Thanksgiving Didn't Disappoint Bulls

As a bear, I was hoping this year would be different but of course, it wasn't. The odds of a Thanksgiving rally in the equity markets are high; light volume tends to favor melt-ups because the "buy and hold" investors are busy celebrating the holidays while the active traders (most of which are short) are biting their nails and collectively causing the same annual short squeeze they are suffering from.

The recent sell-off is being blamed on Trump's trade deal comments but in my view, the market was simply looking for a reason to sell. The indices were massively overbought and the last buyer appeared to be in, last week saw massive inflows into the stock market. Further, U.S. corporations have altered their supply chains leaving the relationship between the U.S. and China less critical than it was at the beginning of this skirmish. In short, whether we get a deal or no deal, might not even be material at this point.

It is also important to note that despite two days of hefty selling the S&P 500 is essentially back to where it was a few weeks ago (a time in which we all thought the market was lofty). President Trump was mocked when he referred to this sell-off as "peanuts" but so far that is all it has been.

Treasury Futures Markets

30-year Treasury Bond Futures

Safety In Treasuries

Treasuries appear to be benefiting from the stock market's losses as investors allocate away from risk and toward what they believe to be safer assets. Gold and Silver also went along for the ride. Yet, we aren't ready to jump on the bond bandwagon just yet. Treasury seasonals are mixed, at best, and the chart is unconvincing. At this time, we are neutral and have little insight to offer.

*YOU SHOULD BE TRADING THE MARCH CONTRACT.

Treasury Futures Market Consensus:

We are neutral and waiting for the next clue.

Technical Support: ZB : 155'02 and 153'30 ZN: 130'14, 132'06, and 133'0

Technical Resistance: ZB: 161'15, 165'04, and 167'09 ZN: 128'04, 127'08, 126'06.

Stock Index Futures

Shoulda, Woulda, Coulda

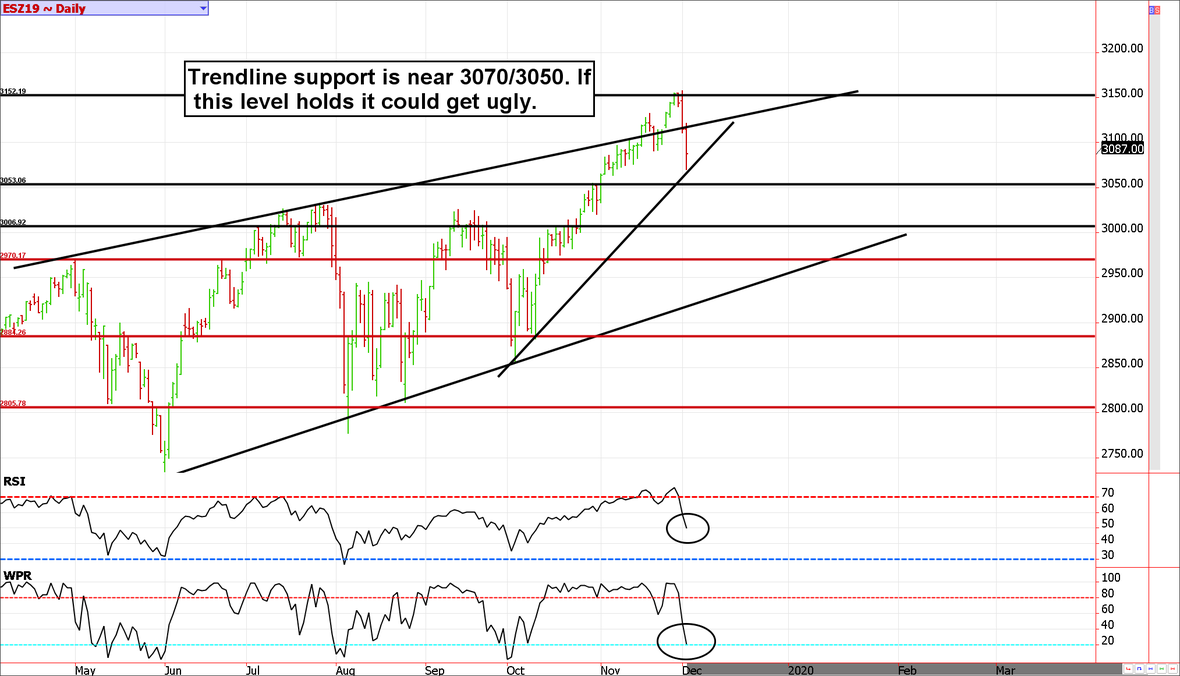

As it turns out, 3150 was the magic number for the ES. We had acknowledged this level as a real possibility, but despite pinpointing it well in advance we had lost most of our conviction "up there" and failed to recommend adding to shorts (as was the original plan). Things could have been worse, though.

We are certain the Thanksgiving rally took its toll on the bears. Not only was it a painful and one-directional rally, but it also occurred in the midst of a shortened holiday trading week. This made for a difficult trading environment, opening the door for plenty of mistakes. We suspect quite a few bears missed the trade or were squeezed out before the move occurred and many of the bulls probably missed their chance to lock in profits.

Trendline support in the December contract will be 3070/3050; this is where things get interesting. A break and hold below could get (temporarily) ugly.

Stock index futures market consensus:

3150 was the magic number on the upside, the critical pivot area on the downside will be 3070/3050.

Technical Support: 3050, 3006, 2970, 2887 and 2805

Technical Resistance: 3150 and 3175

E-mini S&P Futures Day Trading Ideas

These are counter-trend entry ideas, the more distant the level the more reliable but the less likely to get filled

ES Day Trade Sell Levels: 3137, 3157, and 3173

ES Day Trade Buy Levels: 3062, 3019, 2994, 2977, 2955, and 2926

Seasonality is already factored into current prices, any references to such does not indicate future market action.

Disclaimer: *There is substantial risk of loss in trading futures and options.** These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 or more years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year. While seasonal trends may potentially impact supply and demand in certain commodities, seasonal aspects of supply and demand have been factored into futures & options market pricing. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.