Dollartakes another hit after soft data

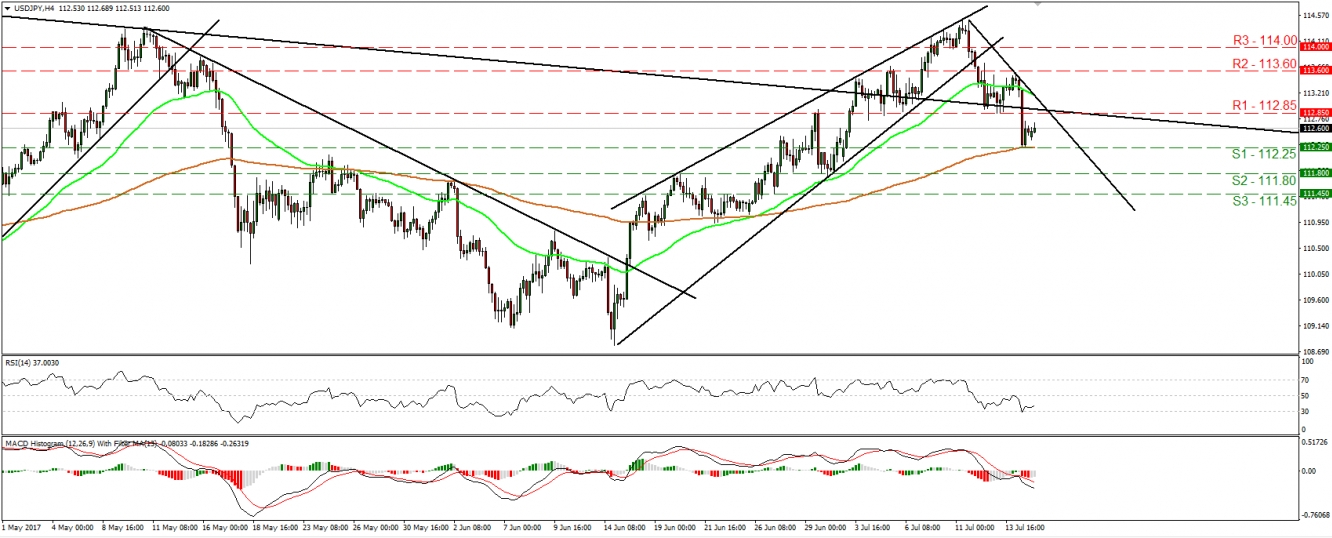

- The US dollar came under renewed selling pressure on Friday, with the USD index reaching its lowest level since September, following the release of disappointing inflation and retail sales data for June. Even though the core CPI rate held steady as anticipated, the headline rate dropped by more than expected. Meanwhile, both the headline and the core retail sales rates missed their forecasts for an increase, and instead declined.

- The worse-than-anticipated CPI data call into question the view of some FOMC members who noted that the recent softness in inflation is transitory. This was also touched upon by Chair Yellen in her testimony last week, when she said that even though low inflation is owed to temporary factors, “there may be more going on”. What’s more, the decline in retail sales suggests that Q2 GDP growth may be worse-than-previously-anticipated. Coming on top of the weak GDP print for Q1, which the Fed also viewed as transitory, another quarter of lackluster growth could lead FOMC officials to recalibrate their view about the growth outlook as well.

- Combined, these soft data pushed back market expectations regarding the timing of the next Fed rate hike, with the Fed funds futures currently suggesting less than 50% probability of another rate hike this year. With no Fed speakers or US economic data on the agenda this week to distract investors, this negative sentiment could continue to weigh on USD over the next few days.

- USD/JPY tumbled on Friday on the disappointing US data. The pair fell back below the downside line taken from the peak of the 11th of January and below the support (now turned into resistance) of 112.85 (R1). The slide confirmed a forthcoming lower low on the 4-hour chart and perhaps signaled a short-term trend reversal. Therefore, we switch our view with regards to the short-term outlook to negative for now. Even though we may see a small rebound due to some short-covering, we would expect the bears to take charge again soon, perhaps near 112.85 (R1), and aim for another test at 112.25 (S1), where a break is likely to open the way for our next support level of 111.80 (S2).

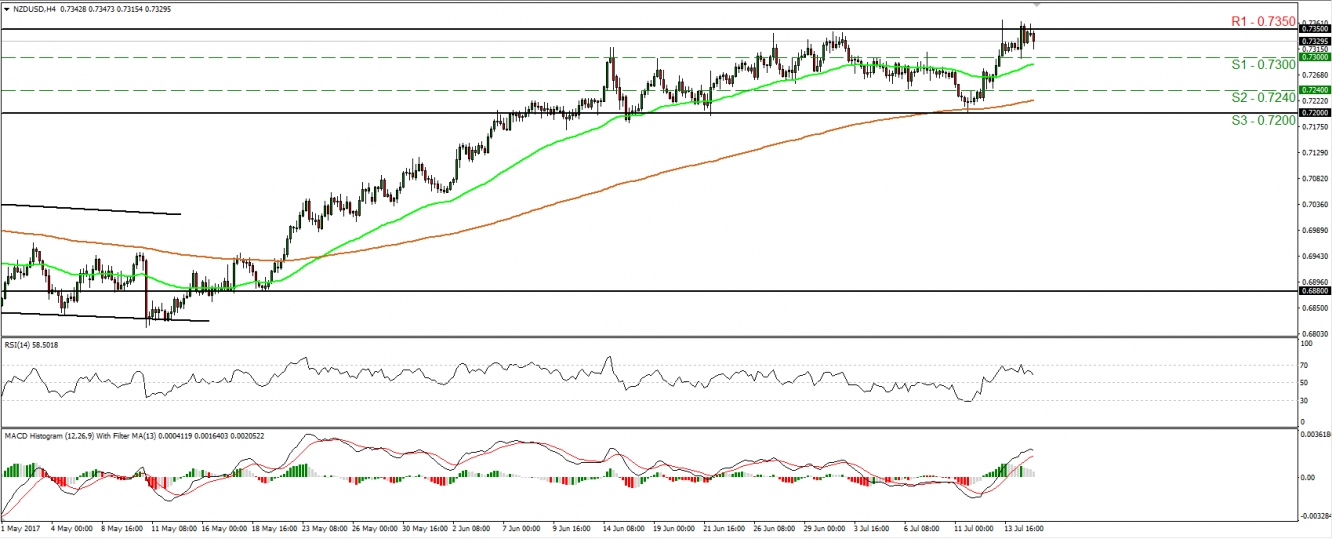

New Zealand’s CPI data to drive the Kiwi

- During the early Asian morning Tuesday, New Zealand’s CPI data for Q2 are due out. The forecast is for the nation’s inflation rate to have declined to +1.9% yoy, from +2.2% yoy previously. The case for a slowdown is supported by the ANZ inflation gauge, which came in at +2.1% yoy in June. A decline in the nation’s CPI rate could amplify the case that the RBNZ is likely to remain on hold for the foreseeable future, perhaps throughout this year. Something like that could reverse some of NZD recent gains.

- NZD/USD traded in a consolidative manner on Friday, staying near 0.7350 (R1), the upper bound of the sideways range that has been containing the price action since mid-June. As long as the rate is trading within that range, we consider the short-term outlook to be neutral. Having said that, slowing inflation in New Zealand could encourage the bears to take advantage of the range’s upper bound. If they manage to push the rate below 0.7300 (S1), we would expect them to aim for our next support zone of 0.7240 (S2). Another dip below the latter level could challenge the lower bound of the aforementioned range, at 0.7200 (S3).

Today’s highlights:

- The economic calendar is almost empty today. The only noteworthy indicator we get is the US Empire State manufacturing index for July.

As for the rest of the week:

- On Tuesday, besides New Zealand’s CPI data, we also get the minutes from the RBA’s July meeting, as well as the UK CPIs for June. On Wednesday, we have nothing major on the agenda, while on Thursday, the BoJ and the ECB meetings will probably steal the show. Even though not much is expected from the BoJ, the ECB gathering could be eventful, as there is a possibility for policymakers to remove the signal that the QE programme can be expanded. Finally on Friday, Canada’s CPI data for June will be in focus.

NZD/USD

- Support: 0.7300 (S1), 0.7240 (S2), 0.7200 (S3)

- Resistance: 0.7350 (R1), 0.7400 (R2), 0.7480 (R3)

USD/JPY

- Support: 112.25 (S1), 111.80 (S2), 111.45 (S3)

- Resistance: 112.85 (R1), 113.60 (R2), 114.00 (R3)