What was meant to be payrolls Friday and a once again important look at the US jobs market via the monthly payrolls announcement has instead turned into a damp squib courtesy of the US government’s shutdown and the effects that has had on the organs of economic data production. Maybe we should call today ‘delayrolls Friday’ instead?

Headlines from Washington seem to reinforce our view that we are getting no closer to deal around the budget nor the debt ceiling. Both parties seem, on the face of it, to be comfortable enough in their position to let the sand run through the egg timer a lot longer. The hardest part of the game of chicken is knowing when to flinch. As we have banged on about in the recent weeks, the debt ceiling fight is a much more important battle than that of the budget and the prospects for default, significant market shifts and credit rating action cannot be underestimated.

USD fought back yesterday following 2 days on the back foot as investors’ fears got the better of them. A shooting at the US Capitol building will have also shaken market sentiment. The timeline here is important; market weakness as a result of debt ceiling fears started a fortnight before the deadline in 2011; yesterday marked the 2 week point before the Treasury department’s imposed time limit. Equities and emerging market currencies had their wings clipped as a result.

The data we did get yesterday from the US was mixed. US jobless claims, the one jobs report that is showing continual improvement in the US labour market, continued in a similar vein yesterday. Claims fell to 308k last week and brought the 4-week average to 309k; a significant portion off the trend of 350k during the first half of 2013. This inherently shows rising employment but the Fed and the market will be looking for confirmation in other jobs releases. The employment component of the US ISM for the services sector was one such disappointment. Services growth slipped to the slowest rate since June.

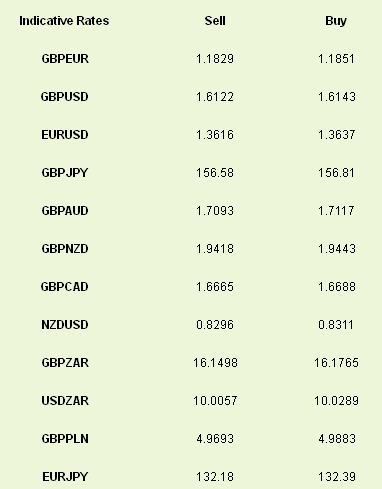

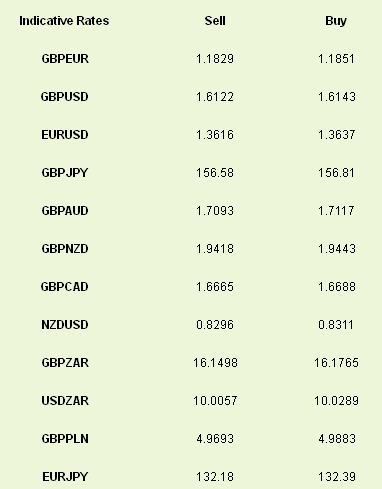

Data from the Eurozone kept EURUSD towards 1.36 for the most part of the morning while GBPEUR slipped once again. Eurozone retail sales rose 0.7% from the previous month in August, accelerating from July’s 0.5% pace of growth and beating the market’s hopes of a 0.2% gain. PMIs from across the region were also stronger than expected with the overall Eurozone services PMI unexpectedly rising to 52.2 from 52.1. Particular strength was seen in the Italian and French measures whilst Spain’s and Germany’s slipped on the month.

GBP skidded lower after a miss on September’s services PMI. Much like the construction sector on Wednesday, the UK services sector has been bolstered by a sharp rise in new orders on the basis of increasing business confidence. The increase in work has created some backlogs within the industry which should naturally lead to an increase in employment in the sector. Should that crystallise then we could easily see job growth improve at a faster rate than July’s 6 year high.

One caveat to all this good news Is where the growth within the service sector is coming from – banks and business to business services are benefiting from housing market and corporate activity improvements respectively however, consumer facing companies are not progressing at the same rate. The pressure on consumers is the obvious factor here, and will continue as wage negotiations fall short of price increases.

Putting the recent PMIs together with the rest of the news for the quarter we are happy with our appraisal that the UK economy grew in Q3 at rate of around 1.1%.

Other than issues out of Washington, half an eye must be kept on Italy as the Supreme Court reaches a verdict on whether Silvio Berlusconi should be ousted from his Senate position given his conviction for tax fraud.

Headlines from Washington seem to reinforce our view that we are getting no closer to deal around the budget nor the debt ceiling. Both parties seem, on the face of it, to be comfortable enough in their position to let the sand run through the egg timer a lot longer. The hardest part of the game of chicken is knowing when to flinch. As we have banged on about in the recent weeks, the debt ceiling fight is a much more important battle than that of the budget and the prospects for default, significant market shifts and credit rating action cannot be underestimated.

USD fought back yesterday following 2 days on the back foot as investors’ fears got the better of them. A shooting at the US Capitol building will have also shaken market sentiment. The timeline here is important; market weakness as a result of debt ceiling fears started a fortnight before the deadline in 2011; yesterday marked the 2 week point before the Treasury department’s imposed time limit. Equities and emerging market currencies had their wings clipped as a result.

The data we did get yesterday from the US was mixed. US jobless claims, the one jobs report that is showing continual improvement in the US labour market, continued in a similar vein yesterday. Claims fell to 308k last week and brought the 4-week average to 309k; a significant portion off the trend of 350k during the first half of 2013. This inherently shows rising employment but the Fed and the market will be looking for confirmation in other jobs releases. The employment component of the US ISM for the services sector was one such disappointment. Services growth slipped to the slowest rate since June.

Data from the Eurozone kept EURUSD towards 1.36 for the most part of the morning while GBPEUR slipped once again. Eurozone retail sales rose 0.7% from the previous month in August, accelerating from July’s 0.5% pace of growth and beating the market’s hopes of a 0.2% gain. PMIs from across the region were also stronger than expected with the overall Eurozone services PMI unexpectedly rising to 52.2 from 52.1. Particular strength was seen in the Italian and French measures whilst Spain’s and Germany’s slipped on the month.

GBP skidded lower after a miss on September’s services PMI. Much like the construction sector on Wednesday, the UK services sector has been bolstered by a sharp rise in new orders on the basis of increasing business confidence. The increase in work has created some backlogs within the industry which should naturally lead to an increase in employment in the sector. Should that crystallise then we could easily see job growth improve at a faster rate than July’s 6 year high.

One caveat to all this good news Is where the growth within the service sector is coming from – banks and business to business services are benefiting from housing market and corporate activity improvements respectively however, consumer facing companies are not progressing at the same rate. The pressure on consumers is the obvious factor here, and will continue as wage negotiations fall short of price increases.

Putting the recent PMIs together with the rest of the news for the quarter we are happy with our appraisal that the UK economy grew in Q3 at rate of around 1.1%.

Other than issues out of Washington, half an eye must be kept on Italy as the Supreme Court reaches a verdict on whether Silvio Berlusconi should be ousted from his Senate position given his conviction for tax fraud.