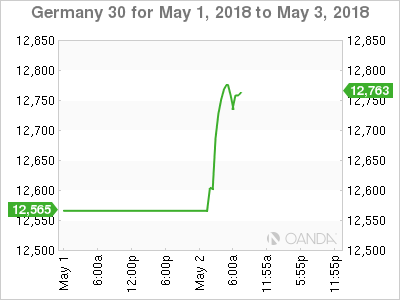

The DAX index has posted sharp gains in the Wednesday session. Currently, the DAX is trading at 12,738 points, up 1.00% on the day. On the release front, German and eurozone manufacturing reports were within expectations and continued to point to expansion. Preliminary Flash GDP came in at 0.4%, matching the estimate. In the US, the Federal Reserve will set the benchmark interest rate and release a rate statement.

On the manufacturing front, German and eurozone PMI reports softened in March, but still met expectations. German Manufacturing PMI edged lower to 58.1, matching the forecast. The eurozone release dropped to 56.0, shy of the estimate of 56.2 points. The readings continue to point to expansion in the manufacturing sector, but there is concern as both indicators dropped for a fourth straight month. The markets are hoping that after a sluggish first quarter, eurozone data in Q2 will improve in the second quarter.

The Federal Reserve will be in the spotlight and the markets will be closely monitoring the rate statement. Policymakers are expected to maintain the benchmark rate at a range between 1.50% and 1.75%, and analysts will be keeping a close eye on the rate statement for clues about future rate hikes. Although the Fed is currently projecting three rate hikes in 2018, there is growing sentiment that the Fed will bump this up to four increases. The Fed last raised rates in March, and some analysts see the Fed raising rates once each quarter – in June, September and December. Higher inflation has raised speculation that the Fed will consider raising its rate hike forecast. The Fed’s preferred inflation gauge, the Personal Consumption Expenditures price index, hit the Fed’s target of 2% inflation for the first time in a year in March.

Economic Fundamentals

Wednesday (May 2)

- 3:55 German Manufacturing PMI. Estimate 58.1. Actual 58.1

- 4:00 Eurozone Final Manufacturing PMI. Estimate 56.0. Actual 56.2

- 5:00 Eurozone Preliminary Flash GDP. Estimate 0.4%. Actual 0.4%

- 5:00 Eurozone Unemployment Rate. Estimate 8.5%. Actual 8.5%

- 11:30 German Buba President Weidmann Speaks

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate <1.75%

Thursday (May 3)

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.3%

- 5:00 Eurozone Core Flash Estimate. Estimate 0.9%

*All release times are DST

*Key events are in bold

DAX, Wednesday, May 2 at 6:10 DST

Prev. Close: 12,580 Open: 12,593 Low: 12,581 High: 12,622 Close: 12,738