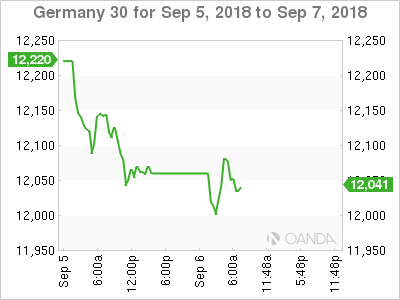

The DAX index is trading sideways in the Thursday session. Currently, the index is at 12,038, down 0.01% on the day. On the release front, German Factory Orders declined 0.9%, missing the estimate of +1.8%. On Friday, Germany releases industrial production and trade balance, while the eurozone will release GDP. The U.S will release one of the most important economic indicators, nonfarm payrolls.

This week’s German manufacturing indicators have been soft. This has raised concerns about the strength of the German economy and weighed on the equity markets. The DAX is having a dismal week, dropping some 2.5 percent. On Thursday, the DAX dropped below the symbolic 12,000 level for the first time since early April. Factory orders dropped 0.9% in July, its fourth decline in five months. New orders were down in the eurozone as well as in other countries, as weaker growth in the eurozone and elsewhere has taken a bite out of the manufacturing sector. Earlier in the week, Germany, Final Manufacturing PMI fell from 56.9 to 55.9 points. Although this is a respectable reading, it is significantly lower than the readings we saw early in 2018, when the indicator was above the 60-level. We’ll get another look at German industrial data on Friday, with the release of Industrial Production. The markets are expecting a small gain of 0.2%.

The trade war continues to spook investors and weigh on the equity markets. Investors are keeping an eye on the White House, as President Trump could announce further trade sanctions against China as early as today. Trade tensions have been on the rise since April, when the U.S started imposed tariffs to protest its claim of unfair trade practices by its trading partners, in particular, China. The dollar has benefited from the global trade war, and further tariffs against China could boost the greenback and send gold prices lower

Thursday (September 6)

- 2:00 German Factory Orders. Estimate +1.8%. Actual -0.9%

Friday (September 7)

- 2:00 German Industrial Production. Estimate 0.2%

- 2:00 German Trade Balance. Estimate 19.1B

- 5:00 Eurozone Revised GDP. Estimate 0.4%

- All Day – Eurogroup Meetings

- 8:30 US Nonfarm Employment Change. Estimate 193K

*All release times are DST

*Key events are in bold

DAX, Thursday, September 6 at 6:45 DST

Previous Close: 12,040 Open: 12,009 Low: 11,987 High: 12,091 Close: 12,038