The DAX index has ticked lower in the Tuesday session. Currently, the DAX is at 12,566, up 0.05% on the day. On the release front, there are no major German or eurozone events. In economic news, the eurozone trade surplus slipped to EUR 16.9 billion, short of the estimate of EUR 17.6 billion. This marked the lowest surplus since January 2017.

European equity markets showed little change last week and the DAX continues to trade quietly on Monday. Still, the trading tensions hovering in the air have many investors wondering if this is the calm before the storm. On Tuesday, the Trump administration said it was considering imposing tariffs on some $200 billion in Chinese goods, which would be a significant escalation in the trade war between the two economic giants. China has promised to respond with “firm and forceful measures,” but hasn’t provided any details. With neither side showing any flexibility, the markets could be heading for stormy waters if China retaliates.

Trade policy is not part of the Federal Reserve’s mandate, but Fed policymakers continue to voice concern about the escalating trade war between the US and its major trading partners, particularly China. On Friday, Dallas Fed President Robert Kaplan said he would have to downgrade his outlook if the tariff battle continues. Kaplan said that US tariffs on steel and aluminum imports had dampened capital expenditures plans and further trade tensions could lead to currency fluctuations and geopolitical instability.

Economic Calendar

Tuesday (July 17)

- There are no German or eurozone indicators

Wednesday (July 18)

- 5:00 Eurozone Final CPI. Estimate 2.0%

- 5:00 Eurozone Final Core CPI. Estimate 1.0%

- Tentative – German 30-year Bond Auction

*All release times are DST

*Key events are in bold

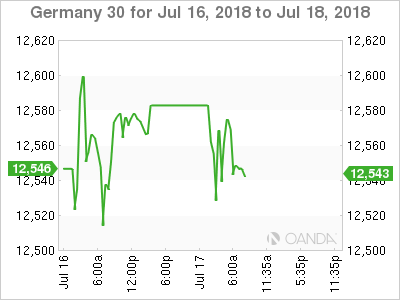

DAX, Monday, July 17 at 6:50 DST

Previous Close: 12,561 Open: 12,555 Low: 12,521 High: 12,594 Close: 12,566