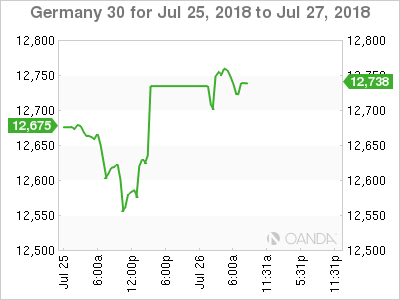

The DAX index has posted strong gains in the Thursday session. Currently, the DAX is at 12,722, up 1.12% on the day. On the release front, German GfK Consumer Climate edged lower to 10.6, just shy of the estimate of 10.7 points. Later in the day, the ECB sets its minimum bid rate, followed by a rate conference with ECB President Mario Draghi.

Trade tensions between the US and the European Union have cast a pall over relations between the sides, so the success of EU Commission President Jean-Claude Juncker’s visit to the White House was welcome news. The parties announced on Wednesday that they had agreed to hold off on any further tariffs while talks are ongoing. This is a major concession from Trump, who had threatened to impose tariffs on European car imports. US tariffs on European aluminum and steel will remain in place, but Juncker pointed out that the US has agreed to reassess these measures. The news boosted the DAX index, as automaker shares have jumped. Bayerische Motoren Werke AG (MI:BMW) has climbed 3.20%, Daimler AG NA O.N. (DE:DAIGn) is up 2.80% and Volkswagen (DE:VOWG_p) has risen 3.53%. Bank shares are also higher, with Commerzbank (DE:CBKG) up 1.46% and Deutsche Bank (DE:DBKGn) up 1.73%.

The markets are not expecting anything dramatic from ECB policymakers, with interest rates expected to remain at 0.00%. In June, the ECB decided to end its massive bond-purchase scheme by the end of the year, which has amounted to some 2.6 trillion euros. However, the ECB is playing it very cautious regarding any interest rate hikes, with the ECB saying it would maintain record-low rates “through the summer” of 2019. Trade tensions between the EU and US have dampened growth forecasts for the eurozone, although the Juckner-Trump meeting has considerably improved market sentiment. The ECB could tweak its guidance but is unlikely to make any changes to current monetary policy.

Economic Calendar

Thursday (July 26)

- 2:00 German GfK Consumer Climate. Estimate 10.7. Actual 10.6

- 7:45 ECB Main Refinancing Rate. Estimate 0.00%

- 8:30 ECB Press Conference

*All release times are DST

*Key events are in bold

DAX, Thursday, July 26 at 7:25 DST

Previous Close: 12,579 Open: 12,705 Low: 12,696 High: 12,778 Close: 12,722