Pretty picture time.

On Fridays in the Wall Street Daily Nation, we ditch our regular routine of commentary-based articles. Instead, we use graphics to present a handful of important investment and economic insights.

This week, I’m dishing on debt, taxes, real estate, the world’s biggest stock and the surprising rise in retail sales.

Without further ado…

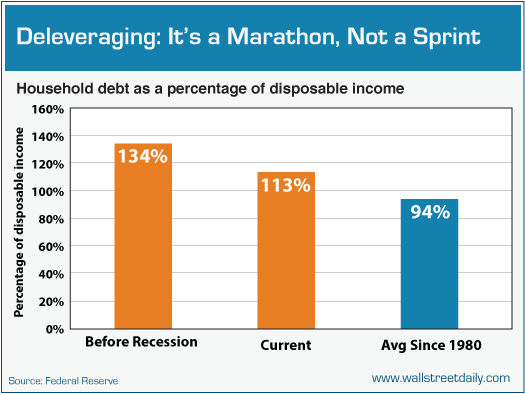

A (Shrinking) Nation of Debtors

Recessions suck. But there is one good thing about them. They force us to change our spending habits. And the Great Recession is leading to a Great De-Leveraging.

Based on the latest Federal Reserve data, household debt as a share of disposable income sank to 113% in the second quarter.

At first blush that might not sound like a good thing. But it is. Especially in relation to where we stood right before the recession hit. Take a look:

Of course, we’re still far from normal levels. The long-term average since 1980 is 94%. But come on people! Deleveraging’s a marathon, not a sprint. It’s all about putting one foot in front of the other, again and again.

Here’s a key question, though: Are we learning anything from the exercise?

Not a chance. As Mark Zandi, Chief Economist at Moody’s Analytics, predicts, “Credit use should soon go from being a significant headwind to the economy to a tailwind.”

Forget soon, Mr. Z. It’s happening now…

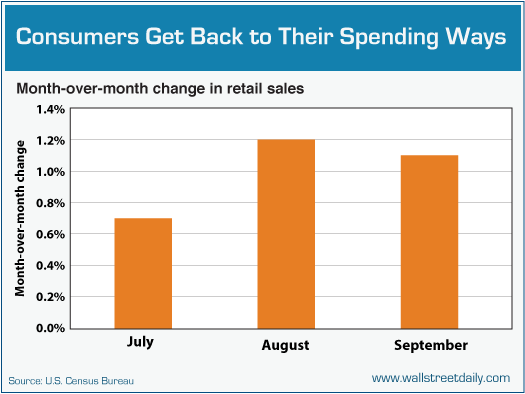

Ready to Shop ‘Til You Drop?

The latest from the U.S. Census Bureau reveals that retail sales increased for the third consecutive month.

Coincidence? Hardly. Consumers freed up more credit. Now they’re using it. For all things.

I say that because 12 out of the 13 segments that make up the overall retail sales figure experienced increases in September. And in August, all 13 segments enjoyed increases.

Mama never met a sale she didn’t like!

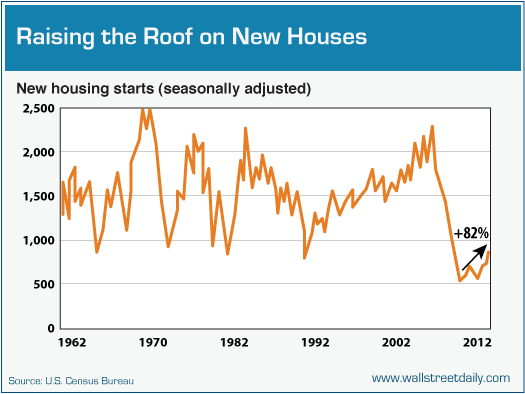

Another Week, Another (Positive) Real Estate Stat

Two weeks ago I turned to LL Cool J. This week, I’m summoning MC Hammer…

The freshest real estate data proves the recovery is too legit to quit (hey… hey).

On Wednesday, the Census Bureau reported that housing starts jumped to a seasonally adjusted annual rate of 872,000. That’s up 15% from last month and 34.8% from last year.

Housing starts hit rock bottom in April 2009 at 478,000 starts. Even after the 82% increase since then, though, we’re still a long way away from normal levels.

Translation: It’s not too late to invest in homebuilding stocks. My favorite way to do so remains the iShares Dow Jones Home Construction ETF (ITB).

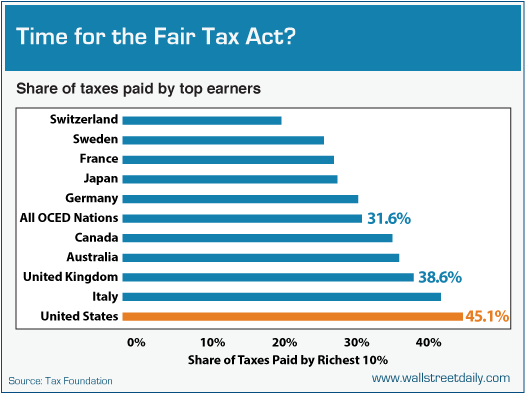

Taxmageddon: On the Way? Or Already Here?

After jobs, tax policy seems to be at the center of the Presidential debate.

We already know America leads the world in corporate tax rates.

According to the Tax Foundation, our 39.2% rate is 50% higher than the simple average of 33 other member nations in the OECD. And it’s about 10 percentage points higher than the weighted average of all OECD nations.

Well, the amount we tax our top earners (people with adjusted gross incomes of $112, 124 or more) isn’t any better. According to this nugget from The Wall Street Journal’s Stephen Moore, our rates are the highest in the world.

Whether or not you think our rates are the “fairest in the world,” too, hinges upon your personal political leanings.

All I’ll say is this: Over 200 years ago, we revolted to get out from under the high taxes of the British Empire. Now our taxes are considerably higher.

Not so sure our founding fathers would consider that progress. But that’s a debate for another venue, so let’s move right along…

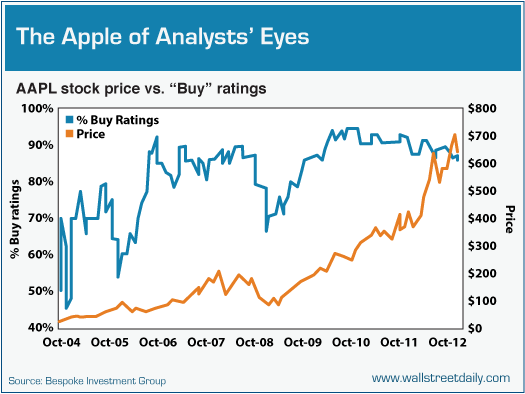

Can I Get a “Sell” Rating, Please?

We all know Wall Street analysts avoid issuing “Sell” ratings like the plague. But no stock proves it better than Apple ( AAPL).

In the last three years, the percentage of “Buy” ratings hasn’t dipped below 80%. At one point in 2010, almost every analyst (literally) was bullish on the stock.

Right now, 85.2% of analysts rate Apple a “Buy,” according to Bespoke Investment Group.

What’s that saying I like to quote? Oh yeah, it’s Humphrey B. Neill’s: “When everybody thinks alike, everyone is likely wrong.”

And wouldn’t you know it? After hitting an all-time high of $705.07 on September 21, Apple’s off about 10%.

The contrarian in me still rates the stock a “Sell.” Only two other analysts agree with me. We’re lonely. Time will tell if we’re stupid, too.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Debt, Taxes And Real Estate, Oh My!

Published 10/19/2012, 06:07 AM

Updated 05/14/2017, 06:45 AM

Debt, Taxes And Real Estate, Oh My!

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.