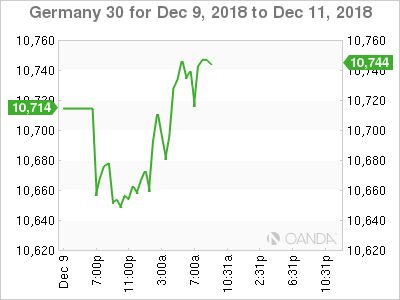

The DAX index is almost unchanged in the Monday session. Currently, the index is at 10,730, up 0.04% on the day. On the release front, Germany’s trade surplus fell to EUR 17.3 billion, edging above the estimate of EUR 17.2 billion. The Eurozone Sentix Investor Confidence posted a decline of 0.3, well short of the estimate of 8.4 points. On Tuesday, German ZEW Economic Sentiment is expected to weaken to 25.0 points.

Global markets had a dismal week, as investors continue to fret over global growth prospects and the nagging trade war between the U.S. and China. The DAX plunged 6.47% last week and dropped below the 11,000 level for the first time since December 2016. The French CAC also dropped sharply last week, declining 5.86%. There was some optimism early in the week after President Trump agreed to suspend further tariffs against China for 90 days. However, there are concerns that the two sides will not be able to close the substantial gaps in their positions in just a few weeks.

There was more bad news for investors on Thursday, after a senior Chinese executive, Meng Wanzhou, was arrested in Vancouver for allegedly violating trade sanctions against Iran. Wanzhou faces extradition to the U.S., and China’s indignant response to the arrest could torpedo upcoming trade talks between the two countries. Even if the negotiations get off the ground, they promise to be difficult, which could mean more headwinds for the DAX.

The U.S. ended the week with unexpectedly soft employment numbers. Nonfarm employment change was dismal, plunging from 250 thousand to 155 thousand. This was well off the forecast of 198 thousand. Wage growth remained stuck at 0.2%, missing the estimate of 0.3%. There was better news from the unemployment rate, which remained at a sizzling 3.7%. The data points to slowing growth in the U.S, which could lead to a change in monetary policy. The Federal Reserve minutes from the November meeting indicated that policymakers discussed changing their stance of gradual increases rate increases. The markets are currently looking at one rate hike next year – just a few months ago, there was talk of a rate hike in each quarter of 2019.

Economic Calendar

Monday (December 10)

- 2:00 German Trade Balance. Estimate 17.2B. Actual 17.3B

- 4:30 Eurozone Sentix Investor Confidence. Estimate 8.4. Actual -0.3

Tuesday (December 11)

- 5:00 German ZEW Economic Sentiment. Estimate -25.0

- 5:00 Eurozone ZEW Economic Sentiment. Estimate -23.2

*All release times are DST

*Key events are in bold

DAX, Monday, December 10 at 7:55 EST

Open: 10,726 Low: 10,673 High: 10,751 Close: 10,730