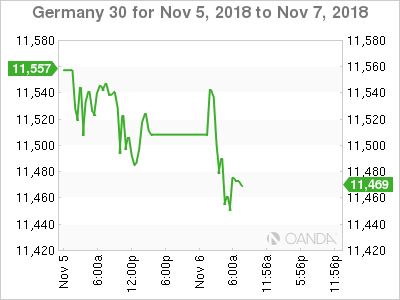

The DAX index has edged lower in the Tuesday session. Currently, the DAX is trading at 11,469, down 0.34% on the day. On the release front, Germany and eurozone services PMIs both beat their estimates and pointed to expansion. Eurozone PPI improved to 0.5%, beating the estimate of 0.4%. In the U.S, all eyes will be on the U.S midterm congressional elections. On Wednesday, Germany releases industrial production and the eurozone publishes retail sales.

German indicators were lukewarm on Tuesday. Factory orders posted a gain of 0.3% in September, easily beating the forecast of -0.4%. Still, this was a significant drop from the August reading of 2.0%. The trend was similar in the services sector, as Final Services PMI dropped from 55.9 to 54.7 in October, marking a 3-month low. The reading did, however, beat the forecast of 53.6. On Monday, Sentix investor confidence pointed to a sharp drop. The indicator fell from 11.4 to 8.8 points, its lowest level since October 2016. The index has dropped sharply in 2018 – early in the year, the index was above the 30-point level. The eurozone economy slowed to 1.7% in the third quarter, down from 2.2% in the second quarter. There are concerns that the slowdown will continue into Q4, which could weigh heavily on European stock markets.

The markets are keeping a close eye on the U.S mid-term elections, as voters go to the polls on Tuesday. Many analysts are calling the election a referendum on the presidency of Donald Trump, who has presided over a red-hot economy but has also alienated many voters with his controversial policies on health care and immigration. There are a host of races that are too close to call, but most analysts expect the Democrats to narrowly win the House while the Republicans will hold onto their majority in the Senate. Traders should expect some volatility in the global equity markets once the election results are announced.

Economic Calendar

Tuesday (November 6)

- 2:00 German Factory Orders. Estimate -0.4%. Actual 0.3%

- 3:55 German Final Services PMI. Estimate 53.6. Actual 54.7

- 4:00 Eurozone Final Services PMI. Estimate 53.3. Actual 53.7

- 5:00 Eurozone PPI. Estimate 0.4%. Actual 0.5%

- All Day – US Congressional Elections

Wednesday (November 7)

- 2:00 German Industrial Production. Estimate -0.1%

- 5:00 Eurozone Retail Sales. Estimate 0.1%

- Tentative – German 10-year Bond Auction

*Key events are in bold

DAX, Tuesday, November 6 at 6:40 DST

Open: 11,508 Low: 11,549 High: 11,436 Close: 11,469