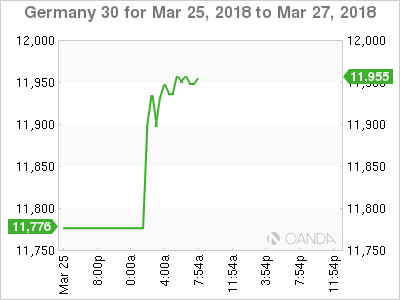

The DAX index has started the week with considerable gains. In the Monday session, the DAX is trading at 11,955 points, up 0.58% on the day. On the release front, there are no indicators in Germany or the eurozone. The sole event is a speech from the head of the German central bank, Jens Weidmann, in Vienna.

It was a rough week for global stock markets last week, as investors lost their risk appetite after more Trump tariffs. European stock markets saw red, and the DAX tumbled 3.7% last week. On Thursday, US President Trump slapped 25% tariffs on up to $60 billion worth of Chinese imports on Thursday. Trump said that the tariffs are needed to address the massive trade deficit with China, which stands at $375 billion. For its part, China wasted no time in threatening to retaliate, saying it was planning to impose tariffs on 128 US products, which amounted to $3 billion in imports. The tariffs directed against China come on the heels of tariffs on steel imports coming into the US, although the US has promised exemptions to the EU and other trading partners. There is serious concern that these moves could ignite a global trade war, and a downturn in the Chinese economy could spread and cause a global recession.

The German economy continues to lead to way, as the eurozone rebound continues. The German business sector continues to have strong confidence in the German economy, but there is concern about possible headwinds due to recent tariffs imposed by the Trump administration. The German Ifo Business Climate report dipped to 114.7 in March, which matched the forecast. However, this marked a second straight drop, and was the lowest reading in 11 months. The report attributed lower business morale to concerns that tariffs could hurt transatlantic trade, as well as the negative impact of a stronger euro. On the bright side, tax reform in the US and the economic rebound in the eurozone have increased the demand for German goods and services.

Manic Monday or Just Singing the Stock Market Blues ?

Trade War Worries Ease as Risk Appetite Rebounds

EUR/USD Fundamentals

Economic Calendar

Monday (March 26)

- 5:30 German Buba President Weidmann Speaks

Tuesday (March 27)

- 2:00 German Import Prices. Estimate -0.3%

- 4:00 Eurozone Private Loans. Estimate 3.0%

*All release times are DST

*Key events are in bold

DAX, Monday, March 26 at 7:35 EDT

Prev. Close: 11,886 Open: 11,934 High: 11,973 Low: 11,891 Close: 11,955