It’s Friday in the Wall Street Daily Nation!

For the newbies in the group, once a week I embrace the adage that a picture is worth a thousand words. And I select a handful of graphics to convey important economic or investment insights.

This week, I’m dishing on the pesky Fiscal Cliff we can’t get away from, the latest dip in stock prices and why Europe isn’t always worse than the United States.

While I can’t promise you’ll walk away from today’s column uplifted, you’ll definitely be more informed. That has to count for something, right?

So let’s get to it…

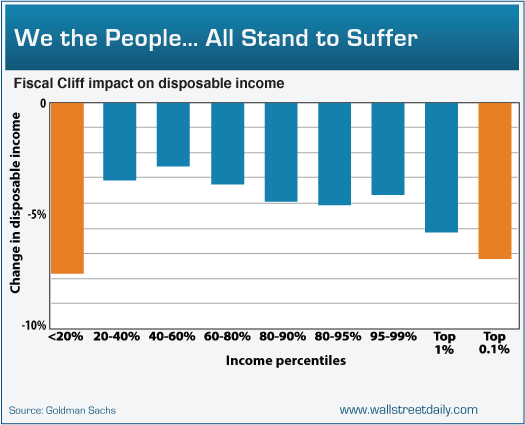

Soak the Rich and the Poor

Too much press has been given to the Fiscal Cliff already. But I’m going to keep piling it on. Sorry – it’s in the name of truth, so I can’t resist.

You see, most media outlets play up how much more taxes the rich are going to pay if we do, indeed, plummet off of the Cliff. But few, if any, talk about the impact on the poor and middle class.

Guess what? It ain’t pretty, either.

Based on the expected changes in disposable income, the “poor” – people with incomes in the lowest percentile – actually stand to suffer the most.

Bottom line: It’s time for politicians to stop ginning up the class warfare and, instead, figure out a way to overcome our addiction to debt. We the people need a compromise, stat! Otherwise, we’re all going to suffer.

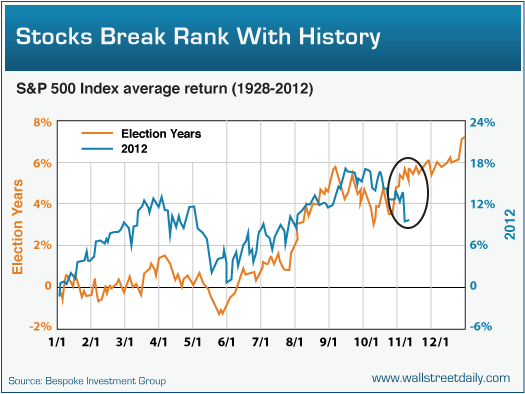

Obama! Or O-Bummer?

For most of 2012, I’ve been chronicling the stock market’s uncanny correlation to past election years, going all the way back to 1928 (see here and here).

As Bespoke Investment Group notes, “By now, stocks have typically started their ascent through year end during election years.”

Not so much this time around.

Since Election Day, stocks have officially broken out of the historical pattern.

Obama! Or O-bummer? Time will tell (for stocks).

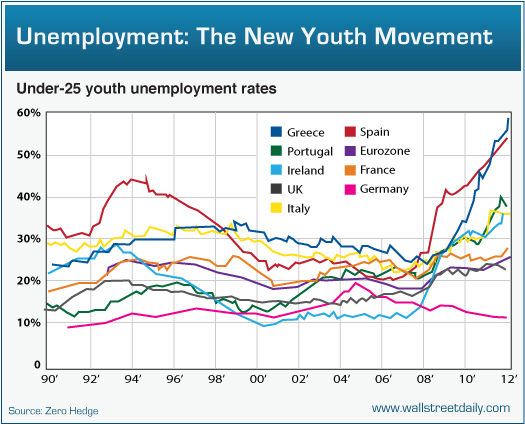

Don’t Worry, Be Happy!

While we bemoan slumping stock prices in the United States, they’re suffering from the same thing on the other side of the pond – as well as an unhealthy youth movement.

More and more young folks in the eurozone simply can’t find a job. In fact, the youth unemployment rate now tops 23%. And in some countries, like Greece and Spain, it’s above 50%.

Youth tend to be rebellious anyway. Give them too much free time – and severe austerity measures – and is it any surprise that riots continue to erupt across the continent? Hardly.

For comparison’s sake, the U.S. youth unemployment rate now stands at 16%. And no riots (yet).

When times are tough, a hand of misery poker seldom fails to brighten one’s spirits. So don’t worry, be happy. We could live in Europe.

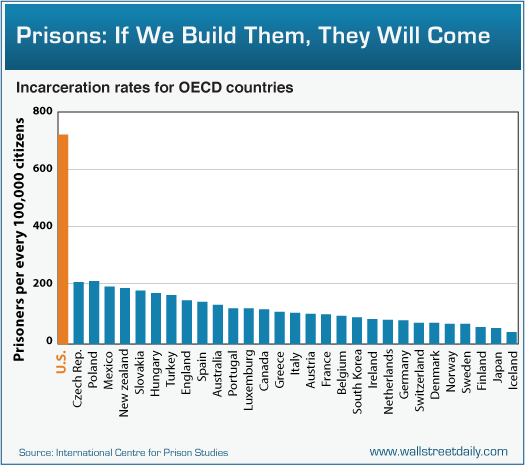

Why Are You Always Picking on Me?

Since the Great Recession began, I’ve been fond of comparing conditions in the United States versus conditions in the eurozone (which are generally worse). But please don’t think I have it out for Europe.

I’m well aware that the United States has its own set of unique and ugly problems. Like this one:

According to data from the International Centre for Prison Studies, we incarcerate a higher proportion of our citizens than any other country.

Being a nation of sinners doesn’t come cheap, either. Last year, states spent $52 billion to construct and operate our prisons. That’s more than four times the amount spent in 1987, according to the Pew Center.

Maybe it’s time to start making crime pay by investing in prison stocks like Corrections Corp. of America (NYSE: CXW) and The Geo Group (NYSE: GEO).

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Debtors, Sinners, Unemployment And Riots

Published 11/16/2012, 12:18 PM

Updated 05/14/2017, 06:45 AM

Debtors, Sinners, Unemployment And Riots

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.