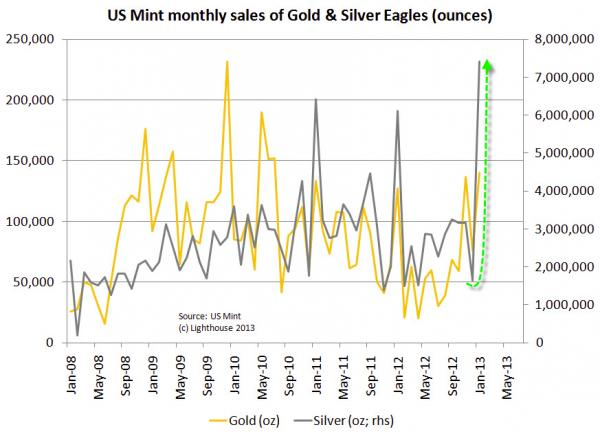

Precious metals and commodities enjoyed another up day on Tuesday, with steady but unspectacular gains. Global equities are hitting levels not seen for four-and-a half years as investor confidence grows. Sales of Silver Eagle coins in America have surged to an all-time record high this month.

(Chart courtesy of ZeroHedge)

We’re stuck in a sort of no-mans land as far as the economy is concerned at the moment. On the one hand, stock markets are roaring to new highs with seemingly every passing day, with pundits talking up the prospects of a new bull market for equities. On the other side of the tracks, however, U.S. consumer confidence dropped this month to its lowest level since November 2011, along with troubling developments in the debt-ceiling debate. Indeed, James Turk notes in his latest King World News interview that the House of Representatives has just voted to “temporarily suspend” the debt ceiling until May 19. In effect -- and assuming that the president and Senate agree to the House’s proposal, which is highly likely -- this gives the U.S. government a blank check to spend as it likes from now until May 19.

Does anyone care to bet that Washington will, after hat date, agree to a new debt limit? If so, Obama’s got an oceanfront property in Illinois to sell you.

As James says:

But here's the really important point: These two words used by Bloomberg in reporting this event -- temporarily suspend -- are chilling… These are the exact same two words that Nixon used in his August 15, 1971 speech announcing that he was breaking the dollar's link to gold. His temporary suspension has now lasted 42 years, which is the key point I am making here. This suspension of the debt ceiling is not going to be temporary. Each time it comes up for consideration, the politicians will just keep extending the suspension again and again. They will always take the soft political option.

As dollar-destructive measures go, this latest wheeze could take a beating.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Debt Ceiling To Be Temporarily Suspended?

Published 01/30/2013, 12:30 PM

Updated 05/14/2017, 06:45 AM

Debt Ceiling To Be Temporarily Suspended?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.