Investing.com’s stocks of the week

Today, we will talk about the German DAX, which is doing pretty well despite the global trade tensions and relatively strong (still) euro. In my opinion, the positive sentiment is mainly supported here by the technical situation and the fact that we managed to stop the February and March outrage from further spreading and the total annihilation of the bullish sentiment.

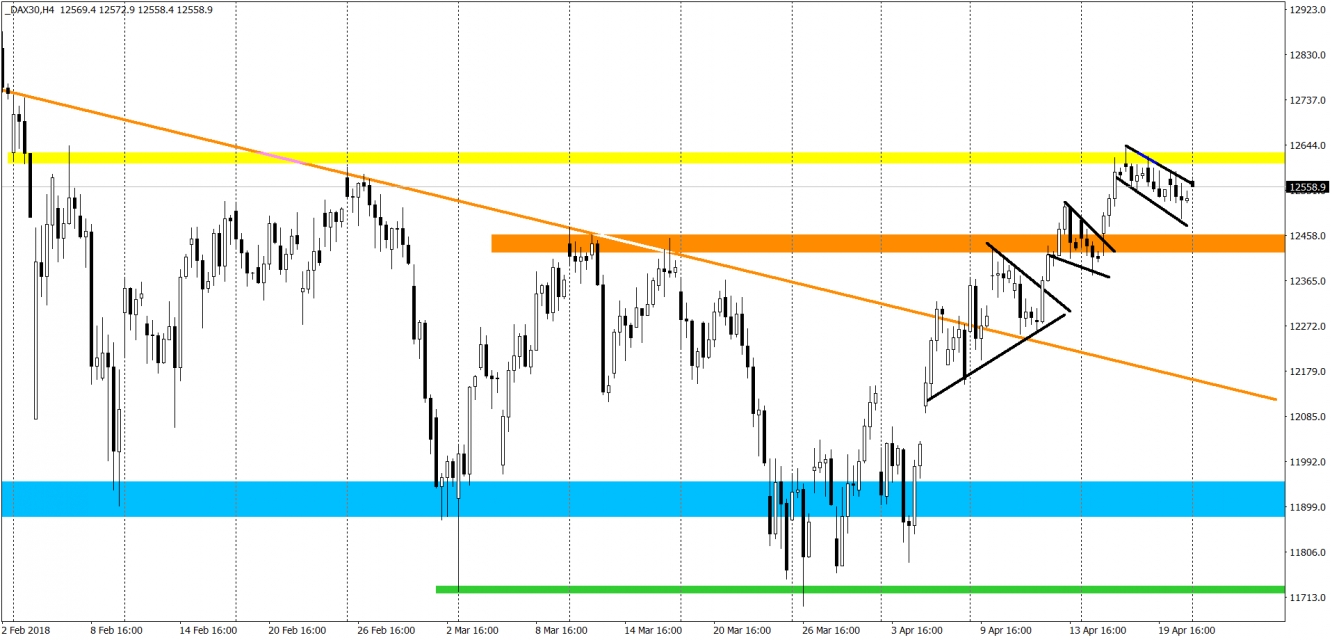

We all remember what happened back then. The price fell sharply and challenged the crucial support on the 11900 (blue). The test was positive for the bulls and since the 11900 got defended at the beginning of the April, the pair had mostly positive days. We are constantly climbing higher, in the meantime creating interesting trend continuation patterns. First was the pennant, then the wedge and now we are inside of the flag (black lines). History loves to repeat itself, so there is a high chance that this pattern will also end with the bullish breakout, especially now that we are above the 12450 support (orange). Breakout of the upper line of the flag should help us with the attack on the 12600 resistance (yellow). Price closing above the yellow area will generate a very strong, long-term buy signal.

Those movements are a part of a bigger pattern – triple bottom formation (9.2, 5.3 and 26.3). We already broke the neckline of this formation so it is up and running and foremost giving the bullish momentum and a hope for the future.