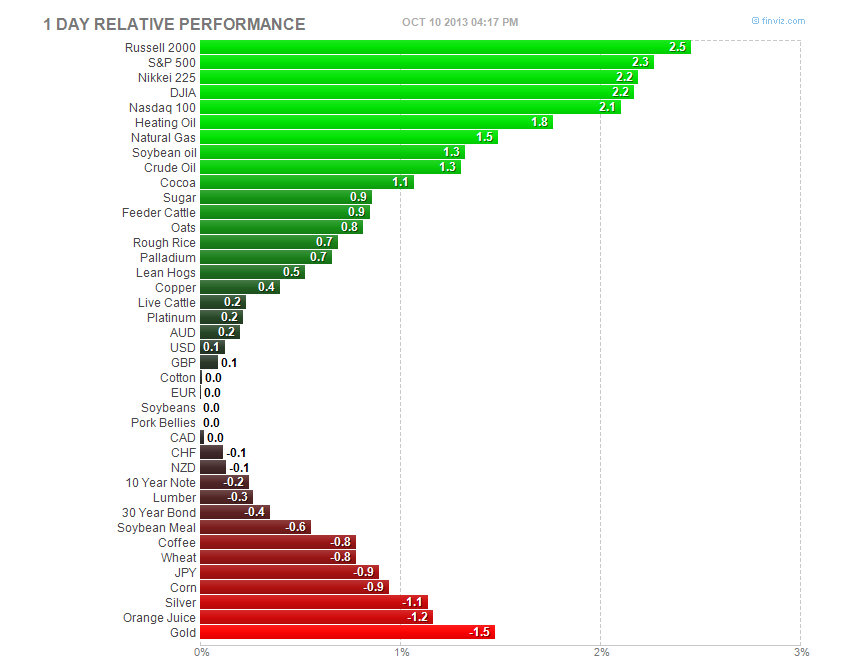

Some sizeable moves in markets today. Visually:

The best day for Equities since 1/2/2013 which was a relief rally that Congress didn't completely drop the ball on the Fiscal Cliff. There's plenty of blame to be spread around - both sides of the aisle. Suffice it to say I don't think the Founding Fathers ever envisioned situations like this....... then again, they didn't have Netflix to keep them entertained.

Bread and circus.

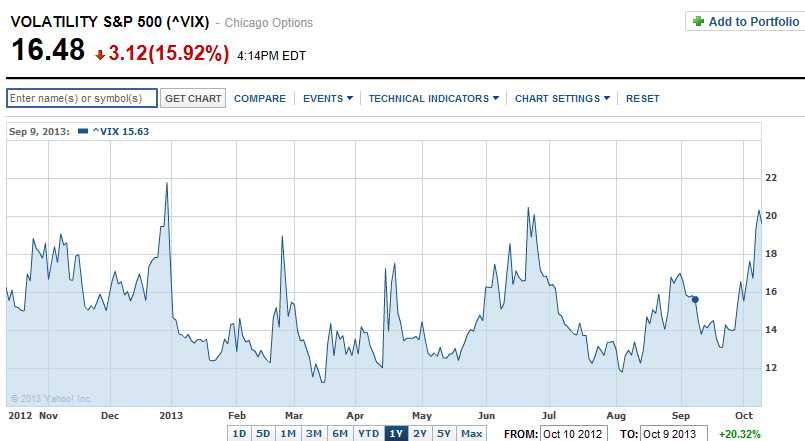

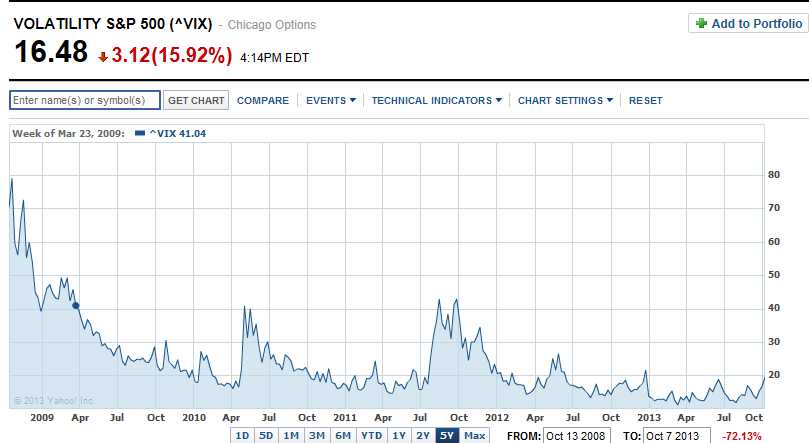

Moving on......Volatility got monkey hammered today. It's been a while since I broke him out, but he came out of his cage today.

Yesterday I mentioned that it seemed like Equities were bottoming based on the panic in outside markets (short term funding and steep inverse in Volatility term structure). That turned out to be the case. Hopefully you were able to capitalize. The Cash VIX fell more than 15% from over 21 yesterday to 16.5% today. The spread between month 1 and month 2 futures (which rarely inverts) moved from 85 cents OVER to 45 cents UNDER. That is a vol beat-down.

Big picture, the spread between Brent and WTI continued to widen on news of Libyan adultnapping and quick release. Not sure what to make of this right now because I don't buy into the "Europe" is improving meme and we don't have percolating Middle East tensions right now, so there must be something I'm missing.

This spread is wider than it was at the height of the Syria tension in late August. I believe aggressive players should look to be LONG WTI v. SHORT BRENT expecting a retrace to $6.00-$5.50 wide.

Big picture, the S&Ps are back to a $400 premium to Gold. The "spread" has struggled here in the past, but it's difficult to make the argument we can't break through this time. Gold outperformed in late summer when geopolitical issues came to the fore. Then Equities took the lead and it got as wide as $410 just before the last Fed meeting when the chose not to Taper. Perhaps there is a play in here.....maybe not. Careful.

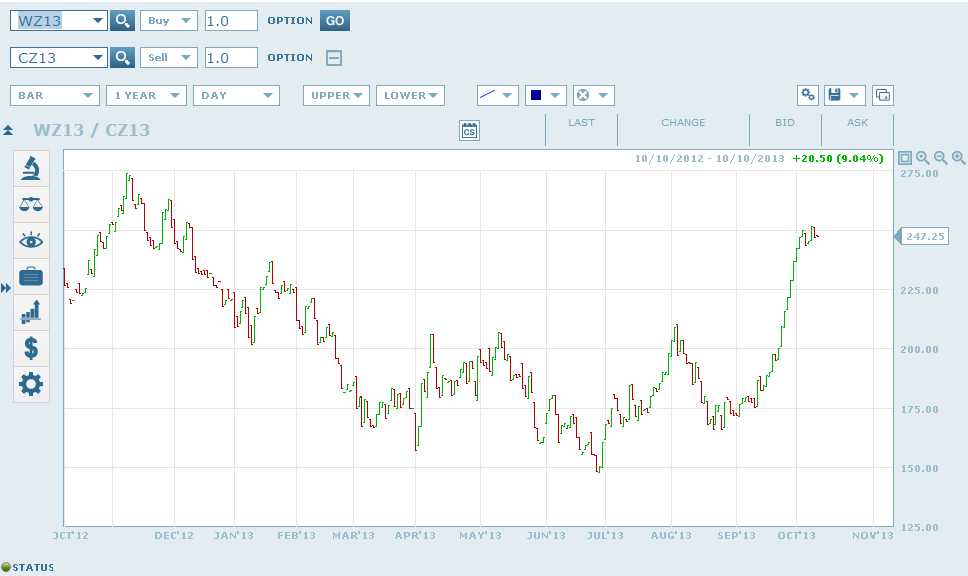

Finally, in less gut wrenchingly volatile markets the relationship between Wheat and Corn MAY be pivoting back in Corn's favor. Seems to be struggling around $2.50 wide.

One final thought - volatility seemed VERY HIGH yesterday when the VIX hit 21. That's because of our short term memories/conditioning bias. Don't get me wrong....it WAS high, relative to March, but those were 7 year lows in historical and implied equity volatility.

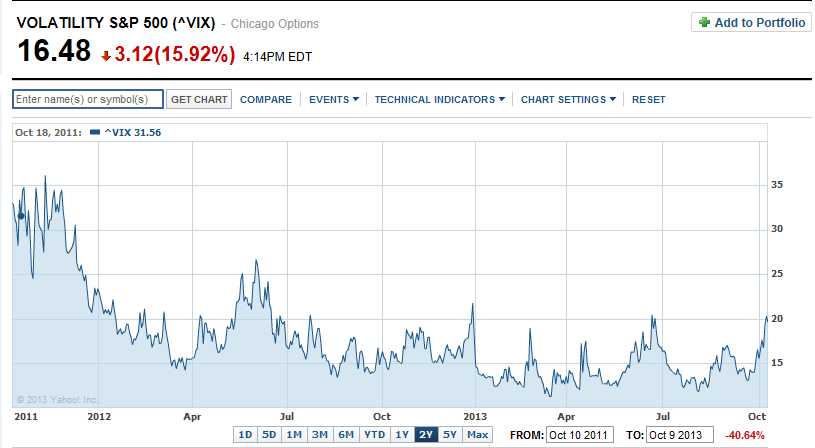

Here's a 2 year look at the VIX:

5 year look - it's all about PERSPECTIVE.....and in DC the PERSPECTIVE IS SHORT TERM. In the House of Representatives they are CONSTANTLY in campaign mode because they're up every 2 years. Kick the can deals will work until they don't and at that point you better have some tail risk insurance.

Risk Disclaimer:This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

DC Thaws: Equities Explode, Volatility Implodes

Published 10/13/2013, 02:36 AM

Updated 07/09/2023, 06:31 AM

DC Thaws: Equities Explode, Volatility Implodes

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.