On Wednesday US tech stocks sold off, as a surge in bond yields weighed on sentiment. Investors dumped stocks with stretched valuations. The weakness has continued into Europe today and judging by the price action on the major indices, we could be heading towards some volatile times.

Among the major indices, the German DAX has provided its first major bearish sign. After hitting a new all-time high, the index closed below the opening price on Wednesday. This helped to created an inverted hammer off the all-time high and prior resistance around 14135 (see shaded area on chart):

Charts courtesy of TradingCandles.com and TradingVew.com

The index has bounced off its lows, but now rallies into former support areas could be sold into.

So keep an eye on the DAX as it could drop sharply from here, potentially providing lots of bearish trade setups in the process.

The index will need to form a key bullish reversal signal at lower levels for me to now turn bullish again, or rally to a new all-time high to nullify the bearish signal that has just been created.

The weakness in the stock markets could hurt sentiment in other markets. This is why I decided to close two trades ahead of their targets for the private group:

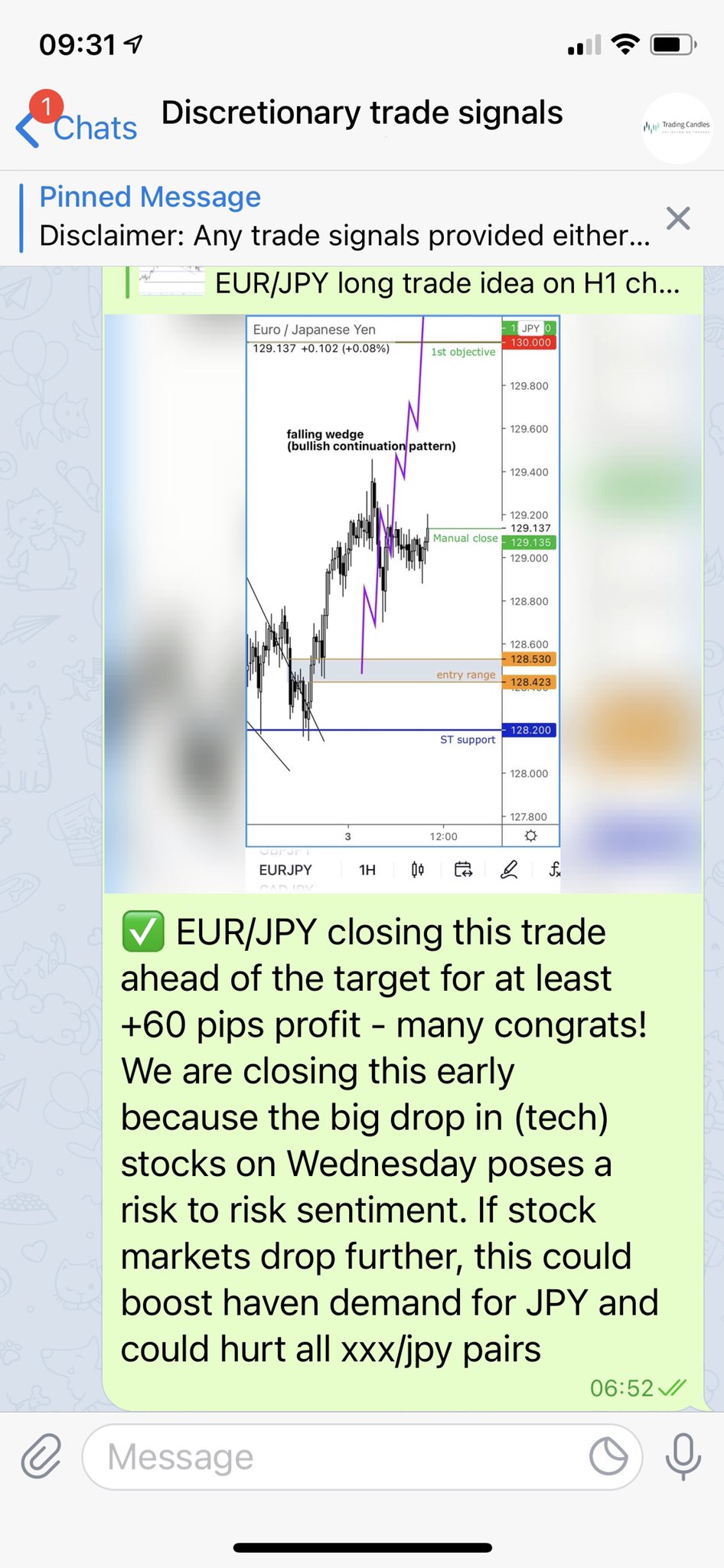

The first trade that previously I had strong conviction on was the EUR/JPY. A few days ago it had bounced nicely off ST support at 128.20, as it continued to consolidate inside falling wedge on hourly. I thought that a breakout above this bullish continuation pattern could see rates climb towards 130.00 again and higher, as ECB QE purchases slowed last week despite concerns over rising yields. This is the chart I posted on twitter:

This is how the private group traded the EUR/JPY:

But because of concerns over a stock market sell-off, I decided to close this ahead of the target, still providing a good +60 pips:

Source: TradingCandles.com private Telegram group

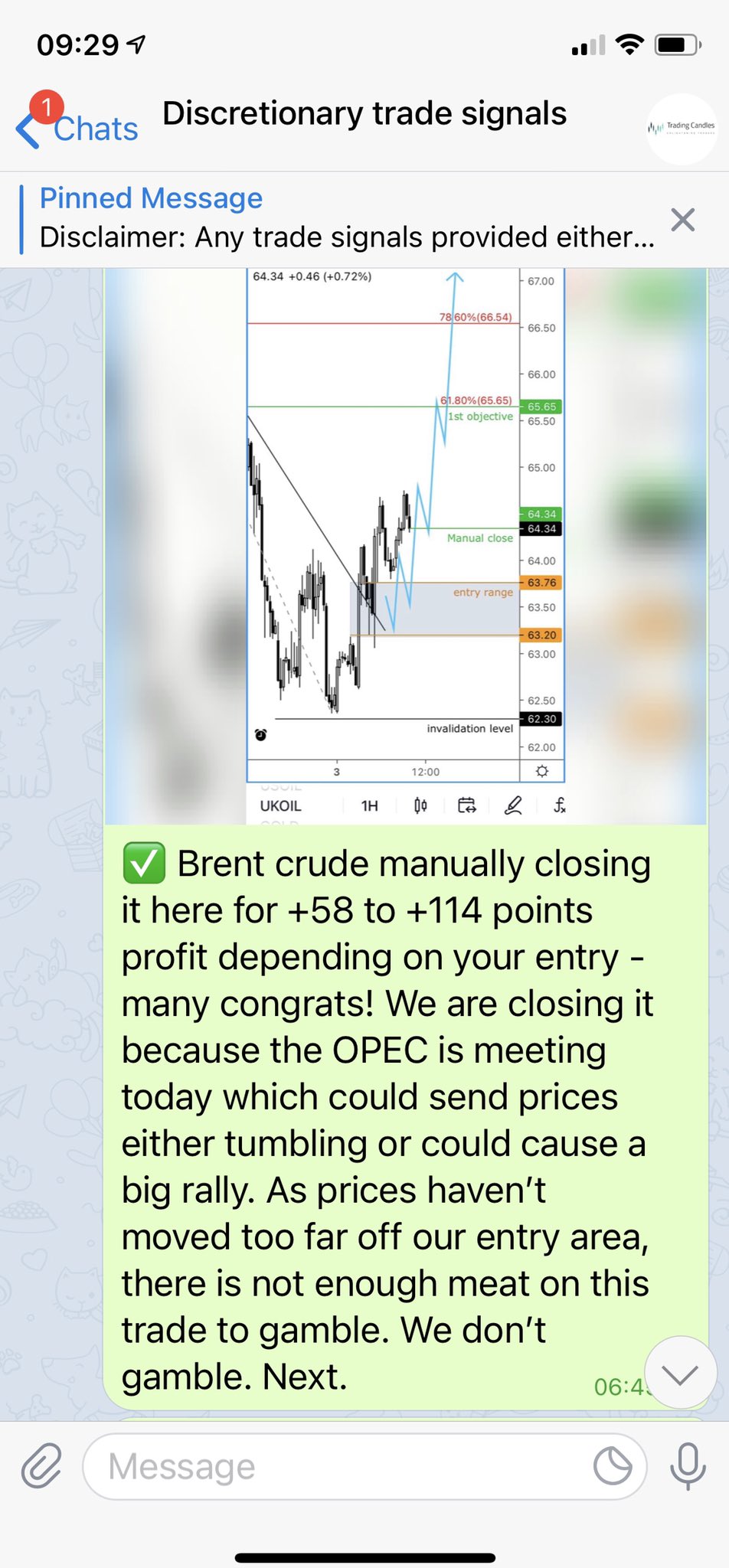

The other trade we had open and decided to close because of the risk-off sentiment coming from the stock market was Brent crude oil.

After falling for 4 days, oil prices bounced back in mid-week ahead of the OPEC+ meeting. As prices broke above THIS trend line we issued a long signal for the private group:

However, fearing a potential drop in oil prices, this too was manually closed:

However, fearing a potential drop in oil prices, this too was manually closed:

Source: TradingCandles.com private Telegram group

Now I don’t know if we have made the correct decisions here, as both Brent oil and EUR/JPY could ignore the stock markets and continue higher. But sometimes intervention is required, especially when you are not too sure. At the end of the day, a small profit is profit nonetheless.

But returning to the issue of DAX and the stock markets, you need to proceed with extra care if you are bullish or long. Patience is the key to success. Waiting for the dust to settle and the right moment is always more important than trying to be a hero and catching falling knives.