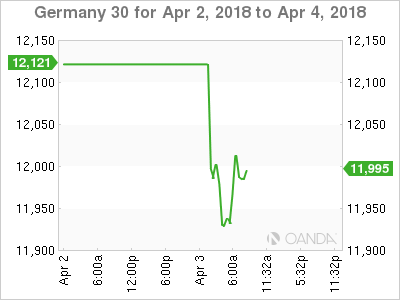

The DAX index has posted strong losses in the Tuesday session. Currently, the DAX is trading at 11,984 points, down 0.93% on the day. In economic news, there are a host of Eurozone indicators after eurozone markets were closed on Monday. German Retail Sales was unexpectedly soft, with a decline of 0.7%. This reading was well off the estimate of +0.7% and marked the fourth decline in five months. On the manufacturing front, German and eurozone manufacturing PMIs softened in March, although both indicators were within expectations and continued to point to expansion.

European stock markets have reacted to the escalating trade war, as China has fired the latest shot. On Monday, China responded to recent US tariffs, imposing its own duties on a range of US goods, including frozen pork and wines. This move is bound to raise tensions between the two economic giants and has investors concerned that a global trade war could be underway. If the tit-for-tat measures continue, both the US and Chinese economies could suffer, which could lead to a global slowdown.

The ECB is unlikely to change monetary policy anytime soon, but there are some rumblings from some of the wealthier eurozone members. German policymakers want to see a tighter policy, given the robust German economy. Last week, the head of the German central bank, Jens Weidmann, called for asset purchases to end “soon”. Weidmann also raised the possibility of interest rate hikes, saying that a rate increase in mid-2019 was “probably not entirely unrealistic.”

Weidmann received support from the head of the Dutch central bank, Klaas Knot, who said that the ECB should not continue asset-purchases after September, as “the top priority is to normalize monetary policy”. In January, the ECB reduced its asset-purchase program to EUR 30 billion, and the program is scheduled to wind up in September. If the eurozone economy performs well and inflation moves higher, there will be more pressure on the ECB not to extend the asset-purchase program. If the bank decides to end this stimulus scheme, the euro could improve sharply.

Dollar at a Crossroads on Trade Worries

Economic Fundamentals

Tuesday (April 3)

- 2:00 German Retail Sales. Estimate +0.7%. Actual -0.7%

- 3:55 German Final Manufacturing PMI. Estimate 58.4. Actual 58.2

- 4:00 Eurozone Final Manufacturing PMI. Estimate 56.6. Actual 56.6

Wednesday (April 4)

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.4%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.1%

- 5:00 Eurozone Unemployment Rate. Estimate 8.5%

*All release times are DST

*Key events are in bold

DAX, Tuesday, April 3 at 7:30 EDT

Prev. Close: 12,096 Open: 11,987 Low: 11,913 High: 12,026 Close: 11,984