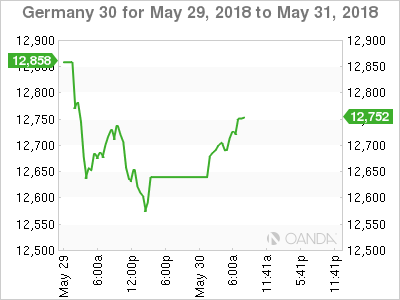

The DAX has moved higher in Wednesday session, after two consecutive losing sessions. Currently, the DAX is at 12,762, up 0.75% on the day. In economic news, German retail sales jumped 2.3%, easily beating the estimate of 0.5%. Later in the day, Germany releases Preliminary CPI, which is expected to rise to 0.3%. In the US, the key event is Preliminary GDP, with an estimate of 2.3%.

European stock markets are seeing red and the DAX is down 2.2% this week, despite rebounding on Wednesday. The decline is in response to the continuing political drama in Italy, the Eurozone’s fourth-largest economy. The drama started when President Sergio Mattarella stunned the nation, rejecting the choice for finance minister of the two parties which were expected to form a coalition, the League Nord and the Five Star Movement. Mattarella said he could not support the nomination of a finance minister who was in favor of Italy leaving the eurozone. The prime minister-elect, Giuseppe Conte, then announced that he had withdrawn his mandate to form a government, and Mattarella invited Carlo Cottarelli, a former IMF economist, to form a temporary technocrat government. However, there are reports that the League and Five Start Movement could get another kick at the can to form a government. Another possibility is that Italy will hold a snap election. It’s doubtful if another election would change the political landscape, so Matterella will likely huddle with political leaders and seek a compromise in order to avoid another general election.

German retail sales were unexpectedly strong in April, with a sharp gain of 2.3%. This reading ended a nasty streak of four declines. The gain is the strongest since December, and raises hopes that second quarter growth will rebound after a sluggish first quarter. Inflation is also expected to improve, with German Preliminary CPI forecast to rise to 0.3% in May after a flat reading of 0.0% in April. The story in France, the second largest economy in the eurozone, was not as bright. Consumer spending plunged 1.5% in April, marking a 3-month low. Preliminary GDP fell to 0.2% in March, down from 0.6% a month earlier.

Economic Fundamentals

Wednesday (May 30)

- 2:00 German Retail Sales. Estimate 0.5%. Actual 2.3%

- 2:00 German Import Prices. Estimate 0.7%. Actual 0.6%

- All Day – German Preliminary CPI. Estimate 0.3%

- 3:55 German Unemployment Change. Estimate -10K. Actual -11K

- 8:30 US Preliminary GDP. Estimate 2.3%

Thursday (May 31)

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.6%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.0%

- 5:00 Eurozone Unemployment Rate. Estimate 8.4%

*Key events are in bold

DAX, Wednesday, May 30 at 7:10 DST

Open: 12,693 Low: 12,741 High: 12.663 Close: 12,762