The DAX is a stock market index consisting of the 40 major German blue-chip companies trading on the Frankfurt Stock Exchange.

Here are the top five weighted sectors:

Sector Weightings

Industrials 24.51%

Financial Services 20.33%

Technology 18.47%

Consumer Cyclical 10.27%

Communication Services 7.25%

The German economy, hit hard by a manufacturing slowdown and weak demand for its exports, has struggled in 2024 and is on course to contract for a second straight year.

However, despite headwinds, the DAX jumped above 20,000 points.

The euro's recent weakness has boosted Germany's export-oriented companies, while easing interest rates both in the eurozone and the United States have also helped sentiment.

Plus, the DAX has caught some of the euphoria from a Trump win with promised tax cuts and deregulation.

The DAX also hopes for China stimulus as China is a crucial exporter.

German investors are hopeful the resolution of ongoing political problems will be solved with new elections in Germany that will produce a government that will stimulate growth.

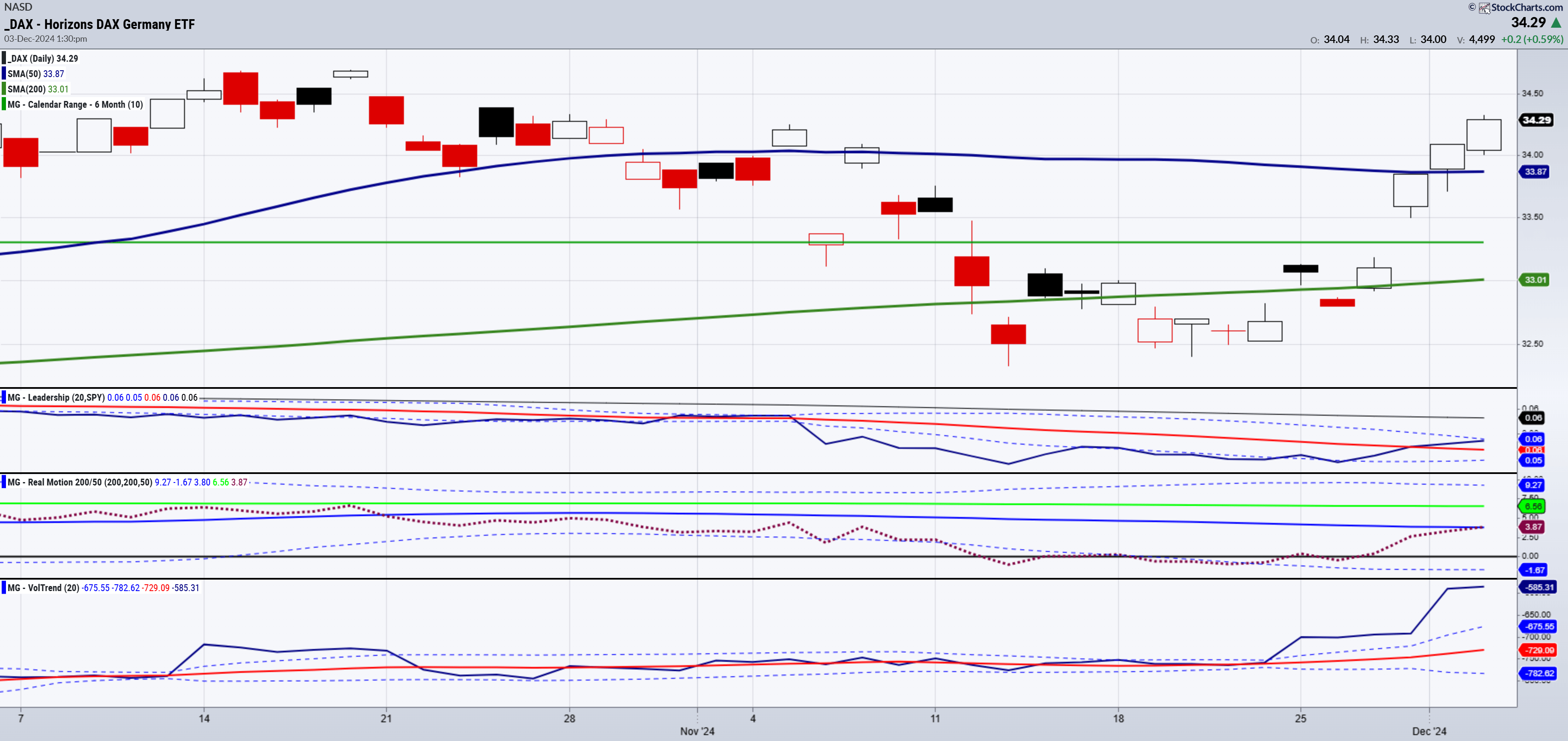

Looking at the chart:

What piqued my interest is the volume pattern, which you can see at the bottom of the chart. The volume has spiked since yesterday.

Then, DAX confirmed the phase change to bullish.

And Real Motion shows momentum slightly behind so the real fun may not have begun just yet.

Finally, note that DAX is outperforming the benchmark in leadership!

We see some chart resistance overhead at $34.50, but like the clear support just under the 50-DMA.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) 600 pivotal-new highs

- Russell 2000 (IWM) 238-240 support to hold

- Dow (DIA) 445 pivotal

- Nasdaq (QQQ) 507 support-new highs

- Regional banks (KRE) 65 support 70 resistance

- Semiconductors (SMH) 235 the 200-DMA to hold 250 resistance

- Transportation (IYT) 72.50 support

- Biotechnology (IBB) 140 support

- Retail (XRT) 80 support 87 resistance

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 79.50 pivotal