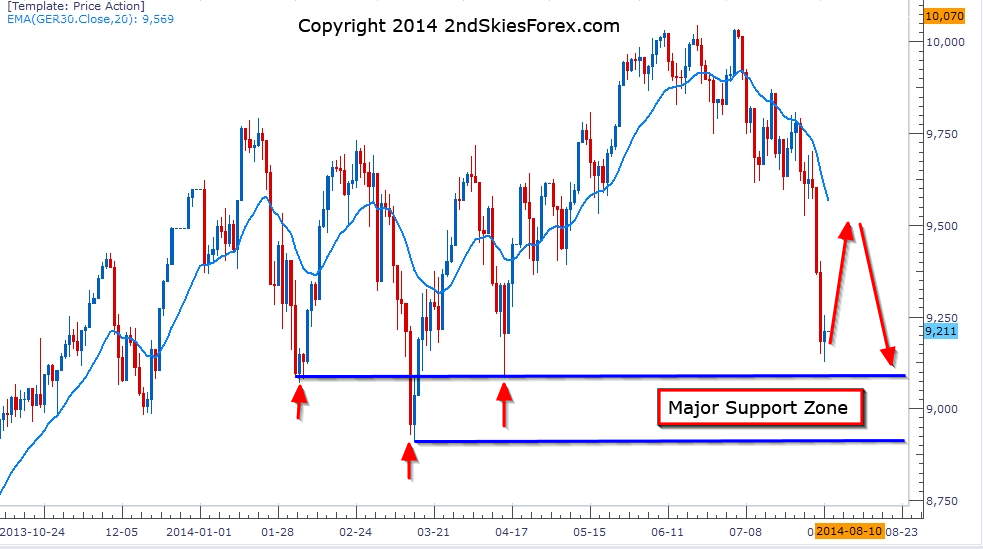

German Dax – Forms Weakest Bounce Amongst EU Indices. Is it A Dead Cat Bounce?

All of the major European indices bounced green today, but the Dax had the weakest of them all. Looking at the daily chart below, we can see there was a lot of two way price action, with almost equal wicks on both sides. This is after selling on the open, bouncing, hitting intra-day highs, then tapering off those highs. The last part (tapering) shows bears are still selling on rallies, even intra-day.

The fact that the Dax had the weakest bounce means its most likely to lead the next sell-off should there be one. This also means if we are going to sell on rallies, then the Dax is the one to go after the most. This is similar to how the CAC 40 recently had the lowest bounce back in July, and was the first to breach its major structural lows, so I expect a similar result.

One other thing I’m noticing on the bearish side is the time spent below the daily 20 ema, which is about a month underwater. The dax has only done this a few times in the last 2-3 years, but in each of those times, it was preceded by a series of HLs (higher lows), suggesting the overall structure was still bullish. In fact this was furthered by the one month period below the 20 ema followed by a HL that led to a resurfacing above the 20 ema, and a new swing high made in the trend.

Contrast that to this time, whereby the one month period was following a large consolidation, and an eventual false break. This to me hints the current time spent below the daily 20 ema gives it the weakest prologue to its current price action structure.

Hence I’ll look to sell rallies as I’m suspecting any bounce will be a dead cat bounce. If a weak corrective price action structure emerges from here, then look for an upside wick and false break from a structured correction to emerge and get short.

However if the pullback has a little more gusto to it, then look towards the 9575-9700 region to get short, targeting the recent 9200 swing lows, and potentially a move lower towards 8900.