DAX had some serious problems at the end of the year but the 2018 started with a bullish optimism. Actually, to be precise it started very badly but the end of the day was positive and gives us hopes for the good start of the New Year.

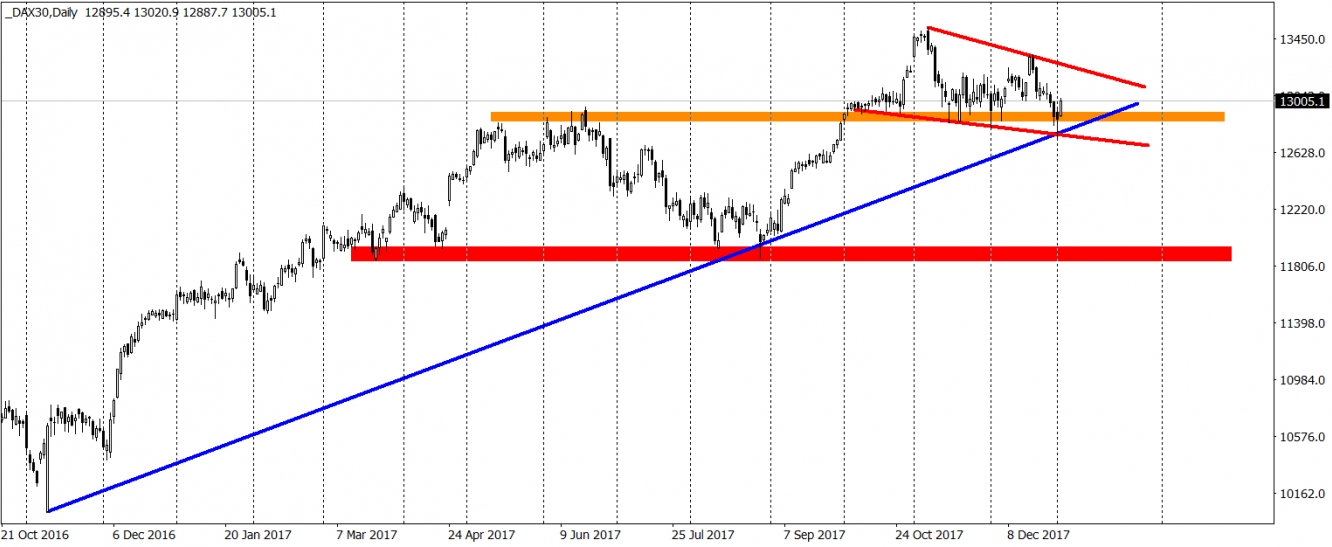

Troubles on the German Index started at the beginning of November. DAX lost the bullish momentum and went significantly lower. Yesterday, the price met levels seen for last time at the end of September and was very close for triggering a major sell signal. On the other hand, we were on a crucial support and I bet that many buyers were waiting for this occasion with great hopes and expectations. That was not only a one support but actually a combination of few: the lower line of the wedge (red line, bullish formation), the long-term up trendline (blue) and the horizontal support around the 12900 points (orange). You just cannot say no to the opportunity like that and as we can see, buyers did not hesitate and used that supports with all powers.

Yesterday, the day ended with a nice hammer candlestick. Today this movements is continued and the price is making higher highs and lows. That creates a setup where we have many positive aspects at once: candlestick formation, technical pattern, trendline and a horizontal support. Hard to find a better technical setup than that. As long as we stay above the lows from yesterday, the sentiment is positive and the buy signal is on.