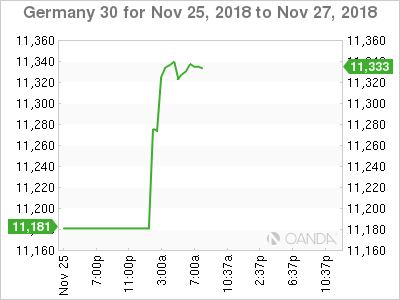

The DAX index has ticked higher in the Monday session. Currently, the DAX is trading at 11,330, up 0.13% on the day. On the release front, there is only one indicator on the schedule. German Ifo Business Climate dipped to 102.3, shy of the estimate of 102.0 points. Later in the day, ECB President Mario Draghi will testify before the European Parliament Economic and Monetary Affairs Committee.

The DAX remains under strong pressure and posted sharp losses for a second straight week. Investor risk appetite has waned, as the ongoing global tariff war between the U.S. and its major trading partners has dampened global growth. The markets are hoping for a breakthrough at the G20 summit in Argentina on Friday, when President Trump meets with Chinese leader Xi Jinping. If there is any progress, traders can expect the DAX to respond with gains.

After a weak third quarter in the eurozone, there are concerns that the downturn could continue in the fourth quarter. German indicators ended the week on a sour note, as GDP and PMI reports pointed downwards on Friday. Final GDP declined 0.2% in the third quarter, in line with expectations. This marked the first decline since 2014 and was identical to Preliminary GDP, which was released last week. Manufacturing PMI fell to 51.6, pointing to a stagnant manufacturing sector. This marked a fourth straight drop in manufacturing activity. Services PMI dropped lower, with a reading of 53.3 points. Both indicators missed their forecasts. There was more disappointing news on Monday, as German Ifo Business Climate fell to 102.0 in November, its third straight drop. The weak numbers are raising concerns as to whether the German expansion is over.

Economic Calendar

Monday (November 26)

- 4:00 German Ifo Business Climate. Estimate 102.3. Actual 102.00

- 9:00 ECB President Draghi Speaks

*Key events are in bold

DAX, Monday, November 26 at 7:10 EST

Open: 11,315 Low: 11,301 High: 11,356 Close: 11,330