rally and is not always indicative of a change in trend.

Those who caught the last rally have strong reasons to take profits and wait for a correction into the retracement zone. Those who missed the rally and choose to wait for a break into a value zone should give the Euro a chance to pull back into 1.2626 to 1.2494. Finally, aggressive traders may want to play the short side for a quick break into the same retracement zone. If anything, this chart pattern suggests that trading activity should increase over the near-term as a battle between the bulls and bears should take center stage.

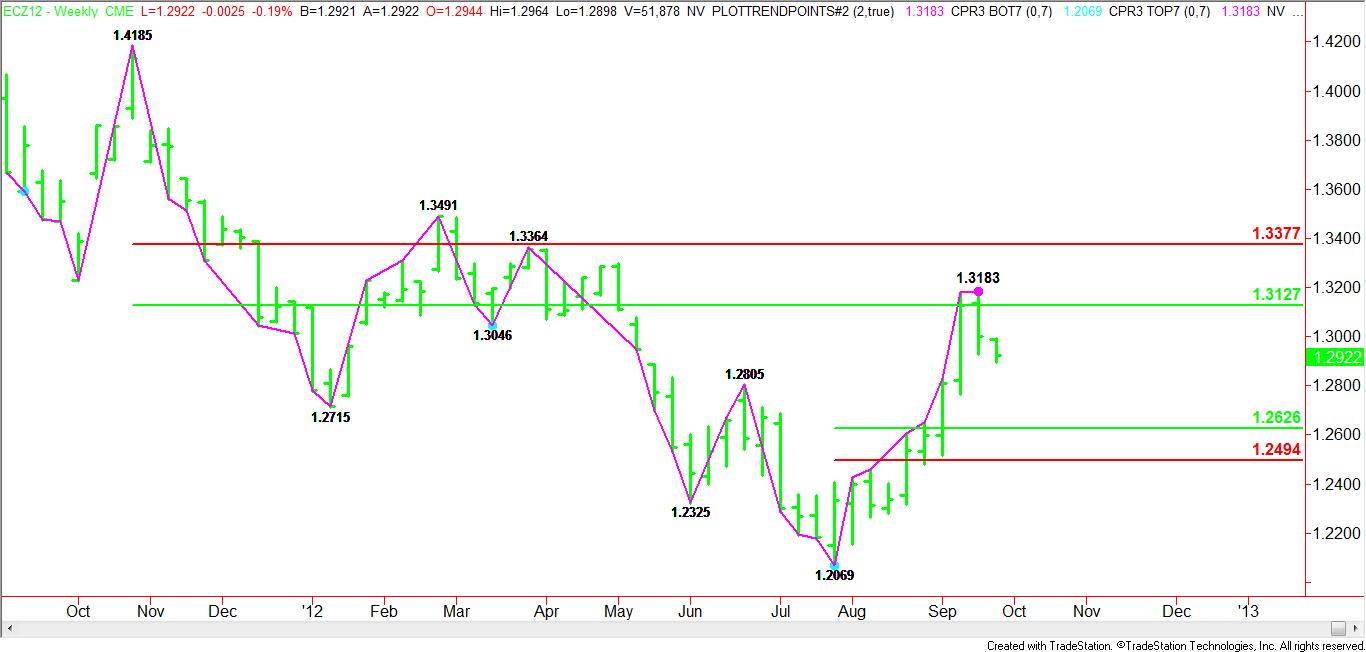

Based on the 1.4185 to 1.2069 trading range, the 50 to 61.8 percent retracement zone was identified as a 1.3127 to 1.3377. The market stopped inside this zone last week at 1.3183 before forming a potentially bearish closing price reversal top on the daily and weekly charts.

On Monday the December Euro confirmed the weekly closing price reversal top with its follow-through to the downside. Because of this action, a new range has been created at 1.2069 to 1.3183. This range has created a new retracement zone and downside target at 1.2626 to 1.2494.

If downside momentum can continue this week then traders will begin to see clearly that the next downside target is 1.2626 to 1.2494. Typically after a closing price reversal top, this retracement is completed within 2 to 3 weeks.

With bearish news beginning to leak out of Europe regarding Spain and Greece, long traders may begin to pare positions, thereby pressuring the market. This is normal action following a strong rally and is not always indicative of a change in trend.

Those who caught the last rally have strong reasons to take profits and wait for a correction into the retracement zone. Those who missed the rally and choose to wait for a break into a value zone should give the Euro a chance to pull back into 1.2626 to 1.2494. Finally, aggressive traders may want to play the short side for a quick break into the same retracement zone. If anything, this chart pattern suggests that trading activity should increase over the near-term as a battle between the bulls and bears should take center stage.