The DAX index has posted losses in the Monday session. Currently, the DAX is at 12,510, down 0.41% on the day. On the release front, there are no key German or eurozone indicators. Eurozone Consumer Confidence, which hasn’t posted gains since January, is expected to dip to -1 point. On Tuesday, Germany and the eurozone will release service and manufacturing PMIs.

President Trump made waves on Friday, after attacking the Federal Reserve’s monetary policy and also taking shots at the EU. Trump criticized the EU and China for manipulating their currencies and keeping interest rates lower. The escalating trade war, which started with Trump slapping tariffs on China, the EU and other trading partners, has weighed on global equity markets. Investors now have a new concern, which is that Trump could once again show that he is not afraid to lock horns with the EU and China, and the result could be a global currency war.

Investors are keeping a close eye on the June service manufacturing PMIs for Germany and the eurozone, which will be released on Tuesday. The manufacturing PMIs have weakened for six straight months – will this continue in June? Although the PMIs continue to show expansion in Germany and the eurozone, the markets remain nervous that the escalating trade war is having a negative impact on the manufacturing sector. If the readings continue to head lower on Tuesday, European equity markets could respond with losses.

After years of monetary stimulus to boost the eurozone economy, the ECB is close to phasing out its asset-purchase program. The ECB plans to trim its monthly purchases from EUR 30 billion to 15 billion in September and wind up the program in December. Is a rate hike next on the menu? Any clues of a change in monetary policy are bound to affect the euro, as the ECB has not raised rates since 2011. Many analysts are predicting a rate hike in the second half of 2019. However, growing global trade tensions could put a wrinkle in plans to raise rates. The European Commission and the International Monetary Fund have lowered 2018 growth forecasts for the eurozone and for Germany. If the tariff slug fest continues, the markets could lose ground.

Economic Calendar

Monday (July 23)

- 6:00 German Buba Monthly Report

- 10:00 Eurozone Consumer Confidence. Estimate -1

Tuesday (July 24)

- 3:30 German Flash Manufacturing PMI. Estimate 55.5

- 3:30 German Flash Services PMI. Estimate 54.6

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 54.7

- 4:00 Eurozone Flash Services PMI. Estimate 55.0

*All release times are DST

*Key events are in bold

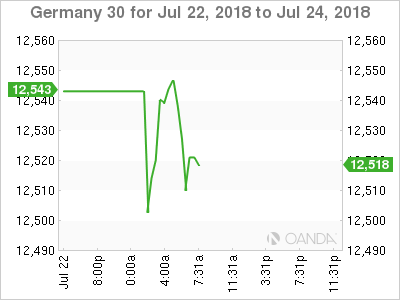

DAX, Friday, July 23 at 6:50 DST

Previous Close: 12,561 Open: 12,519 Low: 12,488 High: 12,564 Close: 12,510