Investing.com’s stocks of the week

DAX – Impulsive Sell-off From Corrective Price Action

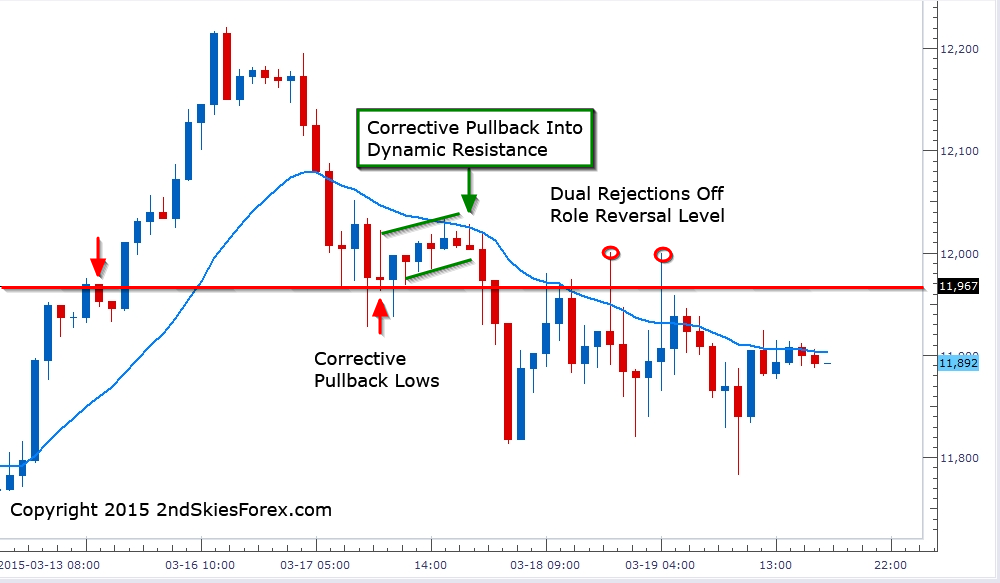

On the 17th we followed up with our call for some bearish selling in the German DAX following our noticing of the climactic price action move into the yearly highs around 12200. As we wrote, the index sold off almost 250 points, thus forming a corrective pullback into the dynamic resistance and 20 EMA.

We mentioned to expect another impulsive leg down as sellers were looking to enter. As you can see from the chart below, this is exactly what happened, with the index dropping about 200 points, offering a solid risk:reward setup of at least +2R or even a decent +3R.

For now, because the index is stabilizing between 12000 and 11800, we have a short term range for both sides to play. Once this breaks, we should have our next directional clues. Clearing the upside resistance would put 12200 back into focus while taking out support would bring 11600 under attack.