Talking Points:

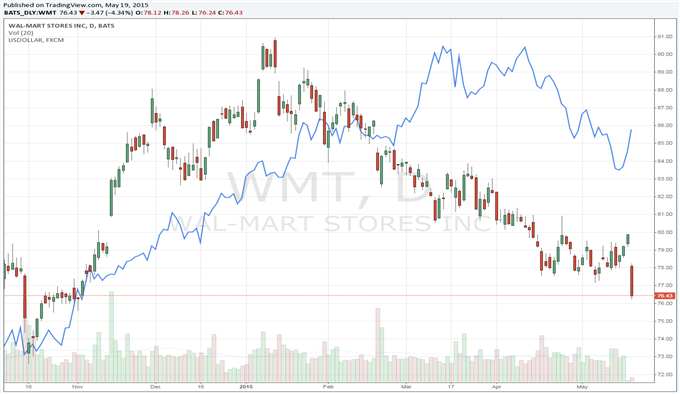

- Walmart (NYSE:WMT)’s Earning s Per Share Came in at $1.03 versus $1.05 Expected

- A Stronger US Dollar Shaved Off $0.03Per Share; Firm Expects More FX Headwinds

- Have Key Macroeconomic Data Directly on Your Platform’s Trading Charts

Walmart’s first quarter earnings per share came in at $1.03, missing analysts’ expectations of a $1.05 print. The miss was strongly associated with the rising US Dollar hurting overseas sales. Overseas revenue in USD terms declined by 6.6% from $32.69 billion to $30.54 billion. The rising Greenback shaved 3 cents off the EPS figure. The company would have been able to slighlty beat the street’s forecasts had it not been for the FX headwinds. For the rest of the year, the company expects a $14 billion (13 cents a share) hit to revenue due to a stronger USD. The stock declined by over 4% in yesterday’s trading.

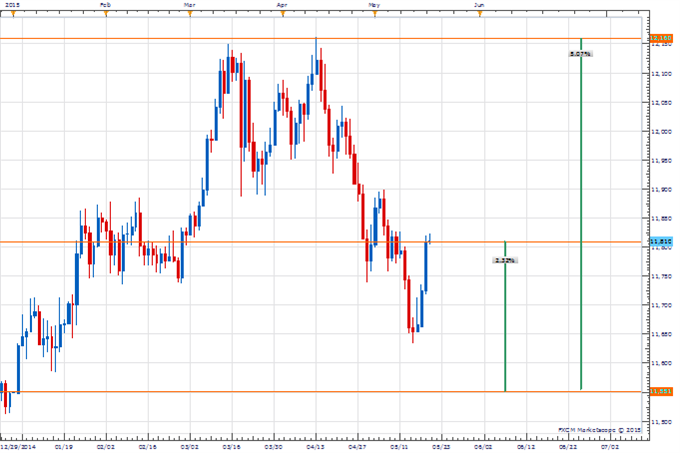

Despite the company deriving a large percentage of their sales in the US, currency movements still affect Walmart’s earnings. A stronger dollar has been blamed by many companies for weaker earnings. If the USD continues to stregthen, it can impact earnings of many S&P constituents as a majority derive revenue in other currenices. So far this year, the Dow Jones FXCM US Dollar Index (below) has risen by 2.32 percent this year.

Despite the recent pullback in the US Dollar, the FOMC policy outlook is the most hawkish relative to G-10 counterparts. 30 Day Fed Fund Futures price-in a 25bps rate hike by the first quarter of next year. Currency Strategist Ilya Spivak remains a long-term bull on the Greenback.

USDOLLAR Daily Chart-MarketScope 2.0

Original post