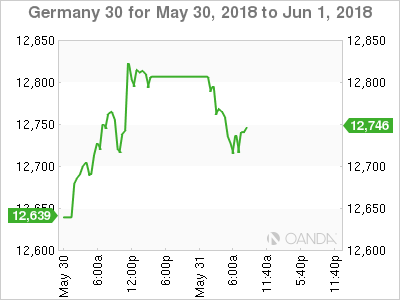

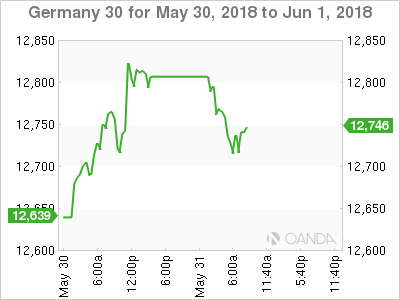

The DAX has reversed directions on Wednesday and headed lower. Currently, the DAX is at 12,717, down 0.52% on the day. In economic news, Eurozone CPI Flash Estimate jumped 1.9%, above the estimate of 1.6%. Core CPI Flash Estimate improved to 1.1%, above the estimate of 1.0%. On Friday, Germany and the eurozone eurozone release manufacturing PMIs.

It’s been a rough road for the DAX this week, which is down 2.2 percent. European stock markets are seeing red in response to the continuing political drama in Italy, as efforts continue to form a government. The two largest parties, the League Nord and the Five Star Movement proposed a eurosceptic finance minister, but this was blocked by the pro-European Matterella. This triggered a political crisis which led to a selloff of Italian stocks and bonds. The prime minister-elect, Giuseppe Conte, then announced that he had withdrawn his mandate to form a government, and Mattarella invited Carlo Cottarelli, a former IMF economist, to form a temporary technocrat government. There was talk of an election in the fall or even earlier, but Mattarella has agreed to let the two parties have a second go at forming a coalition government.

German numbers showed some weakness in the first quarter, but there was positive news on Wednesday. Retail sales were unexpectedly strong in April, with a sharp gain of 2.3%. This reading ended a nasty streak of four declines. The gain is the strongest since December, and raises hopes that second quarter growth will rebound after a sluggish first quarter. Inflation is also expected to improve, with German Preliminary CPI forecast to rise to 0.3% in May after a flat reading of 0.0% in April. On the inflation front, Eurostat is projecting a surge this month, with CPI Flash Estimate rising to 1.9%, its highest level since April 2017. Core CPI Flash Estimate improved to 1.1%, marking an 8-month high. Inflation levels are being closely watched by the ECB, which is scheduled to wind up its stimulus program in September. The ECB reduced its stimulus in January, from EUR 60 billion to 30 billion each month. Still, inflation remains well below the ECB target of around 2 percent.

Economic Fundamentals

Thursday (May 31)

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.6%. Actual 1.9%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.0%. Actual 1.1%

- 5:00 Eurozone Unemployment Rate. Estimate 8.4%. Actual 8.5%

Friday (June 1)

- 3:55 German Final Manufacturing PMI. Estimate 56.8

- 4:00 Eurozone Final Manufacturing PMI. Estimate 55.5

*All release times are DST

*Key events are in bold

DAX, Thursday, May 31 at 7:10 DST

Open: 12,796 Low: 12,803 High: 12,712 Close: 12,717