The DAX index is steady in the Monday session. Currently, the DAX is trading at 12,547 points, up 0.05% on the day. On the release front, German and eurozone manufacturing PMIs dropped in March, but still pointed to expansion. In the US, Existing Homes is expected to inch up to 5.55 million. On Tuesday, Germany releases Ifo Business Climate

The eurozone manufacturing sector softened in March, as underscored by PMI reports. German Manufacturing PMI dropped from 58.4 to 58.1, but beat the estimate of 57.6 points. Eurozone Manufacturing PMI dropped from 56.6 to 56.1, short of the forecast of 56.6 points. The readings remain well above the 50-point level, which separates expansion and contraction. At the same time, there is some concern as manufacturing activity (and general growth) in the eurozone was stronger earlier the year. If second-quarter numbers soften compared to Q1, the euro could respond with losses.

The markets are keeping a close eye on the ECB, which holds a policy meeting on Thursday. Despite stronger economic conditions in the eurozone, the ECB has been in cautious mode. At the March meeting, policymakers took a small step, dropping a pledge to increase stimulus if needed. Will we see additional ‘baby’ steps at the April meeting? The markets are not expecting any change in forward guidance, and concerns over recent trade disputes could mean a dovish statement from ECB President Mario Draghi. Traders shouldn’t expect any dramatic moves next week, as the bank will likely continue to preach patience and prudence.

Economic Fundamentals

Monday (April 23)

- 3:30 German Flash Manufacturing PMI. Estimate 57.6. Actual 58.1

- 3:30 German Flash Services PMI. Estimate 53.9. Actual 54.1

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 56.6. Actual 56.0

- 4:00 Eurozone Flash Services PMI. Estimate 54.8. Actual 55.0

- 6:00 German Buba Monthly Report

Tuesday (April 24)

- 4:00 German Ifo Business

*All release times are DST

*Key events are in bold

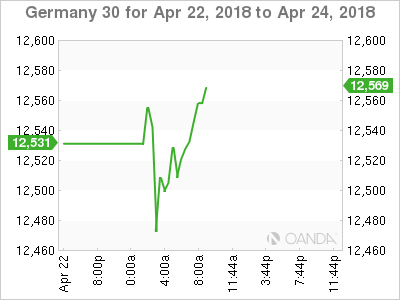

DAX, Monday, April 23 at 8:15 DST

Prev. Close: 12,540 Open: 12,535 Low: 12,464 High: 12,549 Close: 12,547