The DAX rebounded on Monday as traders focused on strong data from China which boosted risk sentiment and overshadowed data showing the German manufacturing sector remains deep in recession

The recovery in the Dax follows on from gains in Asia as investors cheered better than forecast Chinese manufacturing data. The Chinese Caixin / Markit manufacturing purchasing managers index rose to 51.8 in November up from 51.7, the fastest expansion since December 2016. The data eased fears surrounding the slowing of the world’s second-largest economy amid the ongoing US-China trade dispute.

Trade

Regarding the ongoing trade talks, investors stuck with bets that the US and China would reach a trade deal sooner rather than later even after Beijing insisted that trade tariffs would need to be rolled back as part of the phase one trade deal.

German manufacturing PMI

German manufacturing PMI showed the sector remains stuck in recession. The PMI increased to 44.1 in November, up from 43.8 last month, where 50 separates expansion from contraction. It was the second-lowest reading since June 2009. Delving deeper into the figures and some concerning trends remain. New orders fell for a 13th straight month and factories slashed jobs at the fastest pace in 10 years.

Data at the end of last month showed that the German economy avoided a recession in the third quarter and consumer confidence increased. However, inflation for Europe’s largest economy dropped and retail sales also declined. It feels premature to be calling the bottom of this slowdown. More data is needed to confirm whether that has been hit and the German economy is slowly turning a corner.

German politics surprise

Dax traders will be keeping a close eye on the political landscape in Germany after the results of the SPD leadership contest surprised. The SPD voted in leaders from the left-wing of the party, replacing more centrist candidates. The SPD is the junior coalition party. The change of leadership is now likely to result in a change of policy which Merkel’s CDU/CSU will struggle to accept. Traders will keep a close eye on developments.

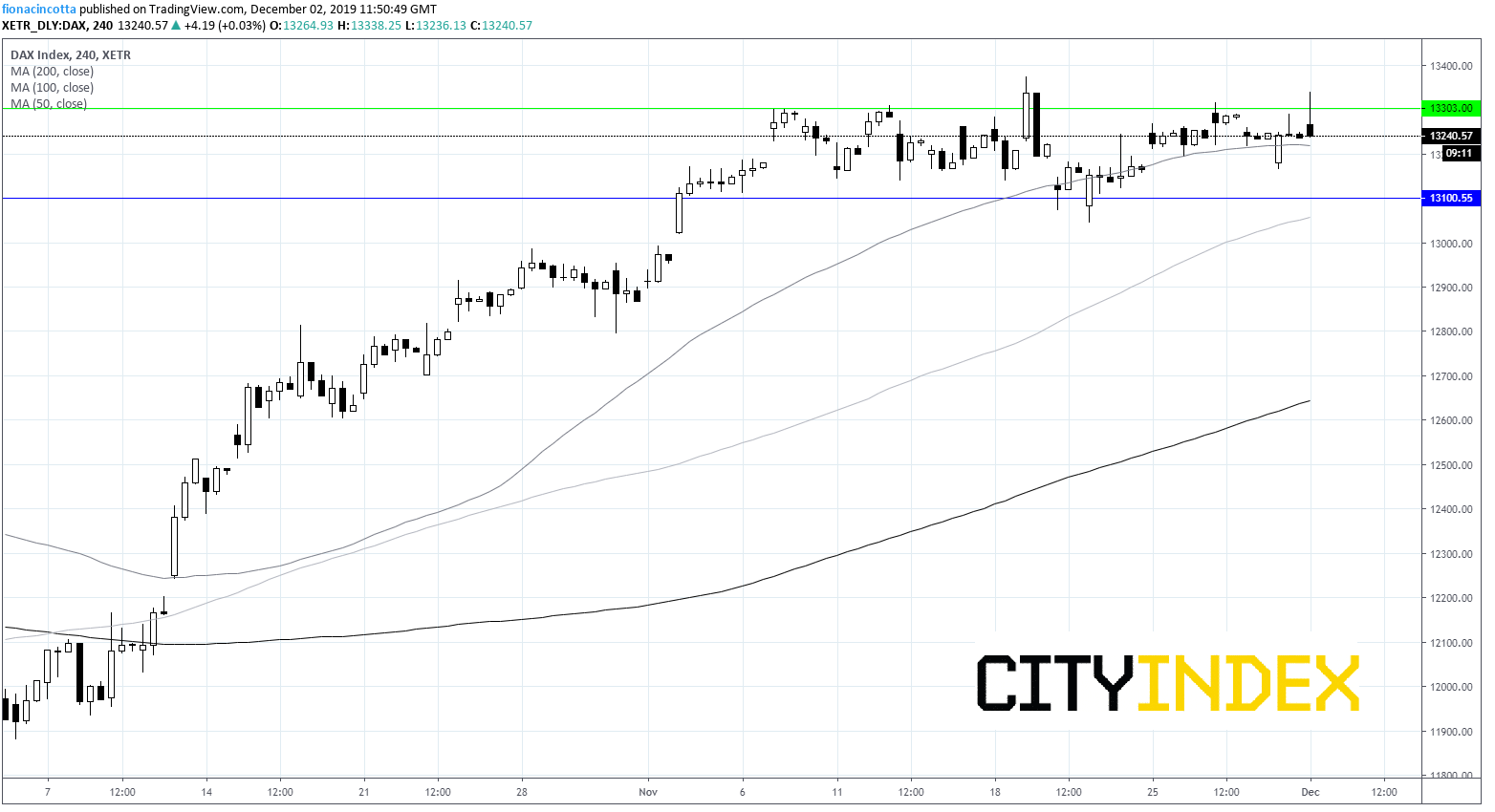

Levels to watch:

Following a strong rally in October, the Dax remains in consolidation mode, with few attempts to break out of the current range 13100 – 13300. The Dax remains above its 200, 100 and 50 sma a bullish sign. We would want to see daily close above 13300 or below 13100 as an indication of direction.