The euro has edged lower at the start of the week. Currently, the pair is trading slightly below the 1.14 level. It’s a quiet start to the week, with no major releases out of the eurozone or the US. On the release front, Germany’s trade deficit widened to EUR 20.3 billion, matching the forecast. The Eurozone Sentix Investor Confidence edged up to 28.4, above the estimate of 28.1.

US employment numbers were a mix on Friday, and EUR/USD didn’t show much interest. Nonfarm Payrolls rebounded in June, climbing to 222 thousand. This easily beat the estimate of 175 thousand. However, wage growth remained stuck at 0.2%, shy of the forecast of 0.3%. Wage growth has been soft in the first half of 2017, which has contributed to low inflation numbers.

The Fed has consistently said that it plans to raise interest rates for a third and final time in December. In June, Fed Chair Janet Yellen shrugged off inflation worries, saying that she expected inflation was mired at lows levels due to temporary factors. However, the markets don’t seem to be buying in, as the odds of a December hike have dropped to 47%, according to the CME Group (NASDAQ:CME).

The US economy slowed down in the first quarter, and there are signs that Q2 will also be soft. Consumer spending, which comprises two-thirds of US economic growth, remains soft. Another sore point in the economy is inflation, which remains below the Fed’s target of 2%. If the economy doesn’t show signs of stronger growth and higher inflation, the Fed might change its tune about a December rate, which would likely send the US dollar lower.

With the eurozone economy showing broad improvement, the ECB is tiptoeing towards a tighter policy, as underscored by the ECB’s June minutes. Policymakers discussed removing its “easing bias” at the June meeting, but ultimately decided not to make a move, since stronger economic conditions had not resulted in higher inflation. At the same time, minutes were cautious in tone, noting that “it was necessary to avoid signals that could trigger a premature tightening of financial conditions”.

ECB chief economist Peter Praet reiterated the bank’s stance at a conference in Paris last week. Praet noted that eurozone economic growth is accelerating, but said that the ECB still needs to provide a “steady hand” in order to spur stubbornly low inflation levels. The ECB holds its next policy meeting on July 20. In June, the bank removed an easing bias towards lowering interest rates. However, policymakers may now be wary about sending more signals of tightening policy, so as to avoid another run on the euro, as was the case after Draghi’s comments at the ECB forum. The ECB doesn’t want the rate statement to shake up markets, so we could see an innocuous statement, to the effect that the economy is headed in the right direction, but QE will remain in place until inflation levels move higher.

Markets Rally on Strong Jobs Data

EUR/USD Fundamentals

Monday (July 10)

- 2:00 German Trade Balance. Estimate 20.3B. Actual 20.3B

- 4:30 Eurozone Sentix Investor Confidence. Estimate 28.1. Actual 28.3

- 10:00 US Labor Market Conditions Index

- 15:00 US Consumer Credit. Estimate 12.1B

*All release times are EDT

*Key events are in bold

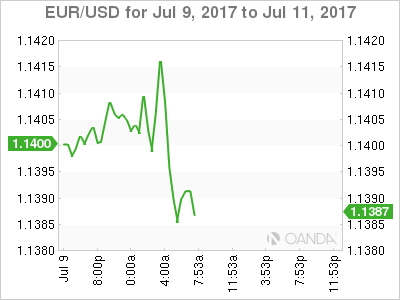

EUR/USD for Monday, July 10, 2017

EUR/USD Monday, July 10 at 6:50 EDT

Open: 1.1403 High: 1.1418 Low: 1.1382 Close: 1.1386

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1122 | 1.1242 | 1.1366 | 1.1465 | 1.1534 | 1.1616 |

EUR/USD was flat in the Asian session. The pair has been choppy in European trade

- 1.1366 is a weak support line

- 1.1465 is the next resistance line

Further levels in both directions:

- Below: 1.1366, 1.1242, 1.1122 and 1.0985

- Above: 1.1465, 1.1534 and 1.1616

- Current range: 1.1366 to 1.1465

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged since Friday. Currently, short positions have a majority (69%), indicative of EUR/USD continuing to move lower.