Focusing on DCC Energy

We believe DCC, (DCC) Energy is a strong business, uniquely placed, given its extensive European footprint and leading market shares in both oil and liquefied petroleum gas (LPG), supported by the group’s robust balance sheet. The division has multiple levers that can help drive solid organic growth, which we expect to be complemented by strategic acquisitions that could provide significant upside to our numbers.

Scope for organic growth across geographies

We believe DCC Energy is well positioned to achieve further organic growth in oil and LPG, both in Britain and internationally. In Oil Britain, we believe the division can benefit from its increasing retail presence, improving market shares in underrepresented product segments and cross-selling additional products and services. In Oil Scandinavia, the group can penetrate new segments (such as the bunker site market), diversify its customer base and take advantage of its flexible logistics, while in Germany the group now has a strong local platform to address a large and fragmented market. In LPG Britain, DCC can leverage synergies from its MacGas acquisition and drive oil to LPG conversions, while internationally the group can improve the performance of previously underinvested assets acquired from oil majors, increase cross-border sales and expand into new segments.

Acquisitions to further strengthen the business

While the Energy division has significant organic growth potential, acquisitions remain a key element in driving earnings growth. On the oils side, markets remain highly fragmented, both in Britain and in Europe, enabling DCC Energy to further consolidate its markets and drive efficiency gains in a business where economies of scale are considerable. In addition, oil majors continue to divest non-core assets and we believe DCC remains well positioned to take advantage of this trend due to its strong balance sheet and reputation. Our numbers incorporate no contribution from further acquisitions, but we estimate that a £150m acquisition spend, coupled with a16% pre-tax ROI, would imply an additional £24m of PBT pa. While uncertainty about targets and timing remains, the Energy division’s historic share of acquisition expenditure at 59% would imply a more than £14m profit uplift pa from inorganic growth in the Energy division alone.

Valuation: Remains compelling

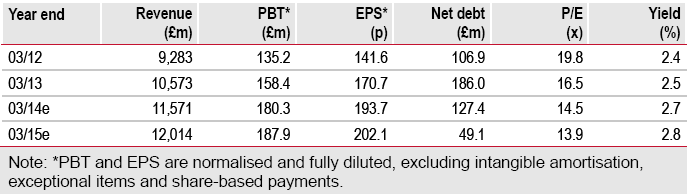

Despite a rise of over 11% in the last month, DCC still trades at an 8% discount to the support services sector on an FY14e P/E basis and at a 6% discount on an EV/EBITDA basis, even with no further acquisitions in our numbers. H1 results gave further reassurance about the strength of the underlying business and we remain buyers of the stock. We maintain our valuation of 3,217p, leaving 13% upside to the current share price.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

DCC: Acquisition To Further Strengthen The Business

Published 11/26/2013, 02:24 AM

Updated 07/09/2023, 06:31 AM

DCC: Acquisition To Further Strengthen The Business

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.