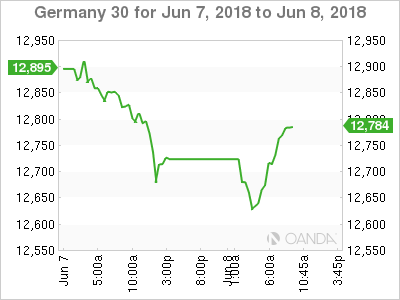

The DAX index has recorded sharp losses in the Friday session. Currently, the DAX is at 12,707, down 0.82% on the day. Earlier in the day, the DAX had declined more than 1.0 percent. On the release front, German numbers missed expectations. German Industrial Production declined 1.0%, well off the estimate of 0.4%. Germany’s trade surplus narrowed to EUR 19.4 billion, short of the estimate of EUR 20.3 billion. Later in the day, leaders of the Group of 7 will gather for a two-day meeting in Quebec City.

It was a disappointing week for Germany manufacturing indicators, which pointed to a contraction in the key manufacturing sector in April. Factory orders declined 2.5%, its worst showing in three months. On Friday, Industrial Production fell 1.0%, marking the fourth decline in five months. Germany is considered the locomotive of the eurozone – if German numbers continue to miss expectations, investor sentiment over the eurozone economy could sour and weigh on European stock markets.

The markets are bracing for a rough-and-tumble meeting of heads of state at the G-7 meeting in Quebec City, on Friday and Saturday. The gathering comes at a time of escalating trade tensions between the U.S and some of its major trading partners. Last week, finance ministers from six members of the G-7 were united in their criticism of US Treasury Secretary Steve Mnuchin over the brewing trade war. The trouble started last week, when the Trump administration slapped stiff tariffs on Canada, Mexico and the European Union. This resulted in threats of retaliation, and Canada and Mexico have already announced duties on a range of U.S products. Will we see a higher profile, repeat performance at this meeting? The tariff spat is sure to dominate the summit, where Trump can expect to hear strong complaints from other leaders over the recent tariffs, which Trump justified on the grounds of ‘national security’. If the leaders fail to resolve matters, the result could be a nasty trade war between the U.S and its major trading partners, which would be bad news for global stock markets.

Economic Calendar

Friday (June 8)

- 2:00 German Industrial Production. Estimate 0.4%. Estimate -1.0%

- 2:00 German Trade Balance. Estimate 20.3B. Actual 19.4B

- Day 1 – G7 Meetings

*Key events are in bold

DAX, Thursday, June 7 at 6:55 DST

Previous Close: 12,811 Open: 12,675 Low: 12,610 High: 12,712 Close: 12,707