The DAX index is steady in the Friday session, after sharp gains on Thursday. Currently, the index is at 12,275 points, down 1.31% on the day. In economic news, German unemployment change plunged by 23 thousand, easily beating the estimate of -9 thousand. In the eurozone, inflation indicators missed their estimates. CPI Flash Estimate edged higher to 2.1%, matching the forecast. CPI Core Flash Estimate ticked lower to 0.9%, shy of the estimate of 1.1%.

European equity markets have lost ground on Friday, led by Italian markets which are sharply lower. Investors reacted negatively after the Italian government approved a controversial budget on Thursday, which aims for a budget deficit in 2019 of 2.4% of GDP. This number could move higher as the budget is debated in parliament. Although EU guidelines allow a deficit of 3%, Brussels will be nervously following the budget. The markets were hoping that Italy’s budget deficit would be around 2%, and Brussels will be nervously following the budget. As well, investors could lose confidence in Italian government bonds, which could weigh further on risk appetite.

In its monthly economic bulletin, the ECB said that it expected global growth to slow in the near term and warned about the effects of the escalating global trade war. The report highlighted “further tariff increases and uncertainties about future trading relations” as factors which could dampen global growth. Still, with the eurozone economy performing fairly well, the ECB is on track to halve its monthly asset purchases to EUR 15 billion and wind up the stimulus program in December. Earlier in the week, the ECB released a study which indicated that if the U.S-China trade spat continued, the U.S would be the big loser, as a result of a decrease in trade and weaker investor and consumer confidence.

Economic Calendar

Friday (September 28)

- 3:55 German Unemployment Change. Estimate -9K. Actual -23K

- 5:00 Eurozone CPI Flash Estimate. Estimate 2.1%. Actual 2.1%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.1%. Actual 0.9%

*All release times are DST

*Key events are in bold

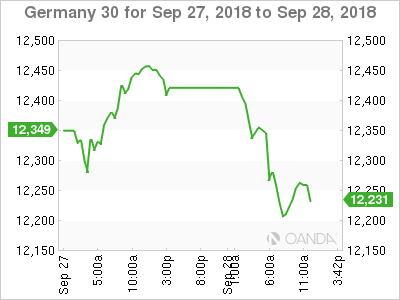

DAX, Friday, September 28 at 6:20 DST

Previous Close: 12,435 Open: 12,387 Low: 12,315 High: 12,392 Close: 12,275