The DAX index is showing limited movement in the Friday session. Currently, the DAX is at 12,510, up 0.14% on the day. On the release front, there are no major German or eurozone events. The German Wholesale Price Index dipped to 0.5% in June, down from 0.8% a month earlier. This edged above the estimate of 0.4%.

European equity markets held their own this week, and the DAX and the CAC indexes have shown little movement over the week. Still, the trading tensions hovering in the air have many investors wondering if this is the calm before the storm. On Tuesday, the Trump administration said it was considering imposing tariffs on some $200 billion in Chinese goods, which would be a significant escalation in the trade war between the two economic giants. China has promised to respond with “firm and forceful measures”, but hasn’t provided any details. With neither side showing any flexibility, the markets could be heading for stormy waters if China retaliates.

At last month’s ECB policy meeting, the markets finally received some clarity with regard to the Bank’s asset-purchase program (QE). ECB President Mario Draghi said that the ECB would taper the purchases from EUR 30 billion to 15 billion in September, and terminate the program completely in December. True to form, Draghi left open the possibility of extending QE if needed. Still, with the eurozone economy generally performing well and inflation up to 1.7%, the markets are optimistic that the ECB will wind up QE on schedule. That means that attention is focusing on the timing of a rate hike. At the June meeting, the ECB said it would keep hold rates at current levels “through the summer” of 2019, but this wording is vague, leaving the precise timing open to debate. Does this phrase mean that that the ECB will wait until the October meeting, or could the ECB raise rates during the summer, if conditions warrant a hike? ECB policymakers will be carefully monitoring growth and inflation data in the eurozone, with strong numbers reinforcing the case to raise interest rates sooner rather than later.

Economic Calendar

Friday (July 13)

- 2:00 German WPI. Estimate 0.4%

- All Day – ECOFIN Meetings

*Key events are in bold

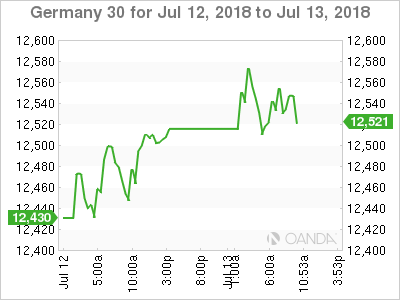

DAX, Friday, July 13 at 6:10 DST

Previous Close: 12,492 Open: 12,539 Low: 12,498 High: 12,584 Close: 12,521