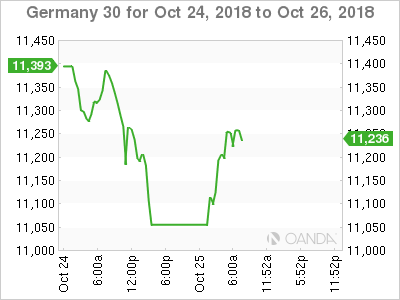

The DAX index has rebounded with gains on Thursday, after three straight losing sessions. Currently, the DAX is trading at 11,240, up 0.44% on the day. On the release front, German Ifo Business Climate dipped to 102.8, a 3-month low. This missed the estimate of 103.1 points. Later in the day, the ECB holds a policy meeting, followed by a press conference with ECB head Mario Draghi. On Friday, Germany releases GfK Consumer Climate and the U.S publishes Advance GDP for the third quarter.

Global markets are seeing red, as Asian markets and Wall Street continue to spiral downwards. The DAX has slumped some 3.6% this week, and the index touched a low of 11,078 earlier on Thursday, its lowest level since December 2016. However, the DAX has moved higher in the European session. Nervous investors are keeping a close eye on the ECB, which holds a policy meeting later on Thursday. The bank is expected to hold the course with interest rate levels, which have been pegged at a flat 0.00% for almost three years. Despite a host of geopolitical hotspots, both in Europe and abroad, the ECB remains on track to end its massive stimulus program in December. Trouble spots include the spike in Italian bond yields, the Brexit impasse and the U.S-China trade war. This has taken a toll on the equity markets, as well as on the euro, which is down close to 1 percent this week. The eurozone economy remains in good shape, but is vulnerable to these negative developments, and investors will be closely attuned to statements accompanying the rate decision, as well as Draghi’s follow-up press conference.

Barring an economic meltdown, it’s a safe bet that the ECB will wind up its asset-purchase program in December. The markets are now looking ahead to 2019, focusing on the timing of a rate hike. The ECB has adhered to the line that rates will stay on hold “through the summer of 2019”. However, it’s unlikely that policymakers can ignore the issue of a rate hike, which would be a historic move, as the bank last raised rates in 2011. The head of the Dutch central bank, Klaas Knot, recently said that the ECB will have to initiate discussions over the timing of a rate hike in January. Investors will be keeping a close eye on the ECB, looking for clues as to the timing of a rate hike.

Economic Calendar

Thursday (October 25)

- 4:00 German Ifo Business Climate. Estimate 103.1. Actual 102.8

- 7:45 ECB Main Refinancing Rate. Estimate 0.00%

- 8:30 ECB Press Conference

Friday (October 26)

- 2:00 German GfK Consumer Climate. Estimate 10.5

- 8:30 US Advance GDP. Estimate 3.3%

- 10:00 ECB President Draghi Speaks

*All release times are DST

*Key events are in bold

DAX, Thursday, October 25 at 7:10 DST

Previous Close: 11,191 Open: 11,099 Low: 11,078 High: 11,267 Close: 11,240