The DAX index has posted gains in the Wednesday session. Currently, the DAX is at 12,898, up 0.44% on the day. On the release front, Eurozone employment change edged up to 0.4%, above the estimate of 0.3%. Eurozone industrial production declined 0.9%, weaker than the forecast of -0.6%. In the U.S, the Federal Reserve is expected to raise the benchmark rate by a quarter-point. On Thursday, Germany releases CPI and the ECB is expected to maintain rates at a flat 0.0%.

All eyes are on the Federal Reserve, which is expected to raise rates by a quarter-point at its policy meeting on Wednesday. The odds of a quarter-point move stand at 96% percent, according to the CME Group (NASDAQ:CME). Although a rate hike has been priced in by the markets, such a significant move could still boost the stock markets. Investors are still uncertain whether the Fed will raise rates three or four times in 2018. Fed policymakers seemed divided on this question, and the rate statement could provide clues about future monetary policy.

Central banks will be in the spotlight this week, with rate statements from the Federal Reserve on Wednesday and the ECB on Thursday. The Fed is widely expected to raise rates, with odds of a quarter-rate hike at 94%. Although the rate increase has been priced in, the U.S dollar could still make some gains against its major rivals. In Europe, the ECB will be looking for any clues with regard to the ECB’s asset-purchase program. Currently, the bank is purchasing EUR 30 billion/mth, and the scheme is scheduled to wind up in September. However, some ECB policymakers want to phase out the program slowly, rather than turn off the tap completely in September. ECB chief economist Peter Praet recently said that the ECB board members would conduct a detailed discussion about the fate of the stimulus package at the June meeting. Mario Draghi will likely make mention of the program at his press conference, so we could see some movement in the stock markets on Thursday.

Economic Calendar

Wednesday (June 13)

- 5:00 Eurozone Employment Change. Estimate 0.3%. Actual 0.4%

- 5:00 Eurozone Industrial Production. Estimate -0.6%. Actual -0.9%

- Tentative – German 10-year Bond Auction

- 14:00 US FOMC Economic Projections

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate <2.00%

- 14:30 US FOMC Press Conference

Thursday (June 14)

- 2:00 German Final CPI. Estimate 0.5%

- 7:45 Eurozone Main Refinancing Rate. Estimate 0.00%

- 8:30 ECB Press Conference

*All release times are DST

*Key events are in bold

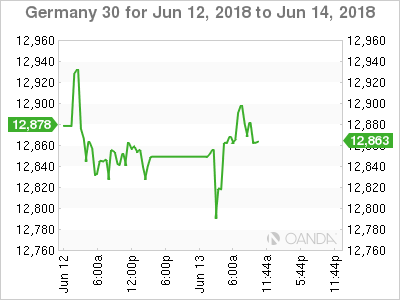

DAX, Wednesday, June 13 at 7:40 DST

Previous Close: 12,842 Open: 12,861 Low: 12,779 High: 12,897 Close: 12,898